Mobile operators benefit from the TowerCos concept primarily from a financial perspective. But what about the strategic benefits? Our experts Christiaan ten Berg, Tim Haunz and Thomas Switala have analyzed the business model.

TowerCo companies are not a recent trend. Until the 2000s, cell towers represented a significant part of telco assets and corresponding valuations – and were not considered a sellable asset. Since beginning of the millennium, however, independent TowerCos were established, offering a carrier-neutral portfolio of “passive” wireless network infrastructure such as mobile towers for Mobile Network Operators (MNOs) to lease.

Global backdrop and trends of TowerCos

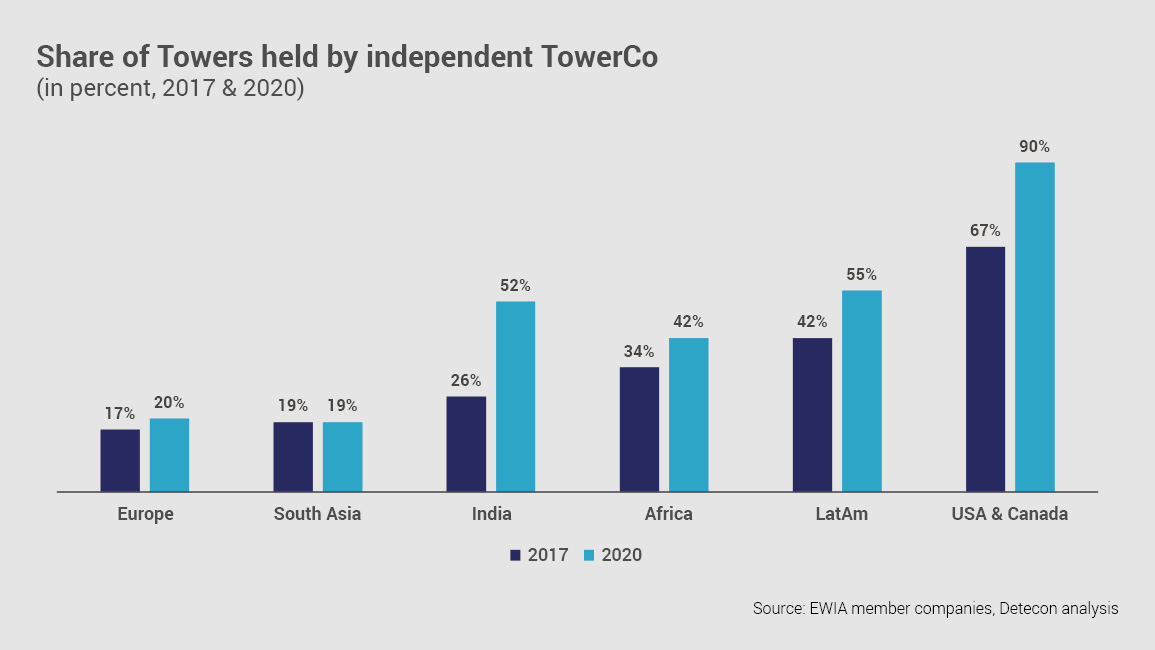

TowerCos first emerged in the US where Steve Bernstein Associates (later: SBA Communications), Castle Towers (later: Crown Castle) and American Radio (later: American Tower) setup first companies at the end of the 90s. Eventually when tower-sharing had managed to gain traction in the USA, the same TowerCos ventured into introducing the concept into the Central America and Latin America region.

TowerCos gained traction in Africa due to the huge green-field infrastructure opportunity. In Asia, infrastructure sharing setups such as TowerCos were formed to reduce capital expenditure. Asia holds some of the largest TowerCos in the world; most prominently China Tower Corp, the largest globally with over two million sites.

Europe is the last market on the planet when it comes to independent TowerCo penetration, however, the region is rapidly catching up by MNOs carving out their tower portfolios in separate MNO-controlled TowerCos.

For instance, Cellnex started in 2014 with strategic buys and is now the largest independent TowerCo in Europe. Followed by Vantage Towers the spin-off from Vodafone Group, that went public in March 2021. Together with Orange, GD Towers, Telxius and Inwit they form the bulk of independent EU towers.

TowerCo strategy for shareholders and society

TowerCos are typically created to capture the benefits of network sharing whilst unlocking further shareholder value.

Shareholder value from MNO perspective as independent TowerCos have larger economies of scale by hosting multiple tenants. This reduces overall costs for MNOs. They also enable quicker and cheaper network rollouts, supporting the coverage obligations from the regulators.

On top of that, they enable the release of additional capital for MNOs to reinvest into their (active) part of the network. This has become an increasingly important factor as next-gen technologies such as 5G demand increasingly more CAPEX investments.

An independent TowerCo can operate the portfolio at higher margin then a MNO can do standalone. They are more capable to focus on operational excellence, managing the points of presence at higher cost efficiency then a typical MNO. From a revenue perspective they can drive growth and value with a stronger commercial business development focus, for instance looking into new tenant profiles, such as non-MNO (private networks, IoT, FWA), indoor coverage cases, FttS cases and even complete (smart) cities.

Positive financial aspects

Moving from operations- to a financing perspective, the carve-out of towers enable (group) operators to financially optimize the company whilst retaining control. This includes for example improving the balance sheet, maximize their leverage and increasing their funding.

Retaining control also helps in managing long-term contracts. This especially holds true when it is related to IFRS16. The long leases need to be accounted for as an asset lease on the balance sheet in case it is a Master Lease Agreement and convert it to a Master Service Agreement between MNO and own controlled TowerCo, with short period service end dates and service fees. This has a positive financial impact, not only on the valuation (EV/EBITDA) of the group but also on that of the TowerCo spinoff.

Summarized, TowerCos bring many benefits from an operational and financial perspective. The digital shift in society means a growing demand of data that requires more strategically positioned sites to support digital (mobile) services. TowerCos are much better positioned to support shaping the increasing demand of digital “always mobile” society

Business model causes headaches for local mobile OpCos

Clearly the TowerCo narrative gives a positive view from shareholder and society perspective. The perspective of the tenants is more balanced with key challenges ahead to manage.

Typically, the first tenants of an independent TowerCo are the local mobile operators. At minimum the tenant is the local OpCo that receives the TowerCo as the new “partner”, following the carve-out of the portfolio from the group.

The TowerCo business model is centered around controlling the following key factors:

- Securing stable revenue through long-term contracts – typically 5-10 years, that are non-cancelable with the tenants. Once the contract ended renewal rights are typically “all-or-nothing” based

- Maximizing the number of tenants on a tower site, including in segments beyond traditional telecom (e.g. private networks, IoT etc.)

- Inflation linked growth as “annual lease escalators” build in the contracts

- Tenancy commitments to contract the TowerCo as the preferred partner for long-term site rollouts (so called “Right of First Offer”)

The above business model of a TowerCo not necessarily aligns to the interests of a local OpCo, giving it multiple “headaches” to manage:

First of all, once the lease ends, they face an “all-or-nothing” negotiation dynamic with little alternatives to choose from. Typically, in a local market there are as many TowerCos as MNOs. In some markets the passive infrastructure owned by independent TowerCos is highly concentrated. For instance, in the Netherlands where Cellnex merged their tower business with Deutsche Telekom and is now operating the majority share of independent TowerCos.

From a financial point of view, TowerCos generating revenue from long-term contracts with a term of 5 to 10 years are classified as asset leases under IFRS 16 and must therefore be capitalized and considered as long-term debt on the MNOs Balance sheet. However, this does not change anything from a cash flow and tax perspective.

In order to keep leases off-balance sheet, which prevents deleveraging of the MNO, it is recommended to convert them into a master service agreement. This can be done if the MNO retains a certain level of control after carving out the Towers into a TowerCo. But as IFRS16 does not only affect the telecommunications industry, the general view of covenants on debt will change in the long-term.

Beyond direct implications, TowerCos can choose to compete with operators in certain (B2B) market segments. For instance, Cellnex recently acquired Edzcom to launch Mobile Private Networks for B2B customers, including hosting these on their sites when applicable to the use-case. This will create a more complicated business partner relation with conflicting interests.

Is a ServCo future the ultimate scenario for MNOs?

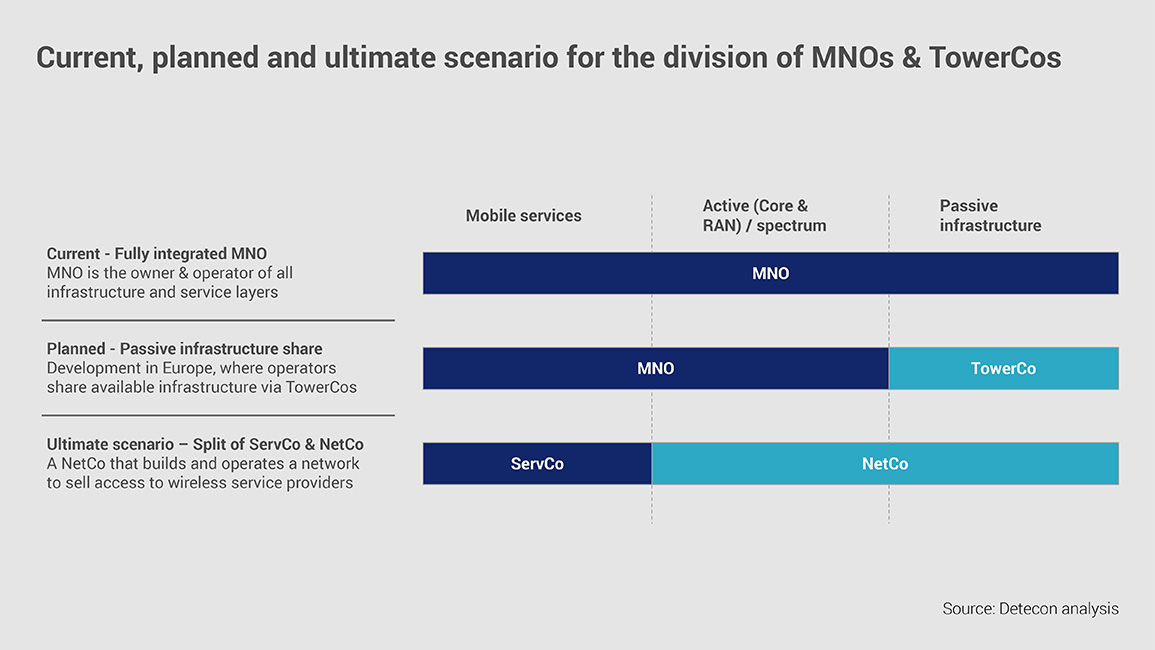

We are already seeing TowerCos becoming active as service providers, such as the Edzcom example mentioned earlier. A next logical step could be that the active part of the RAN follows the passive sites and will be planned, build and run by the TowerCos as well. Initiatives such as ORAN further supports these as the lock-in effect of vendors and devices will be resolved through an open, interoperable RAN network standard.

A market environment with increased network sharing and lower intensity of (mass) deployment will give MNOs less benefits to compete at infrastructure level.

We could see an end state where there is a “national grid”, similar to the energy utility industry or rail network, of mobile sites available for all MNOs provided by TowerCos – potentially consolidating to one market leader due to cost efficiency drivers.

Where does that leave the MNOs? It could be that the NetCo / ServCo split, frequently explored as a scenario, is finally materializing as a real scenario. In this case the MNO will provide services as a “thick MVNO” with a Core Network but without owning the last mile Radio Network. This future scenario is aligned to recent narrative coming from the leading operators in Europe such as DT and Vodafone where the ‘telco-as-a-service’ (TaaS) model is further being shaped.

The details of these models are still in the making, but what is becoming clear is that the role of an MNO will be much more based on a platform strategy where the monolithic operators are transformed into the role of an orchestrator with a cloud-native and API based architecture.

The above scenarios reflect the various stages where an operator could find itself in relation to its business with a TowerCo. MNOs will find that as they transition from a fully integrated to an outsourced NetCo model, they will need to address the associated risks and opportunities in order to best protect their interest.

Perspectives for MNOs

In the short term, operators should manage and minimize their infrastructure related OPEX position that will be invoiced by their new TowerCo partner. Local operators need to be cognizant of the contractual terms & agreements between them and a TowerCo, ideally before and during the making of the deal. Typically, the deal was closed and the contracts are concluded at group level, which requires the local operator to have a negotiation position at this level.

In the medium term, MNOs should seek the partnership with a TowerCo as an opportunity to collaborate in deploying and offering a high-quality network for mobile subscribers. Especially in situations such as (mass) deployment of new radio technologies, rural coverage, indoor / high-density coverage, TowerCos are in a position to add real value. The collaboration should be beyond the contractual terms, and mutually embedded into the operating model of the two parties, reflecting a spirit that honors both interests.

The adjustments and calibration of existing operating models should reflect a dynamic, such as the outsourcing models between mobile technology suppliers (e.g. Huawei, Ericsson, Nokia) and the MNO community, that have undergone major developments in the last decades.

In the long term, it is imperative that MNOs embrace the future beyond basic connectivity – depending on infrastructure that likely will be further commoditized and centralized in NetCos / TowerCos. This is a significant step away from the status quo for most Connectivity Service Providers (CSPs).

Competitive market for OTT services remains a challenge

Becoming a Digital Service Provider (DSP) asks to not only to transform the current operating model, but also implementing a new business model where the MNO is able to capture the market not in terms of calls or messages but in terms of “time spend on screen.” The fierce competitive market in OTT services will bring the biggest challenge of MNOs at its doorstep.