The “race for the Gs” requires substantial network investments. GSMA estimates that within the next four years approximately US$650bn will be spent by MNOs, 85 percent of this figure on 5G. Yet no corresponding revenue boost is expected — annual growth will be no more than a dismal 2 percent to 3 percent between now and 2025. Compare this figure with that of the vendor equipment market, which in 2021 grew by 7 percent.

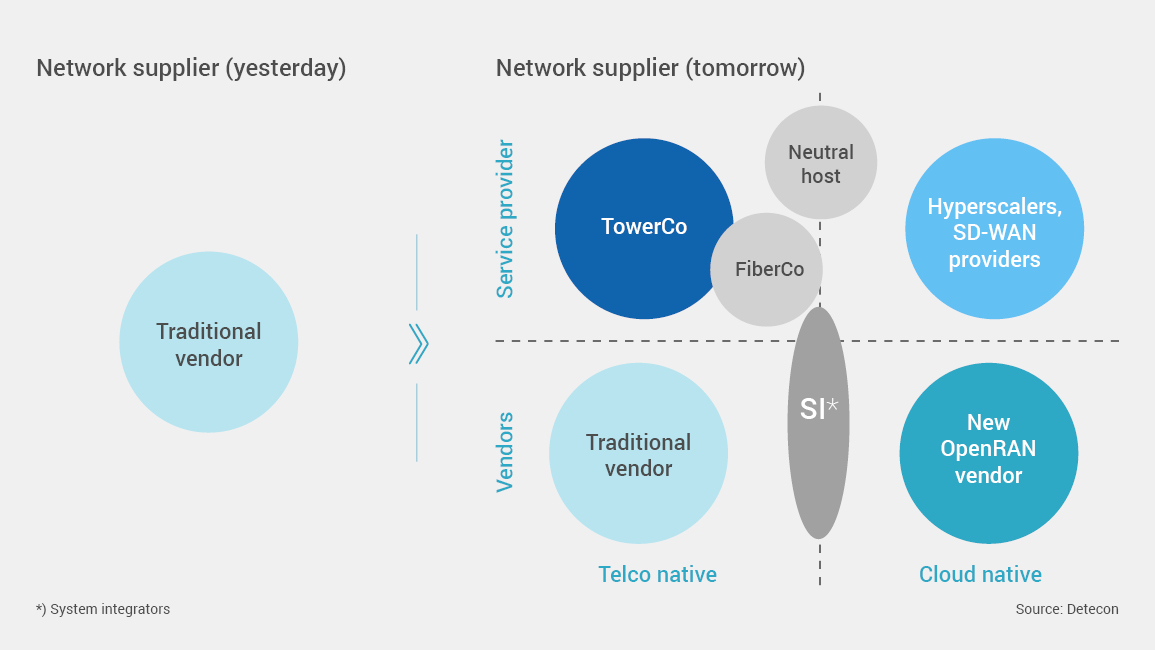

This disparity is due to a lack of alternatives. This is changing now. New RAN vendors offering open architecture solutions are emerging. TowerCos are becoming a major presence on the market. These two megatrends have in combination enabled Radio-as-a-Service sourcing partnerships, breaking the mold of traditional vendor relationships. Emergence of active InfraCos is a game changer and a win-win model for wireless carriers.

Evgeny Shibanov and Nikolay Zhelev are convinced that a silent revolution is unfolding that may fundamentally change a decade-old telco business model.

.

Carriers spend 40 percent to 60 percent of their CAPEX on RAN, yet this is not a differentiator MNOs can monetize long-term. Nor is there any product differentiation — the four main RAN vendors all offer similar product lines. Worse, vendors release major upgrades roughly every ten years that build on the previous generation or “G” for short. As of the moment, we are in the 5G era, itself preceded by 4G, which started around 2009.

Race for the “Gs” requires a rethinking of the sourcing model

Most MNOs are under pressure to fall in line with this cycle even if there is no obvious business need. Not wanting to fall behind in the race, they sink CAPEX into RAN upgrades. Yet monetization prospects may be short-lived. It is true that early movers can skim higher ARPUs from next-generation network upgrades. Finnish Elisa, for example, reported growth in ARPU of $3.5 from 5G customers. But early movers also tend to pay higher prices than followers to equipment vendors. Eventually, their leadership gap closes, and within two or three years all networks are comparable.

Customers themselves seem to have little appreciation of such rapid advancements. Consumers do not care about technology or the vendor, as the service itself does not change. How do they genuinely benefit if a webpage loads in two seconds instead of three (albeit a 33% improvement)? This lack of a noticeable advantage has caused customers to turn a rather cold shoulder towards 5G, at least in the West.

We are not 5G skeptics at all; on the contrary, rising network load demands productivity improvements to cope with traffic growth. What is more, 5G is expected to unlock an array of new use cases. But the industry’s obsession with Gs intensifies the vendor lock-in, diverting investments from growth areas. Even worse, the industry is already talking today about the introduction of 6G — a technology that is not expected to become available for (probably) another ten years, around 2030. The effect has been to create the impression that 5G technology is already rather obsolete.

High costs are certainly on the horizon. The investments required for 5G may be five to six times greater than for 4G. Leveraged MNOs sell their towers to generate the cash needed to pay vendors for network equipment. The paradox of selling these unique assets (towers) while keeping non-USP assets (RAN) is confusing. Given the plethora of alternatives, few arguments remain in favor of traditional Radio network sourcing.

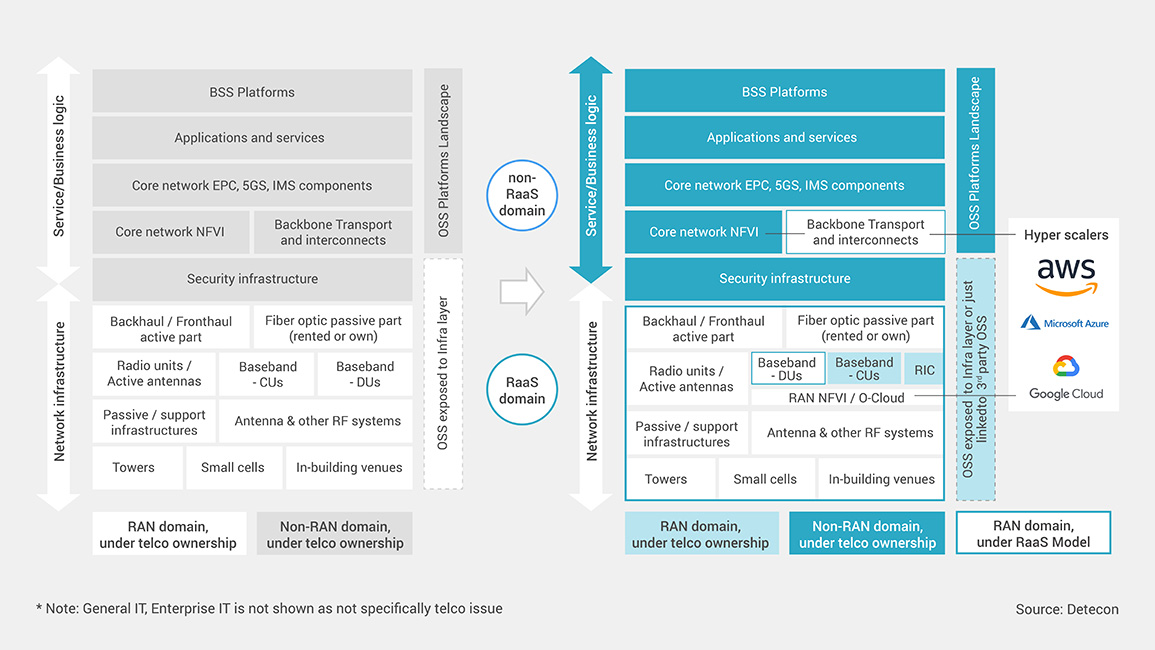

In our previous article, we proposed the Radio-as-a-Service model (RaaS) as an alternative. The fundamental element of the model was the abandonment of control over active infrastructure and the procurement of infrastructure as a commodity service instead. While heavy outsourcing is not new to telecom industry, we see the recent emergence of a new class of players such as (active) TowerCos, ORAN vendors, and hyperscalers that are strongly supportive for RaaS operationalization.

RAN vendor oligopoly nears end

Mobile operators have spent most of their CAPEX on the radio access network (RAN). Their activities enable the digital revolution, but they have not reaped the full benefits of their efforts. The industry has been operating in an environment of one-sided telco-vendor relationships for too long. The lack of alternatives and vertical proprietary RAN stacks have led it to a dead end.

On the one hand, the rise of TowerCos in recent years has created a new class of “telco native” service providers. On the other hand, alternatives to traditional RAN vendors have emerged. Cloudified RAN, but first and foremost OpenRAN solutions, have triggered dynamic movement in the stalled market.

Lastly, we observe large cloud providers expanding their telecom sector presence. The US greenfield MNO Dish has selected AWS to provide host services for their infrastructure, completely bypassing traditional vendors. The aspiring MNO Drillisch in Germany has followed the same course. This latter case is particularly interesting as the company is using a number of alternative providers. A towerco (Vantage) will host their radio network, Rakuten will provide an OpenRAN solution (RCP platform), and AWS will be used for all other infrastructure hosting.

The emergence of new players brings an influx of capital. But there will also be new competition, particularly from the same hyperscalers. In late 2021, AWS announced its plans to offer a private network solution —competing directly with MNOs.

Of all the new players, TowerCos in particular seem set to become the Radio-as-a-Service providers with the greatest impact.

“Slicing the RAN” within the RaaS concept

The key rationale for relinquishing control over infrastructure management is to free up resources and to focus on innovative services.

The non-RAN domains (hosting core network, applications, BSS) are the ones with strong user focus and relationships (B2C, B2B). They create the products and services and launch them on the market. Differentiation is a key lever in a competitive marketplace. These domains traditionally interfaced the RAN domain via well-defined core network interfaces. The RAN delivered the mobile services with the desired (or available) QoS.

An MNO seeking to leverage disaggregation and O-RAN alliance architecture can split the RAN into two sub-domains:

- The RAN “logic and control” domain translates the requirements from non-RAN domains and keeps service and user experience under control, enabling specific approaches (software features, QoS management, capacity and reliability options, etc.). But it allows software level differentiation and innovation on a technical level.

- The RAN “Infra” domain consists of radio, transport, and passive infrastructure without user awareness. Quality of service is maintained at the network level using SLAs and KPIs from RaaS providers.

The emergence of disaggregation and virtualization of RAN components increases the scope of potential services. An MNO has the flexibility to choose which services from other service providers are offered/consumed. Note that the traditional RAN vendor has deliberately not been shown. Including a RAN vendor as a potential provider will reduce the case to managed service setup while lock-in remains.

Unsurprisingly TowerCos turn out to be the most suitable partners. The ability to manage thousands of distributed infrastructure units makes them a robust and reliant provider. We also see clear evidence for TowerCos evolving towards an infraco, embracing RaaS model implementation.

TowerCos on the road to InfraCos

Until the early years of this century, cell towers represented a significant part of telco assets and were not considered sellable. At the beginning of the new millennium, independent TowerCos started offering carrier-neutral “rental services” for MNOs.

Independent TowerCos have a more credible standing on the market and easier access to customers. But giving up control is hard for many MNOs; in Europe, more than 60 percent of all towers are still captive (MNO-owned). In contrast, more than 90 percent of the towers in the USA are owned by large TowerCos.

Investors favor TowerCos, which are valued at far higher multiples (ranging between 11 to more than 30 times their annual EBITDA) than integrated telcos[1]. This is far higher than the average MNO (including towers), which hover around a multiple of six to eight times. Investors favor businesses with forecastable and steady cash flows. From this perspective, a towerco is much closer to the real estate sector (even REIT) than to a telecom service provider.

Independent TowerCos post higher valuations — their market attributes reduce possible friction when acquiring lessees. There is simply a higher strategic risk to entering a tower-sharing agreement with an entity that is controlled by a competitor.

Fulfilling such high expectations forces TowerCos to search constantly for both value extraction and value creation opportunities. The scale is important (number of sites) as are unit economics. Yet the demand for sites is limited and restricts the prospects for revenue as well. The key is to offer more advanced services extending beyond the basic real estate management model.

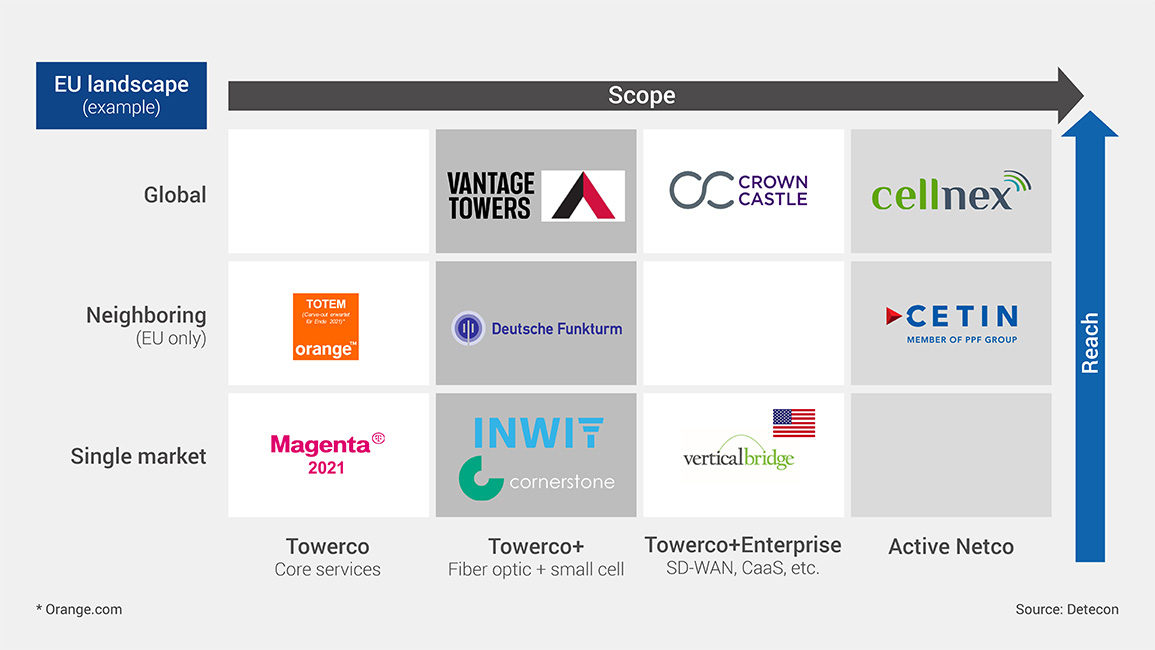

Over the last several years, we have observed TowerCos moving into both adjacent and new domains. American SBA, for example, offers data center and edge services. Many TowerCos have started offering fiber optic and small cell deployment services. The most advanced TowerCos, however, are already operating as real infrastructure players. We have already seen today the emergence of active InfraCos such as Cetin and Cellnex.

We expect this trend to intensify in the coming years. So far, TowerCos have avoided the more complex RAN domain. Yet we think that OpenRAN technology will result in strong impetus to TowerCos becoming active InfraCos.

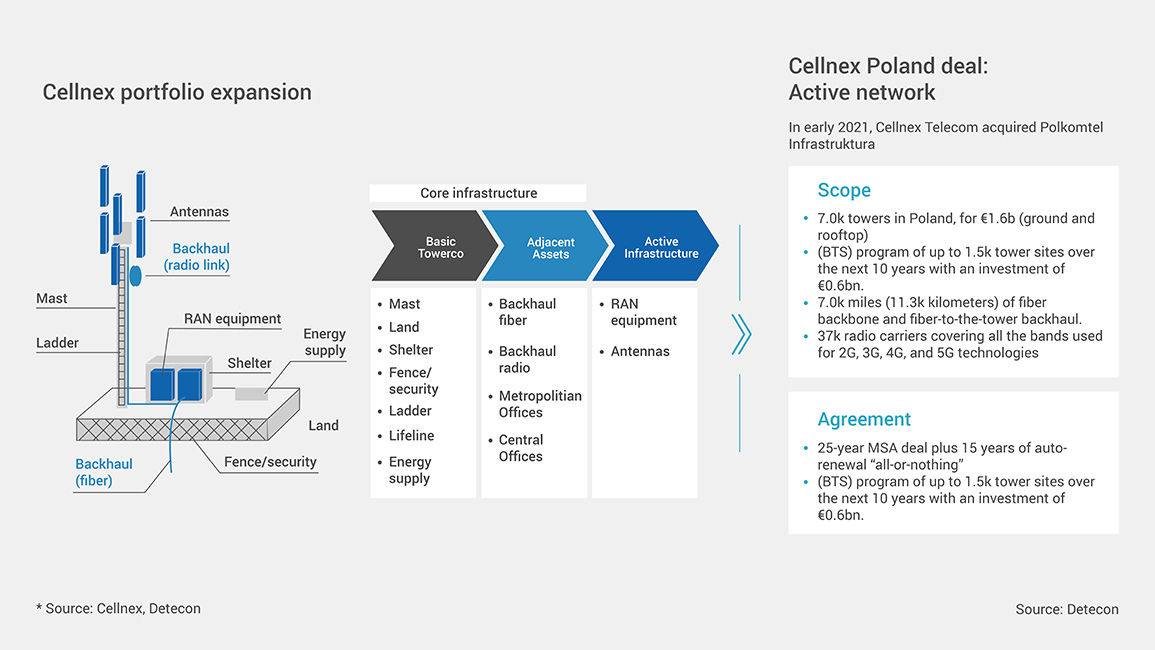

In fact, the Cellnex deal with the Polish operator Play is an early trend indicator. In 2021, the former acquired Polkomtel Infrastruktura, an entity with a passive and active infrastructure. Cellnex committed not only to lease back the infrastructure, but even to expand the network (“build-to-suit”). Besides seven thousand towers and antennas, Cellnex operates about thirty-seven thousand radio carriers. Cellnex’ announced strategy underlines its ambition to evolve into an active infraco.

Active equipment deals are arguably more challenging. A towerco aims to maximize its asset utilization, installing the equipment of two or more lessees on the same site. Maximizing utilization on active layers is far more difficult. Service level and quality agreements become key components of such deals.

Infraco — a better partner for managed network services

The partnership with an infraco and becoming “RAN-less” sounds exotic only at first. Many MNOs have long since “outsourced” their RAN, albeit to their equipment vendors. The latter already provide either full turnkey installation or even managed services. MNOs offload end-2-end quality requirements to third parties. There are valid reasons for doing so. For one, a vendor can manage its own product better than the telco. For another, there could be cost benefits from such outsourcing.

Sourcing Radio-as-a-Service may appear as a “shift and lift” to traditional managed services with vendors, seemingly no more than a shift in dependency from one provider (vendor) to another (infraco). But there are differences.

First, a vendor can manage solely its own products. If MNOs have a landscape comprising various vendors, there is virtually no synergy for a managed service provider.

Second, the business objectives do differ. The primary aim of a vendor is to sell equipment and licenses. A managed service contract is used as a means to lock-in its own equipment for repurchases and replacements. An infraco does not sell any equipment and focuses on service only.

Third, although possible, a vendor is not the preferred partner for operating shared networks. An infraco, especially in combination with OpenRAN, could prove to be ideal for such projects (for details, read our article: “Let’s Talk About Network Sharing – Again”).

Infraco as RaaS provider: three main win-win scenarios

MNO cooperation with an infraco is clearly a win-win situation for both. In contrast to vendor-managed services, we see a broader variety of possible partnerships here:

-

Full Radio-as-a-Service

MNO separates its RAN and sells it to a towerco under a build-to-suit contract. The Cellnex-Polkomtel deal described above is an example of such a partnership. The benefit is fully transparent and focuses on the service layer. Full-scale benefits can be realized. On the downside, there are the risks of overdependence on a single provider that would potentially impact quality of service and bargaining power. This type of model is less suitable for incumbent MNOs. At the same time, it could be an option for greenfield challengers.

-

Mixed model outsourcing

One possible way for an MNO to lower the dependency risks would be to carve out parts of its network. An infraco could be responsible for building and operating active infrastructure in greenfield regions. This would be an approach in countries lacking full-area coverage. This type of model is also viable for brownfield networks (e.g., some regions of less strategic significance where business risks are lower). The main benefit is the lower dependence on, and a balanced portfolio of, service providers. But the benefits are also lower, given the smaller scale. It forces MNOs to keep some of their maintenance in-house. We see greenfield coverage as the most economically viable variant.

-

Network sharing facilitator

Network-Sharing, while common practice, is not especially widespread despite cost savings of up to 35 percent. Our experience shows that two out of three deals never pass the MOU stage. The main reason for failure is the lackluster interest in direct agreement among the MNOs themselves.

An infraco can facilitate such deals with far less friction than can occur during bilateral negotiations. An impartial party can ensure confidentiality and the balancing of interests. Network sharing is a way to increase the leasing ratio and maximize asset utilization.

A counterargument is that network sharing reduces the scope for a towerco. A consolidated network is smaller than two independent ones (hence the large savings). This would cut into the core business of a towerco. Still, having two lessees on fewer sites is more profitable. A towerco is unlikely to decommission its physical equipment; instead, it can lease it out at a discount.

Finally, network sharing relies on equipment harmonization, which is costly. This is where OpenRAN could provide another edge to InfraCos, even more than to the MNOs. Disaggregated shared RAN networks achieve more than simply reducing network sharing costs. They also enable simpler, faster augmentations and modernization of a RaaS infrastructure.

Conclusion

The “race for the Gs” requires a rethinking of how network spend should be utilized. Disaggregation through open architectures enables refocusing investments on services and user experience. Underlying infrastructure of a commodity nature can be spun off and sourced from a new breed of providers.

Independent TowerCos in particular have an opportunity to increase business portfolio, revenues and thus valuations. By extending their service offerings to include Radio-as-a-Service, they would evolve into InfraCos. TowerCos are in a stronger position than all other possible providers and must take advantage of this fact. They need to work on a win-win solution by showcasing tangible CAPEX and OPEX reductions. Promoting an easy-to-implement network sharing solution could be a unique selling proposition. Offering OpenRAN integration and maintenance service would be another option.

Strategic investments in active infrastructure capabilities are key. In-house hiring and partnerships with specialists are equally important. Cooperation with ORAN vendors opens the door to know-how transfer. Yet independence from specific vendors must be ensured — impartiality is the major USP.

The RaaS model is no longer theoretical — there are real-life examples are already in operation. The need for TowerCos to act is high. First, those getting an early start secure the best deals. Second, there is competition not only from “their own breed”. MNOs could decide to separate from their network operations and spin off their InfraCos, either through sale or IPO. Either way, we see fundamental changes in the decade-old telecom business and operational models ahead. And that is good news.