The outlook of 5G use cases needing edge computing is already attracting hyperscalers who are setting up distributed clouds in proximity to end customers, simultaneously jeopardizing telco providers’ traditional businesses. Carriers must reposition themselves among a new competition landscape in order to monetize edge assets.

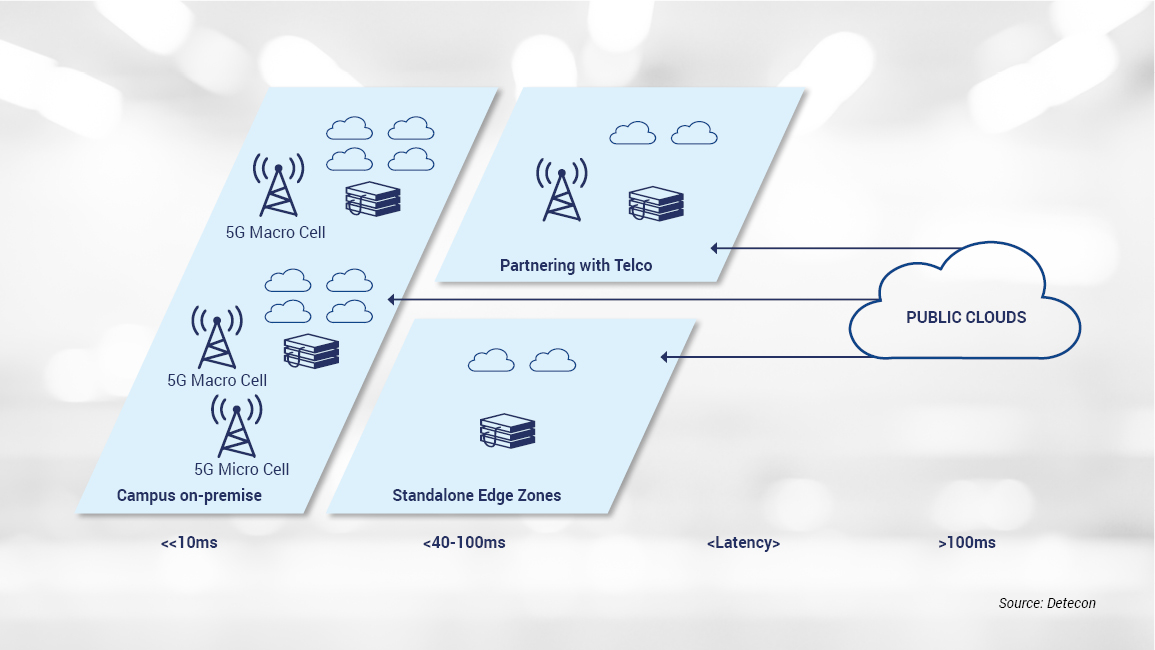

The development of 5G networks as well as the enormous variety of use cases requiring ultra-low latency are pushing the IT industry to host computing power closer to end users. A significant decrease in today’s achievable latency values is the prerequisite for the delivery of immersive, (near-) real-time experiences for customers and developers. Single-digit-millisecond end-to-end latency is the target and drives compute power hosting spots.

Driven by 5G use cases development, hyperscalers firmly enter carriers’ territories

Direct access to, and “ownership of relationships” with end customers, both consumers and enterprises, have been primarily the domain of telecommunication carriers for several decades. Now, however, this position is changing significantly, especially since the release of edge-oriented products and services by hyperscalers, i.e.

- AWS Outpost and Wavelength

- Google Anthos, Anthos for Telecoms

- MS Azure MEC - Multi-access Edge Compute and NEC - Network Edge Compute.

All these activities are aimed at the extension of public cloud environments, as distributed clouds, and host them on-premise/on-campus as well as within carriers’ networks. A new ultra-low latency environment with local computing power is achieved.

Hyperscalers are also focusing on launching stand-alone edge data centers with embedded public cloud functions.

What does this ultimately mean for carriers and operators?

There are three potential scenarios for carriers:

- As long as hyperscalers’ edge infrastructure, stand-alone edge zones (DCs), and access networks are immature and short in scale, they will be looking to partner with telcos. This is happening even now. For instance, MS Azure has concluded partnerships with AT&T, Vodafone, and SK Telekom; there is another partnership between Google and TIM along with AT&T as well; and last, but not least, AWS has become a partner with Verizon, Vodafone, and SK Telekom. Partnering is gaining momentum.

- It is very likely that hyperscalers will approach enterprises directly. Full-stack products with fully managed hardware and software from hyperscalers represent a turnkey solution for enterprises. This may disrupt the traditional and direct relationships between telco operators and enterprises.

- Once stand-alone edge infrastructure from hyperscalers reaches maturity and sufficient scale, it is likely that partnering with carriers and operators will no longer be a priority for hyperscalers. Telcos may become a “dumb pipe” providing just basic connectivity features.

Positioning in a new competitive landscape

Hyperscalers’ recent moves on the edge market have undoubtedly jeopardized telcos’ domination in areas in which they have had unchallenged “rights to play” for decades. Even though the edge market still is in its infancy, telcos must initiate immediate countermeasures. First, carriers need to unite in terms of a common edge view. Next, bold decisions are needed to redefine their positioning within a new competitive landscape by streamlining monetization options for real estate, sites, connectivity, and network APIs as well as building value streams beyond connectivity.

On the national scale at least, if not, indeed, internationally and even globally, operators must not allow hyperscalers to play a “divide and conquer” game, even if the sums in play are high. Moving forward will require operators to become digital service providers, and though they may be lagging behind in terms of agility and perhaps even creativity sometimes, they still own the last mile and regional data centers, they have paid for the spectrum, and they are required by regulatory authorities to provide high coverage most everywhere without regard for economic efficiency.

Evaluation of the stand "on the edge"

In short, the time has come for operators to assess their standing “on the edge.” What is the condition of the access infrastructure? How reliable is coverage along highways, for instance? Perhaps there are rural areas where an edge computation location would be needed, but power and fiber optic grids may not be near or would be extremely expensive to build. How dense is the network in terms of “access points per square kilometer” or “number of regional data centers”? - and a related question: How many alternative locations are available if the preferred one is not feasible? Operators need to review their assets and determine what opportunities (and risks) they bring along.

While partnering options appear to be promising, win-win partnerships are essential for carriers. Telcos should pursue these goals:

- 5G network capability and co-innovations with hyperscalers

- Greater proximity to developer communities on a global scale (through hyperscalers or even directly)

- Conclusion of the right partnerships for a rapid roll-out in the domain of access networks

As for hyperscalers, they will continue their efforts to obtain access to telco edge assets.

Win-win situation with partnering

The described measures are “home field” for the operators. Nobody knows the network better, and no one else has the in-depth knowledge of the local, regional, and national opportunities for building and expanding networks. Hyperscalers, on the other hand, can exploit their agility and innovative strength to ensure excellent customer experience with new disruptive services and use cases.

From the operators’ standpoint, these steps should be taken if they are to defend their “rights to play” on the new edge battleground. From Detecon’s point of view, the combination of strong operators, equipped with dense, tightly meshed and powerful networks, the profound understanding of national markets, and established brand names equates to the best possible counterpart for agile, innovative hyperscalers. At this stage, a win-win situation results when both parties benefit from each other in a partnership of peers.