In the past decade, we have seen multiple abbreviations of radio access networks like C-RAN, S-RAN or V-RAN popping up in academia and industry. The motivation was always to create flexible, scalable, cost and space-efficient radio access networks. Recently yet another RAN, called Open RAN or ORAN surfaced. But what is it exactly? What makes it “open”, what are the opportunities and what are the associated challenges? A Detecon Opinion.

Open RAN aims to benefit from many advances in radio access technologies in the past decade such as virtualization, cloudification, multi-tech single base stations (2G/3G/4G/5G) and adds on top the open interface aspect. That means having no vendor-lock in - possibility of more than one vendor for RAN - and having the flexibility and freedom to pick and choose.

Open RAN is different

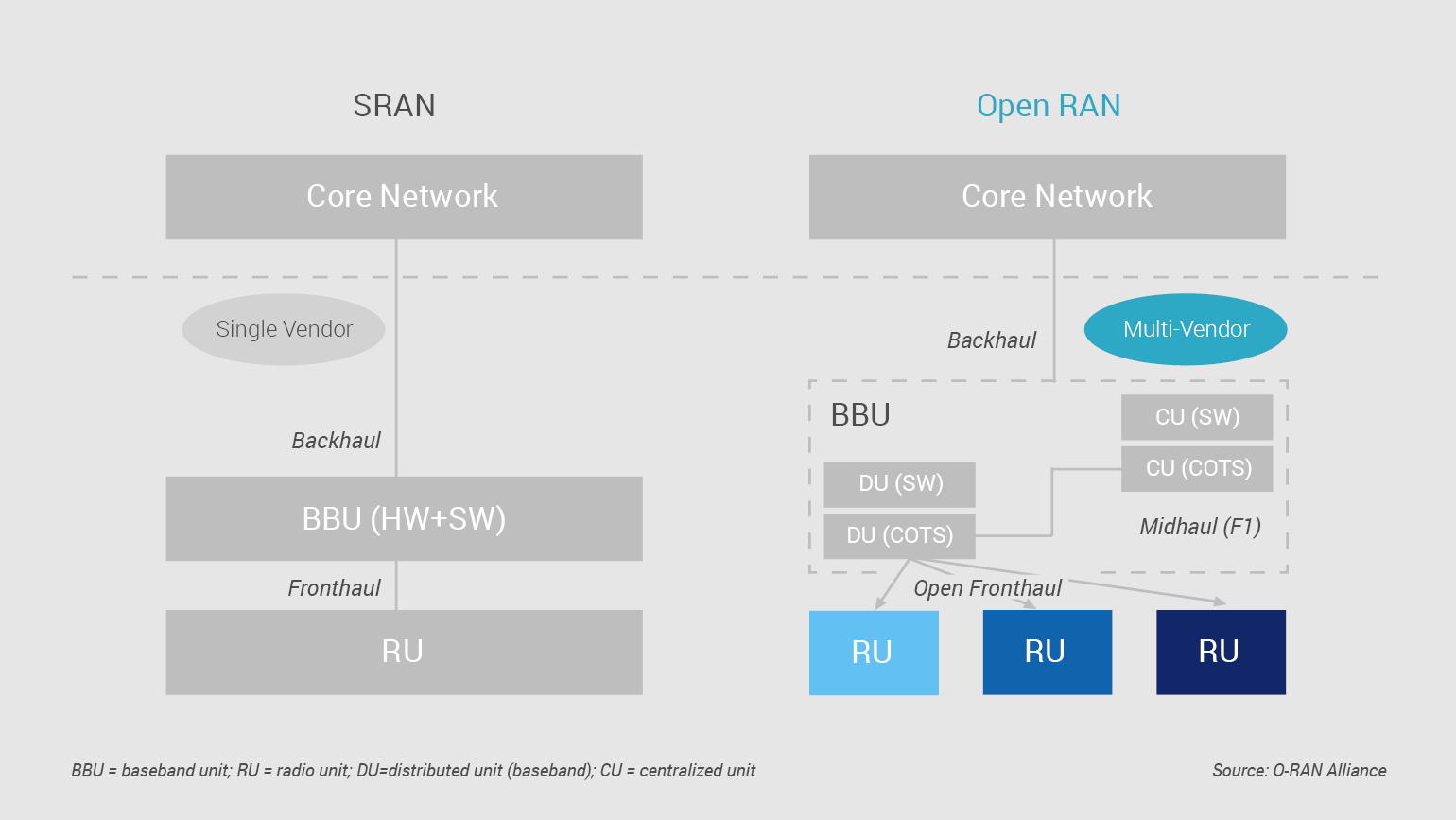

Traditionally, one vendor is responsible for the BBU/RU hardware and software (see Figure, left side). The same functionality has now become very colorful thanks to the open interfaces in Open RAN (each color representing a different vendor, see Figure, right side).

Figure: SRAN and Open RAN comparison

Here different vendors provide hardware and software components for CU and DU, giving the ability to pick and choose for different scenarios and approaches e.g., centralized or distributed cloud / latency tolerant or intolerant.

By the way: O-RAN should not be confused with Open RAN as former is the alliance for standardization and latter is the concept itself.

Open RAN has become increasingly important as it offers an alternative to the limited choice of vendors present in the market. The vendor situation became even worse after the ban on Chinese vendors in several countries. These bans provided a tailwind to Open RAN when Telco operators started to look for alternatives. The interest is not only coming from the CSP’s but also from small and medium sized vendors who were unable to have a piece in the Telco pie due to the vendor lock-in and their limited offerings.

We have also seen interest from some governments as well after they excluded certain vendors due to security reasons. The UK government is investing in establishing a Telecoms Lab to bring together academia, suppliers, telco operators to diversify and innovate the telco vendor landscape.

This makes Open RAN different!

What does Open RAN mean for telco operators and the industry?

These days, when operators go to the tendering process to modernize their networks, there is very little choice in the vendor and product/feature landscape. A vendor that might be very suitable in terms of price might not have the required features. The vendor providing the required features might not be allowed by the government. This creates a monopoly situation in the market. The situation gets especially worse when operators pursue a multi-vendor strategy in their networks, but the second vendor does not provide similar features.

Consistency is key here as feature disparity may lead to negative marketing consequences. The goal is to ensure consistency in a multi-vendor landscape. But how?

Flexibility, choice, uniformity and agility in radio access networks

Now, imagine having the ability to choose suitable hardware and software for radio access networks from a range of vendors. This would make the vendor landscape more colorful and the overall network experience more uniform because homogeneity in features can be achieved. Rolling out a new feature from another vendor would become as easy as updating the software on a system.

In short, Open RAN will offer more flexibility, choice, uniformity, and agility in radio access networks. Some might argue how such a “colored” landscape can provide uniformity. It is due to the deployment of virtualized functions on general purpose hardware using a consistent software platform.

Increased Innovation

Then, there is the opportunity for increased innovation. A 5G network, unlike legacy networks is poised to have diverse use cases that lie beyond high bit rates. This requires a different approach to network rollout due to the diverse use cases.

A full-fledged 5G network needs not only the coverage and capacity layers but also the edge and managed latency layers for use cases such as autonomous control and AR-VR applications among many others. The product and feature requirements are so diverse that it is practically impossible to be provided by a single telco vendor.

Traditional telco vendors are trying to go beyond the typical connectivity offerings by offering solutions such as campus networks etc. However, we see the sprouting of an eco-system just like app store or google play where the software community will play a very important role. Open RAN therefore, acts as an enabler for the startup scene to bring innovation directly to the heart of the telco industry without worrying about any hardware, networking, or radio expertise.

This opportunity is a win-win for all sides including traditional telco vendors. Some might argue why traditional vendors? It is because innovation benefits everyone! They can also follow suit and innovate.

Power Consumption

When we look at the challenges, one of the most critical challenge is the power consumption in Open RAN. Numerous telco companies have set goals for carbon neutrality in the next 10 to 15 years’ time. The trials and tests that we have seen using commercial of the shelf servers consume at least 3 to 4 times more power (if not more) than a traditional S-RAN setup. A rollout with Open RAN especially now, would make it much harder to meet the carbon neutrality goals.

However, the good news is that chip makers are developing and designing chipsets specially designed for 5G physical layer performance, but still retaining the programmability that Open RAN requires. Such developments would help optimize the power consumption of Open RAN equipment such as CUs and DUs.

Another opportunity to save power is in the Open RAN centralized approach. When we use lower layer splits in Open RAN, most of the processing is performed in a centralized location, where processing can be scaled up or down depending on the traffic requirements, benefitting from the cloudification. This would save energy costs as compared to having distributed processing capabilities at each base station.

Complexity

Next, comes the complexity. We must consider the increased complexity arising from having a dozen vendors (if not more) only in RAN. This colorful mix of vendors would exponentially increase the integration effort and more resources will certainly be needed. The management of Open RAN demands new platforms and skillset for the required orchestration and automation of the network. This all would result in increased costs especially in the first network transformation cycle.

There is also a challenge of effective operation and maintenance of the network. How would the fault management be carried out? Would a single integrator/orchestrator take this role? What if this single integrator/orchestrator creates a monopoly? As we know, every challenge comes with an opportunity. These challenges, if rightly handled, would reduce the costs of running a network in the long run.

Cost situation

Then there is the challenge of costs coming from Open RAN for both brownfield and greenfield deployments. The question is whether Open RAN will be able to reduce the CAPEX and OPEX of a network? Rakuten touted a 40% lower CAPEX and 30% lower OPEX as compared to a traditional network (see Rakuten Mobile 3rd Quarter report 2020) and presented it as one of the main reasons for going Open RAN. Although, there are no details on how these cost reductions were achieved and how the comparison was performed.

When we look one step deeper in the CAPEX category hardware, the question is, how would an operator like Rakuten be able to acquire radio equipment at a much lower price from ORAN vendors as compared to the prices offered by the traditional vendors?

Quite challenging for smaller vendors competing with traditional vendors in terms of hardware as the latter benefit from the economies of scale and optimized value chains. For Open RAN, hunting short term CAPEX and OPEX savings might not be the best approach. A long-term vision with a future oriented plan is required to overcome the cost challenge of Open RAN.

However, Open RAN is exerting pressure on the traditional vendors and has the potential of creating a competitive market (E.g., by benefiting from virtualization, allowing start-ups and medium sized software players to join the telco vendor landscape). One direct benefit can be the influence on the licensing models that the vendors currently offer which are one of the major cost drivers in radio access networks.

In short, the cost reduction, for now, is more likely to come from breaking monopolies and softwarization, rather than power savings or the underlying hardware (e.g., radio equipment).

The future of Telcos is “open”

To summarize, Open RAN will offer telcos the required flexibility to pick and choose the required hardware and software in each geographical area type (dense urban, urban, sub-urban or rural). It also has the potential of bringing the software costs of a telco RAN down by bringing in more vendors, driving up the competition. But it is still to be seen whether the benefits coming from Open RAN will be able to offset the costs due to the increased complexity, and the resulting overheads. Telcos will also be able to pursue innovative business models by easily bringing in small software players in the radio access arena.

Many telecommunications operators are joining forces in industry alliances like O-RAN and TIP to drive growth and maturity in the Open RAN ecosystem. We are certain, that the winners in the telco industry will be decided based on their RAN strategies where the flexibility and innovation coming from Open RAN is exploited while managing the overheads and complexity due to the resulting colorful vendor landscape.

Open RAN will be deployed both by greenfield and brownfield operators. While initial large scale rollout will be mostly with new operators, the performance and efficiency achieved by greenfield deployments will be critical for Open RAN to establish itself the solution of choice for CSPs RAN modernization efforts.

We believe that the future of telcos is “open”. Time will determine the extent of this “openness”.