Mobile operators have spent most of their capital expenditure on the radio access network (RAN), enabling the digital revolution - but without benefiting from it equally. The traditional telco-vendor relations resulted in a lock-in relation for the former, further intensified by lack of alternatives and siloed proprietary RAN stacks. Today, the emergence of new players and the expanding RAN disaggregation ecosystem enable new sourcing models for carriers to explore. To embark on new models will require courage - Evgeny Shibanov and Nikolay Zhelev are convinced that now is the perfect time for bold moves.

The dilemma for mobile operators worldwide is to keep up with traffic growth while maintaining a healthy financial position. The size of mobile networks is a function of data traffic, and data traffic is growing by at least 40 per cent a year. As a result technological progress consumes enormous financial resources.

Industry estimates show that global network spending has reached $250 billion over the past decade. In contrast, global revenues have declined by $27 billion. Network costs are expected to rise to a stunning $1.4 trillion for 5G networks by 2024, about 5-6 times the amount spent on LTE networks in the last decade. And there is little reason to believe that these costs will come down at the next generational shift around 2030, when 6G is expected to go commercial.

Vendor oligopoly locks-in telcos

For mobile operators, the problem will thus remain that they spend a lot of money on technologies but cannot monetize them because the profitability is very low. A look at the market structure and the business model explains the status quo.

A mobile network is a layered cake of different technologies, both new and legacy. Single RAN architecture brought much needed optimization through a unified solution set, but essentially forced telcos into a commercial and operational lock-in with equipment vendors. The common practice of obtaining different RAN layers from different vendors and being able to change the RAN vendor relatively easily and finance part of the replacement costs (swap) of the incumbent vendor by the new vendor became obsolete.

Replacing a vendor today means replacing the entire stack, and as networks continue to grow, there is little incentive for new vendors to finance the swap. With every new generation the lock-in only intensifies, with 5G even imposing technological dependencies (NSA) which relies on part of the 4G for its functioning. Overlay solutions while technically possible are far more challenging from a quality of service perspective and are the least desired solution to exert price pressure on the vendor.

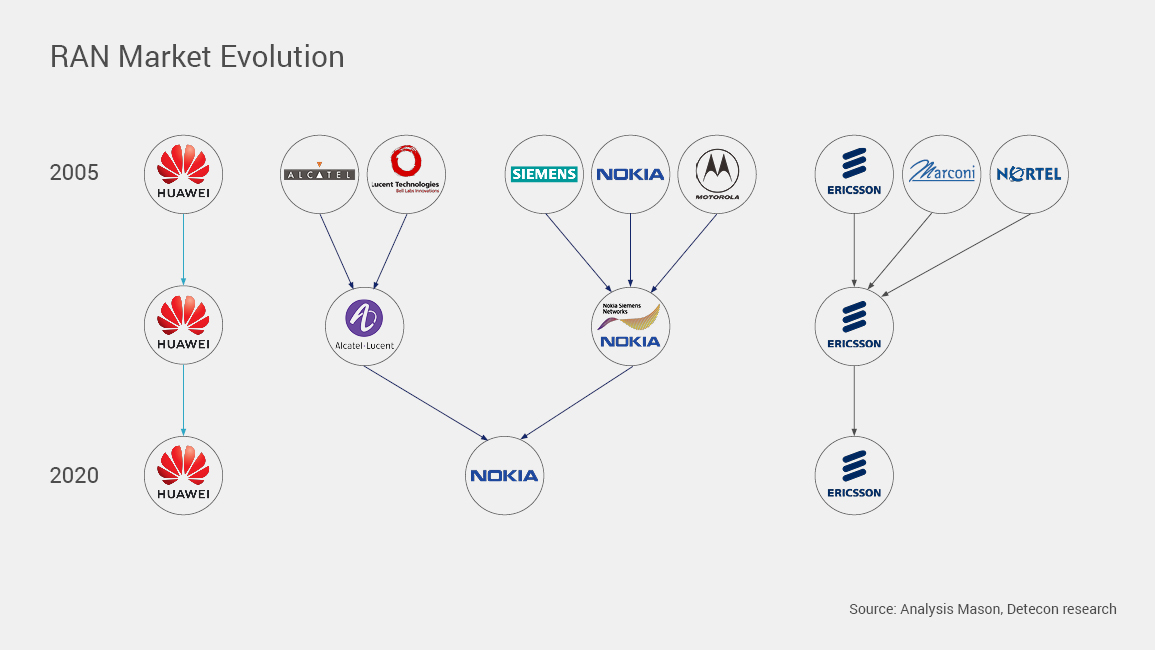

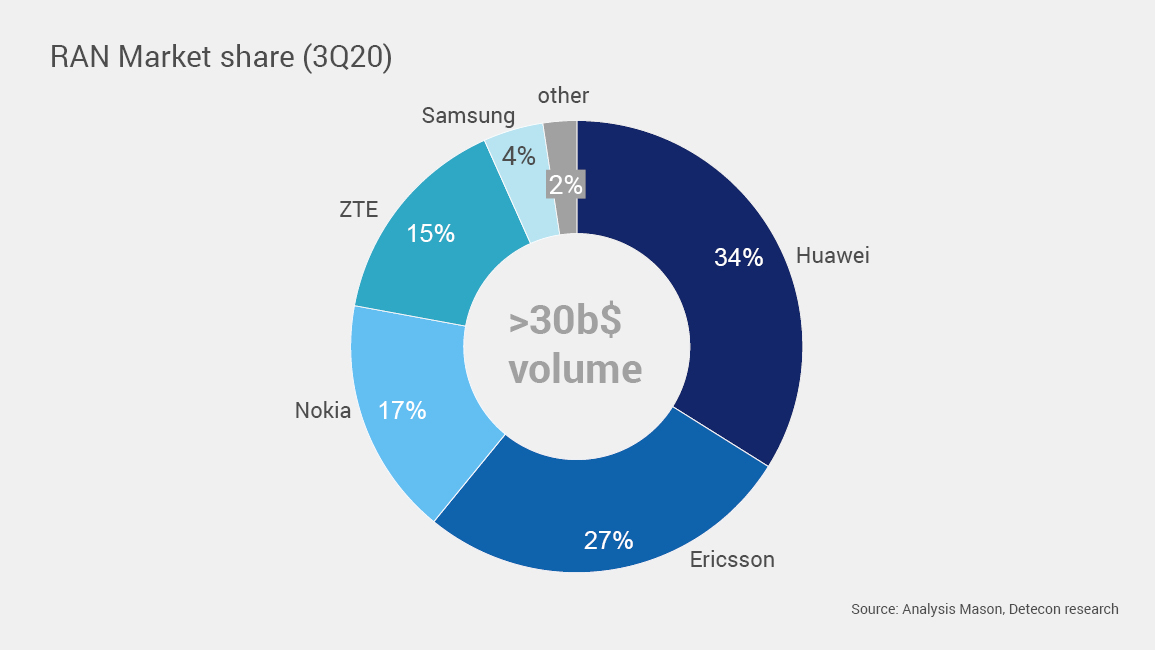

But even if overlay would be on par with Single RAN stack, there is not really many vendor options to choose from. There are more than 850 mobile operators worldwide, but there are only three major RAN equipment vendors. This market today is an oligopoly, which lacks transparency and generates frictions.

Commercial model disadvantages telcos

One of the reasons for such decoupling is the commercial model. In simplistic terms, the carrier’s revenue unit is a customer, or subscriber. Particularly, since the whole industry is selling bundled packages, the legacy drivers of minute, SMS or gigabyte have little impact – there is virtually no unit-based charging scheme.

In a vendor contract, however, the charging unit is not the subscriber but a set of capacity-related units. The traffic forecasts are recalculated in number of required radio modules. The disconnect happens at this point: number of modules is almost a linear function of their capacity, and as data quota in bundles sold to consumer grows so does the number of modules. Only that the operator increases the quota usually to sustain price, while for vendor more traffic means more revenue!

While price per GB is falling, it’s the carriers who are paying for this consumer surplus and the vendors who benefit fully. And there is little MNOs can do about it and so they sell their valuable assets to the benefit of others.

Telcos pay for hardware but really require just the service

Network equipment purchases are complex set of agreements to deliver complex solution comprising of hardware, software and services both for installation as well as support. The contracts govern many aspects, such as delivery mode, payment terms, commercial model, liability, and service levels.

While there is negotiation room for all the aspects of the contract, the solution is pretty much given by the vendor. Ultimately the purchase boils down to paying for a set of hardware with software features delivered and installed to be operated with an agreed quality. The broad selection in vendors portfolio suggest the MNO has a level of control and can judge the quality and look through the marketing promises.

Only that is rarely the case. To discuss on par with vendors deep inhouse R&D expertise is required. Today, unfortunately, these functions have long ceased to exist or shrunk to a size irrelevant to match the vendors knowledge.

What carriers really need to procure

Carriers need a contractually binding agreement to install a network that handles the traffic with a certain service quality. Simply put: the vendor should be paid for what the telco’s users are charged for. Hardware specifications are secondary, what counts is the output service.

An ideal commercial model should not be based on complex pricing consisting of hardware units, software licenses units and vendor service units to a pure service-based metric - the unit of price should reflect the unit of revenue for the Telco. Switching to such a model requires strong bargaining power on the telcos side.

Traditional outsourcing intensifies lock-in

The service-oriented approach has manifested in different models which extent beyond pure equipment supply. In many cases full turn-key contracts are part of a deal and vendor takes over installation and commissioning of the equipment including construction. Over the year the service scope extended to managed services, where the vendor also takes responsibility for day-to-day operations became common.

The benefits come from economies of scale the service provider could realize by assuming operations of more than one carrier and through internal efficiencies, e.g., in tool development capabilities. To the carrier there is a risk, that if the provider is not able to increase scale – there will be little to no cost reduction. Accounting for the transformation costs - these always arise when switching to outsourcing - business case could be even negative.

The downside of managed service is that it is easier to setup than to revert. Outsourcing intensifies loss of core competencies in designing, implementing, and running efficiently networks. Provided MNOs would revert and insource, they are facing lack of inhouse competence and tight market for qualified resources.

For worse, managed service is provided by the same few RAN vendors as equipment. We have not observed a major third party managed services provider as in the IT world. Hence apart from the high termination costs, outsourcing operations adds up to the already strong lock-in with the vendor.

How Telcos can regain control

The situation described above fits to most if not all operators worldwide. The degree of control varies somewhat based on size and thus bargaining power, but ultimately the status quo is unchanged. To change the situation, operators have only three options:

- Renegotiate commercial model with vendor in line with revenue drivers

- Fragmenting vendor market share to regain control

- Switch to a new network sourcing model

Option (1) has the lowest potential of all the measures as only very few large telecommunications companies are in a position to exert sufficient pressure. The other two options, however, are feasible for a broader range of mobile network operators.

Fragmenting vendors bargaining power through RAN disaggregation

A very promising way that is currently moving the industry is the access disaggregation, driven by technological developments of Cloud and Open RAN. The main promise of Open RAN is to break the siloed vertical stack of Single RAN and make each of the subcomponents replaceable without having to swap the complete stack. The incumbent's bargaining power would get fragmented.

Disaggregating RAN would lower the barriers to entry for new vendors. In fact, this is already happening - and is probably the most exciting development in this area. Deals are being inked around the globe and the heralded case of Rakuten is a strong proof of concept. Large players like Vodafone in UK are planning to replace parts of their network with Open RAN solutions to break silo of their incumbent vendors. Ultimately the hope is that TCOs would decrease along with the benefits of running a flexible operating model.

Establishing this operating model will be very challenging. Carriers would require in-house expertise to wed all the different component vendors together but would ultimately be responsible for the service quality. This is the approach of large groups, like Vodafone. For smaller carriers the alternative is to contract third-party integrator to orchestrate all the different vendors. But essentially that would be just another lock-in, from vertical to horizontal.

Disaggregation, while being a strong technological trend, has to be exploited with the right sourcing model behind. Otherwise, the status quo will not change, but only shift.

New RAN sourcing model works in the background with great effect

But what is really the value of keeping active RAN in the books? Only few analysts look at book values when analyzing carrier’s financial prospects. For a telco internally, there is also little reason to hold on to it as we discussed before:

- Active RAN equipment is not a USP for telcos.

- Vendor controls the know-how, or there is merely a faint of a choice

- What carriers really need is not a hardware catalogue, but a service that they can resell back-to-back or packaged in a more sophisticated product.

- Yet, the commercial model is dictated by the vendors, is decoupled from revenue drivers and puts most of business risk on carriers.

Instead, active RAN equipment could be sourced from a third party provider, a model we dub as Radio access network-as-a-Service model (RaaS - to distinguish it from RANaaS model, which describes cloudified RAN operations. This sourcing model should also not be confused with Network-as-a-Service (NaaS) or Connectivity-as-a-Service (CaaS) both of which are aiming towards end-customer service abstraction. Radio-as-a-Service is a service for operators primarily). In the ideal setup it is a model that abstracts RAN from other parts of the network, where carriers would pay for installed capacity and quality in a scheme which is back-to-back to his own revenue drivers.

This third party would manage:

- All the supply chain and vendor relation, including tenders and contract management

- Network development: installation, commissioning and decommissioning

- Network operations and maintenance

- SLA and QoS based on defined radio specific parameters, some of which may be relevant to end user (depending on the breadth of RAN components under the mgmt. of the third party provider)

- Provide to operator the necessary open interfaces / API such that operator can integrate the RaaS into its end-to-end network and manage to a certain degree

The benefits go beyond those of a managed service, as procurement, vendor and product lifecycle management along with vendor replacement is transferred to third party. MNO would stop carrying which vendor’s equipment is installed where at which point in time – ensuring interoperability would be the task of RAN service provider. Service provider could mix network equipment from different provider if it is more efficient. The HW will be largely abstracted, and agreements will stipulate the needed performance and capacity based on well defined, but also managed and steered KPIs.

Why negotiations have failed so far

Feedback we received from CTOs of different telcos indicates that only very few have tried to explore this model with partners, and all have failed as the business case did not materialize. In general, there is a scepsis if this model will make a positive return. We believe to know the reason for that.

But the fact that those “3rd party” in the discussion were the vendors themselves gives clues on why negotiations failed. First, such model goes beyond managed service model. Second, as the cash flow is less predictable, vendor includes high risk margins into the price. Third, and most important, vendors interest to sell own portfolio, which in the past was a tightly coupled hardware and software, whereas carrier should be rather agnostic to specific brands. Lastly, low competition heavily reduces bargaining power.

In short, vendors were not interested in offering such exotic service at a price that operators could accept.

Why now is a perfect time to explore RaaS

We believe that the Radio-as-a-service model is more actual than ever before. The following current industry developments support our thesis:

- New class of market players: passive infrastructure companies, hyperscalers with telco ambition and global system integrators

- RAN disaggregation as instrument for wide choice of carrier grade hardware and software components

- Open RAN standardization (O-RAN alliance) stipulating the necessary open interfaces such that different components are mixed and matched including evolved orchestration capabilities.

The new kids on the block

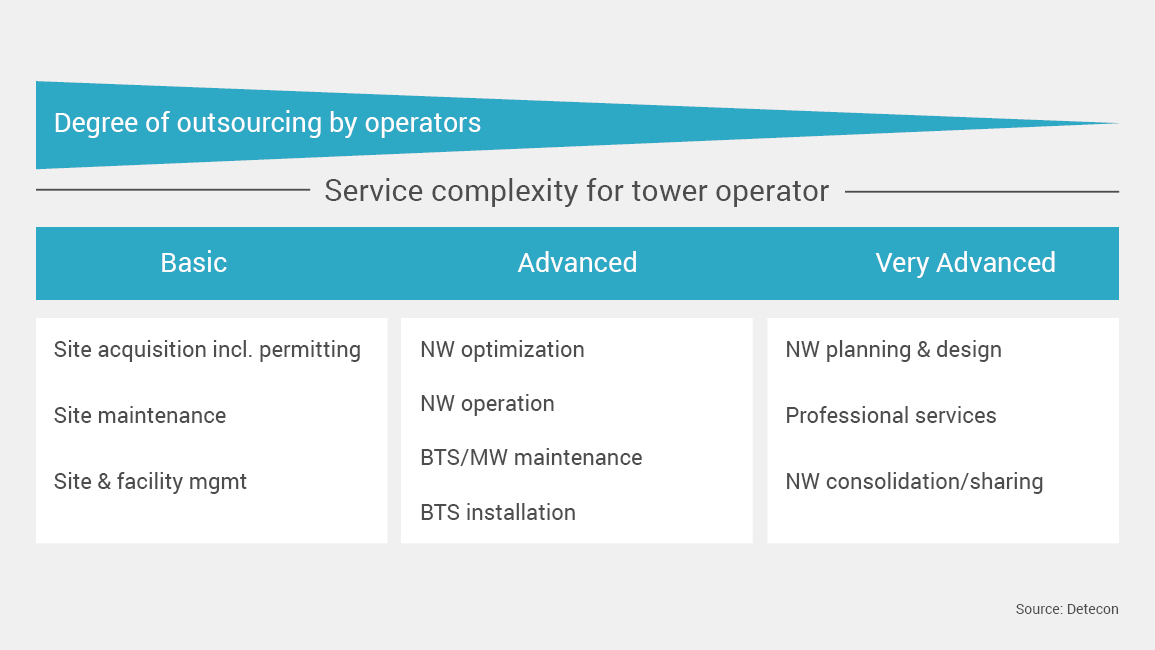

Lack of alternatives is the reason incumbent vendors dictate the rules. The rise of independent TowerCo could create a new class of market players able to challenge this. The business model of TowerCo is based on scale and scope. No wonder they expand horizontally and vertically: They are trying to increase the tenancy ratio and expand their service portfolio from the core services of site rental to more advanced services.

TowerCos could essentially evolve into infrastructure operators, completely assuming the task of managing the RAN network, not just the passive infrastructure. Nothing speaks against outsourcing the vendor management to them, given another degree of freedom to optimize costs. By bundling the volume, TowerCos could gain same bargaining power with equipment providers as carriers themselves, if not stronger.

Such a model is not a theory. The Cellnex deal with Polish operator Play is a first indicator that such a model can work. In 2021, the company acquired Polkomtel Infrastruktura, an entity with passive and active infrastructure, and committed not only to lease it back, but also to expand the network (“build-to-suit”). Another trend are NetCo spin-offs, foremost the example of CETIN - and potentially TDC. Ultimately, we believe that TowerCos could become the driving force behind network sharing, being a 3rd party without conflict of interest. This would provide additional efficiency to the carriers outsourcing their RAN. But even without sharing we see efficiency gains from managing the complete lifecycle.

Hyperscaler could also become potentially interested in such a model. Their relationship with telcos is dichotomic: they are direct competitors in the cloud and data center business and at the time their suppliers, while procuring access connectivity from carriers. So far, hyperscalers have shunned from access, but considering their involvement in RAN disaggregation alliances (Open RAN and TIP) and initiatives around Satellite business (Amazon Kuiper), they are likely candidates. Some analysts even go so far as to speculate whether hyperscalers will become producers of their own RAN solutions.

So far it is early to tell, but larger deals, e.g., between Amazon and Dish show possibilities to bypass traditional vendors, albeit not in RAN - but very close it. At the same time, direct competition in the cloud business may shun large telcos from outsourcing their RAN. But for mid-market players it could be another potential partner.

Finally, global system integrators have the potential to expand their IT outsourcing portfolio to include network infrastructure. Particularly, as virtualization blurs the traditional boundaries between network and IT, those players could more easily achieve economies of scale. Large companies like Accenture or Tech Mahindra, which are not yet fully engaged in RAN management, may well be interested in expanding their business beyond the standard IT outsourcing portfolio.

Summary

The new RAN sourcing model empowers transformation into an end-to-end user centric business and release capital for growth. That does not mean that carriers will diminish into an MVNO. On the contrary, much proclaimed Digital Operator model is not about only abstracting from network. And with all digital products requiring superior network quality, the role of telcos in the plan-build-run cycle will be focused on orchestrating infrastructure providers to ensure end-to-end high quality service creation.