The aftermath of the Covid-19 pandemic has highlighted the gap in high-speed home internet, leading to increased investment in fiber optic network deployment as the limits of copper infrastructure have become apparent. However, given the turbulences that has gripped the economy in 2023, the risks of fiber investment are increasing. Our authors Evgeny Shibanov, Sergio Torres und Massimiliano Meneguz show how fiber optic investments nevertheless can provide resilient shareholder returns by focusing on securing demand, rethinking deployment strategies that streamline costs, and searching for alternative low-interest financing such as subsidies or ESG vehicles.

Fiber optic deals in review – larger size, but significant regional differences

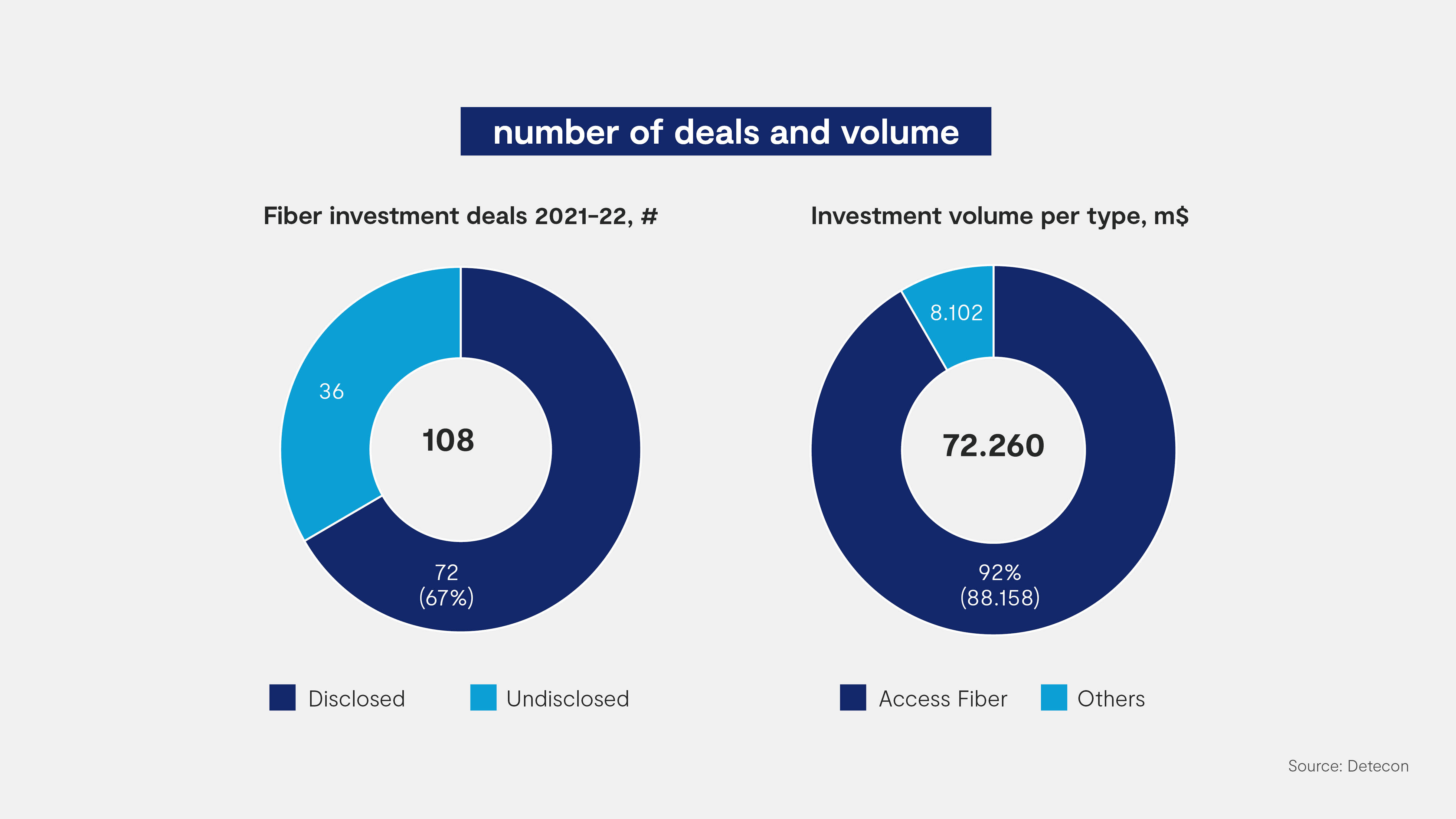

According to Detecon research, around 108 (publicly announced) deals were closed in 2021-22. The investment volume was disclosed for 72 of those deals: a stunning $72bn, an average of $35bn per year (Figure 1).

This represents an increase of ~40 percent over 2019 (pre-Covid), which recorded 35 deals with estimated investments of around $20-25bn.There is no single clear tracking source for such deals and estimates vary sharply among various sources. Approximately 90 percent of all deals were in fiber optic access with the remainder in backbone and submarine infrastructure.

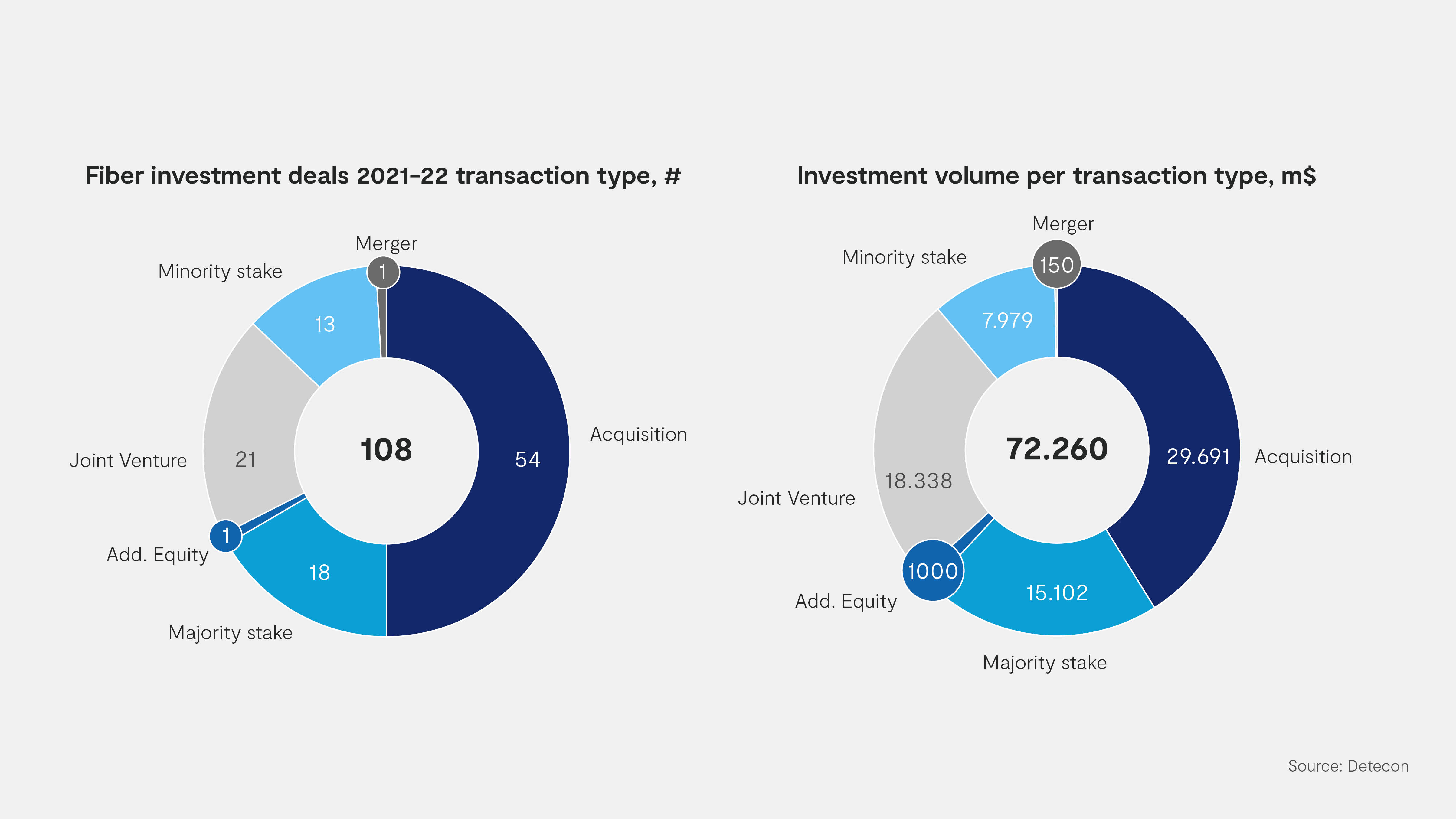

In terms of the overall deal structure, more than 50 percent were acquisitions while the remainder was split among joint ventures and majority or minority investments. Looking at the disclosed deals during 2021-2022, we note that slightly more than one-third were acquisitions (Figure 2).

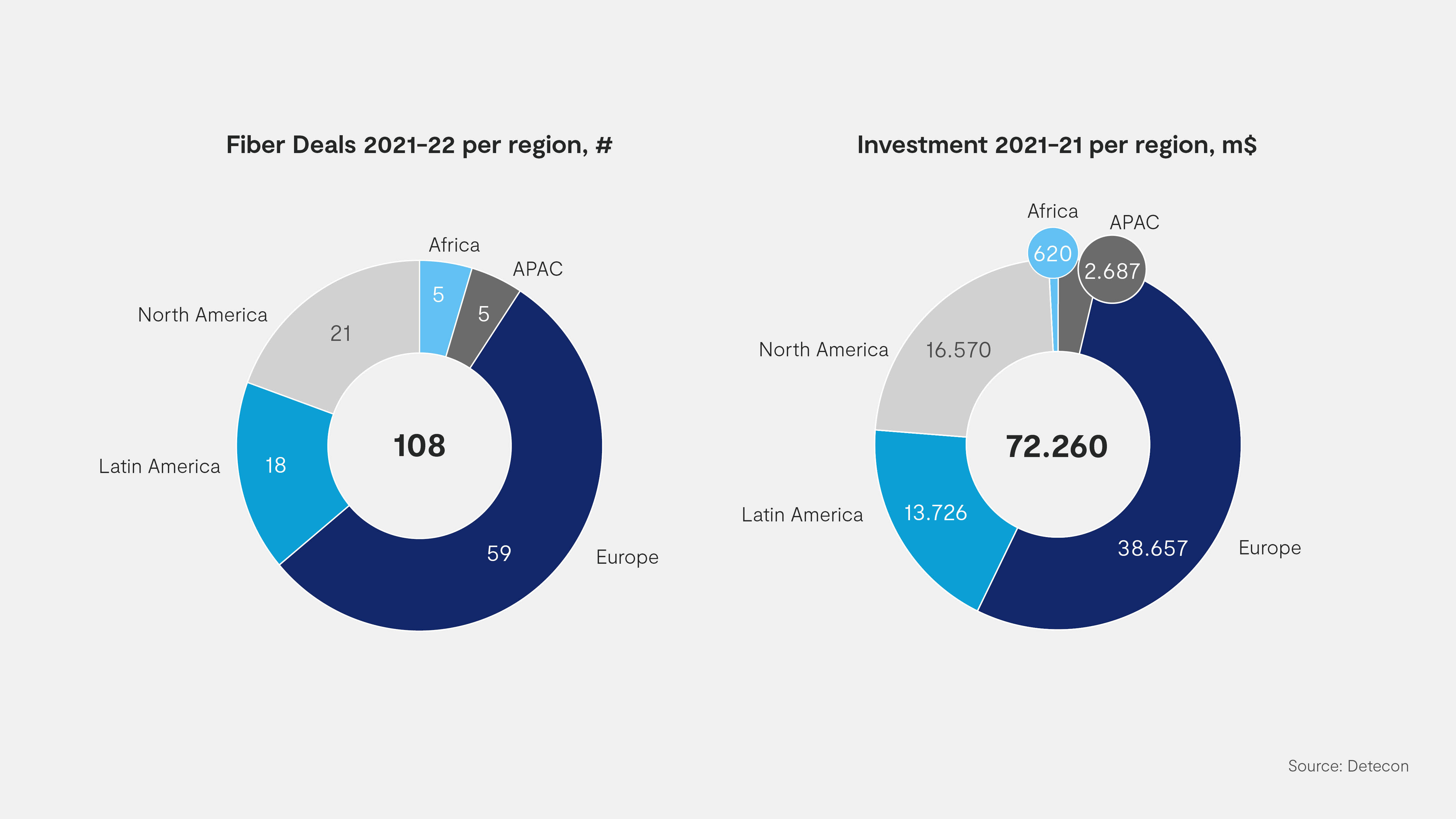

The investment spree is global, yet there are significant differences.

Focus Europe

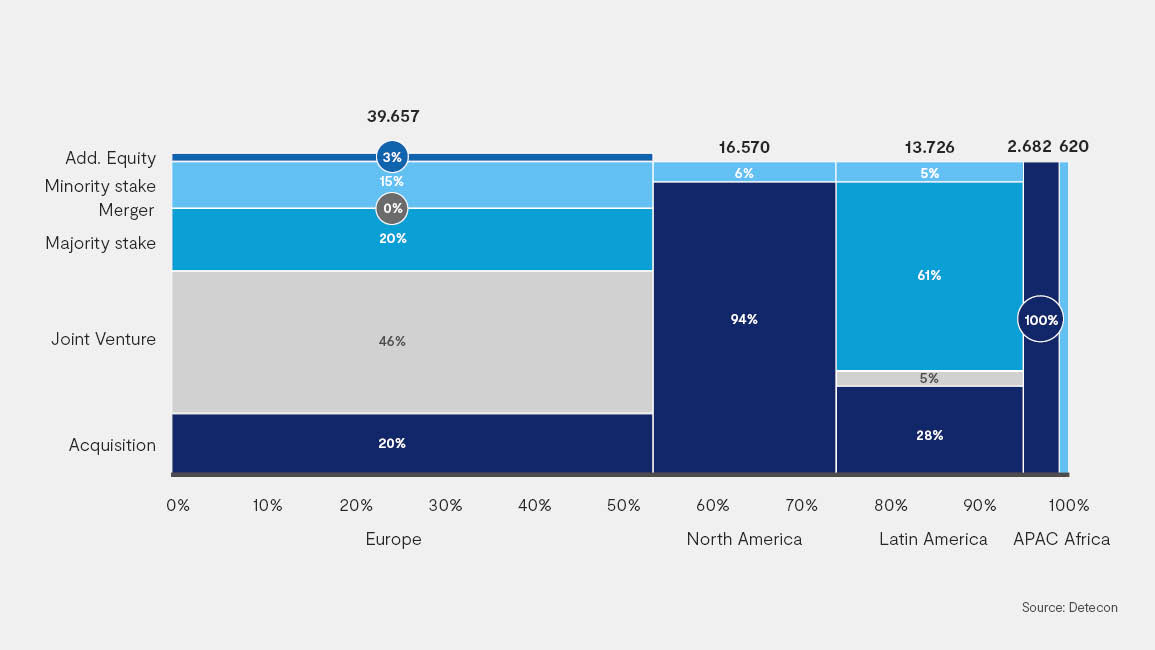

Europe remains the most mature market when it comes to fiber optic broadband investments. Around 53 percent of tracked investments and 55 percent of all deals during the past two years depicted in Figure 3 have been concluded here.

In Germany, a joint venture called FiberCo was launched by Vodafone and the multinational telecommunications and media company Altice. The aim is to reach seven million new fiber optic connections in Germany over the next six years. The total investment is expected to reach as much as $7bn starting from 2023.

Besides equity investments, debt financing is also gaining traction as an alternative vehicle, with UK’s CityFiber securing the largest loan to date of about $6bn in late April 2022. While interest rates had already begun to rise at that time, the conditions were certainly more favorable that they are today.

Incumbents, usually on the sidelines of such deals, have become active. At the end of 2021, Deutsche Telekom and the Australian investor IFM announced the establishment of a joint venture called GlasfaserPlus. They want to install as many as four million fiber optic lines, especially in rural areas, by 2028. IFM’s investment in a 50 percent stake of GlasfaserPlus is roughly $1bn. The incumbent’s activity is an indication of its worry of being left out.

Finally, unlike elsewhere, only 45 percent of all deals were strictly acquisitions (Figure 4). Joint venture or minority stake purchase are more common as deals grow larger in size and investors strive to share the risks.

Focus US

The United States is finally waking up. Until recently, the major infrastructure deals focused on towers. Now interest is shifting to fiber optic broadband. All major telco operators are becoming players in deal discussions. AT&T is working with Morgan Stanley to support the launch of a fiber optic expansion JV with a value of $10bn to $15bn in collaboration with an infrastructure finance partner. T-Mobile US is also aiming to create a $4bn fund with the support of Credit Suisse. Verizon is the most recent nation-wide player to announce similar partnership plans.

But US investors are also looking beyond the de facto consolidated market with few large opportunities. Their funding activities are turning in the direction of investment in Europe. KKR is a notable leader in acquiring funding, leveraging a fourth infrastructure investment of over $15bn. While the amount of the investment in broadband optic fiber has not been disclosed, KKR has been known as a very active investor in this area. We can expect a substantial portion to flow into new fiber optic deals.

A common trend in both Europe and the USA is the striking and generous involvement of governments. Seeking to close the digital divide, authorities are allocating significant funds to fiber optic broadband. The US government has approved a $65bn program, $42bn of which will go to the Broadband Equity, Access, and Deployment (BEAD) program*, plus another $20bn for rural network subsidies. The EU’s major member states are approaching the same level at approximately $56bn from key countries. Government funding is used to stimulate investments in underserved areas where the return on investment is usually far lower. Essentially, the allocations create the third source of funding alongside equity and debt.

*The BEAD program will provide unprecedented funding to states aimed at powering deployments in underserved areas and specifies that grant opportunities must be open to cooperatives, non-profits, public-private partnerships, private entities, utilities, and local governments

While Europe and the USA are accountable for about 75 percent of all investments and constitute the main investment hubs, we see the emergence of activities in other regions as well

Focus LATAM

LATAM has generated around 20 percent of all deals in past two years (~$12bn), mostly through acquisitions of majority investments. Investments have been driven primarily by telcos’ cost rationalization efforts with the result that most deals are spin-offs of established networks (brownfield), and there have been far fewer greenfield partnerships.

The major driver for private fiber optic investments has been activities around Telefonica’s spin-off of LATAM assets. The most notable deals have been the sale of a 51-percent stake in Telefonica’s fiber optic company in Brazil to IHS and the sale of 100 percent of the fiber optic assets in Chile to KKR. But as other important players like America Movil and Milicom are carving out their fiber optic assets in preparation for sale, more action can be expected in this region in the coming years.

The key challenge arises from the drastic differences in the economic and political conditions in the various countries, which are in contrast to the generally homogeneous environments in Europe or the USA.

Focus MEA and APAC

The MEA and APAC regions together generated around 5 percent of all investments. In the latter, deals were signed in Australia and the Philippines and concerned predominately backbone and sea cable deals. However, optic fiber is already the predominant medium for fixed broadband technology within APAC.

As of 2021, fiber optic accounted for around 90 percent of all broadband lines in the region. Countries like Singapore are expected to achieve full-area coverage with fiber optic by 2026. Now that fiber optic development plans have been realized in several countries across the continent in recent years, the rollout is expected to continue in less developed countries of APAC during the next couple of years.

This expectation prompts us to look for an increase in deals and investment volume in the future. In the MEA region, the deals were more isolated and involved a lower level of private funds. A reason for lower activity in this region is that these countries remain underserved and historically have few or even no copper networks. In consequence, there is still sufficient business enabling operators to invest from their cash flow, and their interest in private funding is lower. These are also high-risk regions with very low ARPU and high levels of political uncertainty.

Conclusion of the regional analysis

We believe that for the next two to three years the focus will remain in Europe and the USA and to some extent in LATAM, but increasing activity (on a smaller scale) in Asia/APAC and MEA is also expected. For smart investors, now is the right time to scout out new opportunities in those regions ahead of the crowd. However, there may be a slight cooling-off in investments as economic conditions change.

Economic cooling-off poses significant risk for fiber optic investment returns

The huge investments and expectations for returns force fiber optic companies to deliver ROI quickly. On average, an acceptable IRR is estimated to be about 10–15 percent, implying a breakeven point (positive cash flow) no earlier than ten years from the start of the rollout.

One reason for the high investments has been the low cost of money and outlook for positive demand. This has changed as we move into 2023. Apart from supply chain risks, economic turbulences and tightening financial conditions impact both the cost of capital and the demand. All of those are directly and negatively affecting the returns on fiber optic.

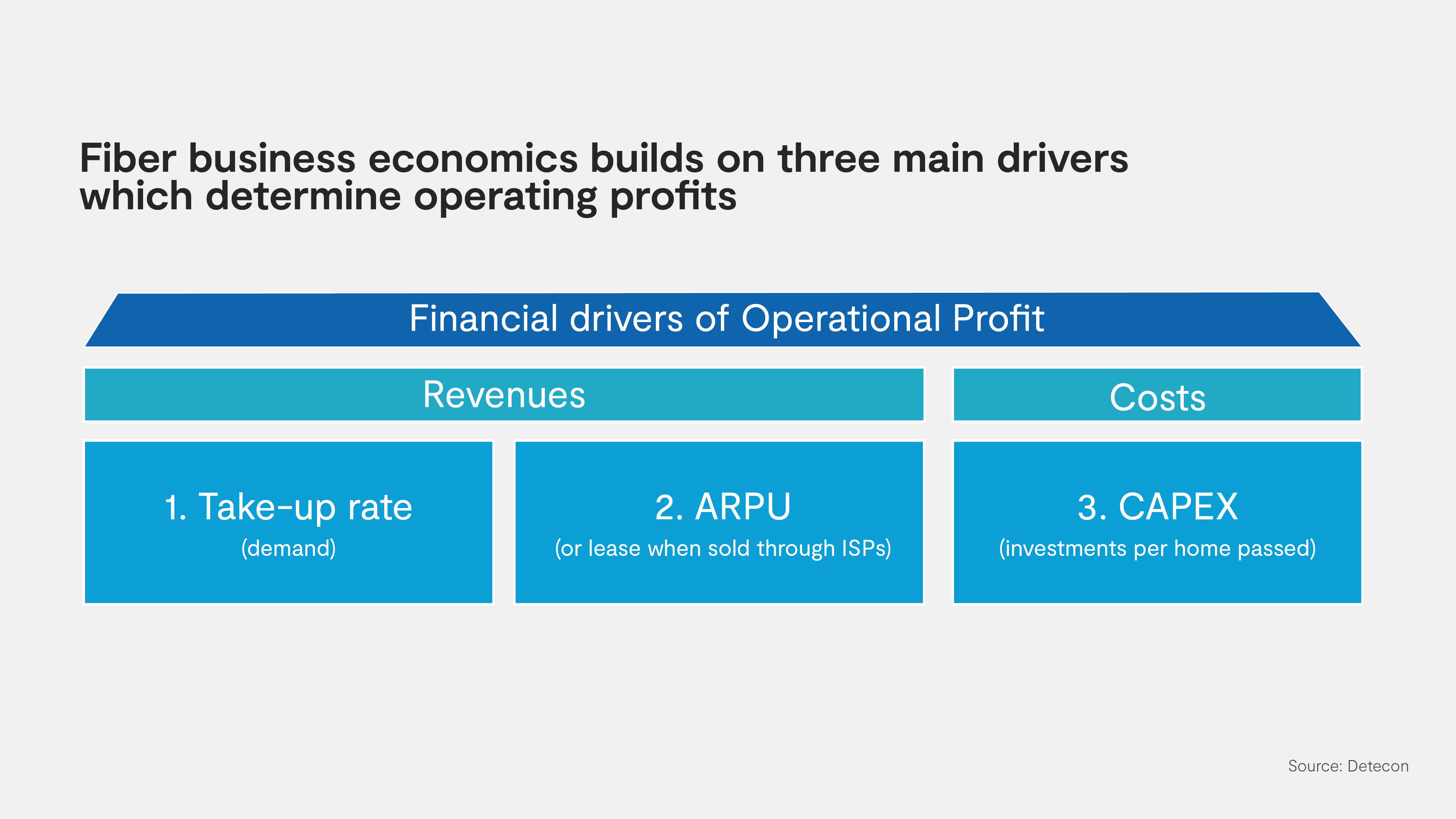

The economics of fiber optic business builds on three main drivers that determine operating profits.

Some operating costs are also factored in (operations, maintenance, marketing…), but the principal drivers are the ones shown above. CAPEX differs from country to country. In Europe, CAPEX ranges from €500 (Spain) to €1,300 (Germany). On average, €2,500 is considered the breakeven limit. Rising inflation negatively impacts the development costs, and maintaining the breakeven limit demands a reduction in the rollout, which in turn impacts revenues.

Lease rate and take-up rate determine the revenues. Lease rates are less impacted by inflation thanks to price adjustment clauses. However, inflation may affect customer spend and take-up or subscription rate. Lower take-up rate worsens breakeven.

Finally, the cost of capital (equity and debt) determines the discount factor. As interest rates rise, so does the cost of capital (or WACC). A higher discount factor impacts IRR.

Rising inflation and interest rates are setting the stage for the perfect storm for investment profitability. The best case is a decline in expected returns as the breakeven period increases. In the worst case, the fiber optic operator will face liquidity challenges when it is unable to meet cost obligations from reduced revenues.

The most recent example is that of German HelloFiber, operated by Liberty Networks Germany, a joint venture (JV) between Liberty Global and InfraVia Capital Partners. The company was founded in 2021 to deploy fiber optic networks across Germany. At the end of 2021, the company announced a surprise withdrawal from the market, citing “inflation, interest rate levels, and access to external capital […] fiber rollout costs with a shortage of construction capacity and the increasing challenge of attracting communities with suitable characteristics[…].

Bankruptcies, even if they remain isolated cases, highlight the exposure of capital-intensive startups to economic slowdowns. As they come under pressure to meet business plan and breakeven targets and to deal with market shrinkage, we see even now highly aggressive and value-eroding acquisition tactics such as overbuilding (i.e., laying fiber optic cables next to one another) instead of open fiber optic cooperation. So far, the available market for fiber optic has been large, and fiber optic operators have managed to overcome these risks.

As fiber optic penetration continues to rise, however, we expect more of a dog-eat-dog competition that poses a further risk (e.g., through overbuild tactics).

How to embrace economic challenges

Despite the grim economic outlook, fiber optic companies can still deliver acceptable shareholder returns sustainably. The de-risking approach is a highly demanding “triple hat” endeavor. First, demand must be secured to finance commitments for an expansion that have already been made. Second, unspent, but planned CAPEX needs to be revisited with adjusted rollout plans and potentially with revised architecture. Lastly, low-cost financing beyond classic equity/debt needs to be explored.

1. Secure (short/middle-term) demand

The goal is to secure demand in areas where CAPEX commitments have been made, especially if construction has not started yet. Measures include the following:

- Deal pre-signing, pricing discounts, and even helping ISPs promoting broadband fiber optic to their end customers through joint campaigns can be considered.

- At the same time, risk of overbuild needs to be addressed through lobbying and direct cooperation with communities. A key challenge for fiber optic companies that must be mastered here is a lack of personnel that can work in several areas simultaneously. A possible solution is to promote aggressively an “Open Fiber” model to more stakeholders.

- Partnering involving the conclusion of swap agreements could be an option. Ultimately, consolidation is a strategic move that is worth exploring.

2. Tightly manage (technology) costs

There is no secret recipe for this, but the key target is first and foremost to keep the CAPEX per household at breakeven level. Possible levers:

- Re-planning of committed, but not yet authorized rollout spend (similar to zero-cost-budgeting)

- A review of technology strategy, architecture, and rollout planning, including cheaper, non-traditional deployment methods such as micro-trenching. If regulations allow, a possible switch to aerial (posts) deployment can be explored. The use of duct rents in lieu of new trenches (e.g., using older copper ducts) can be evaluated.

- Evaluation of rollout synergies, e.g. with backhaul for mobile operators, potentially unlocking new customer segments

3. Evaluate alternative financing sources

Given the high interest rates, there is little a fiber optic company can do to lower traditional financing costs. Luckily, alternative (lower-cost) financing has emerged.

- The most prominent potential alternative sources are government subsidies that are aimed at supporting rollouts in otherwise unprofitable areas. The drawback here, especially in the EU, is the highly complex award mechanism, which requires pre-investment in research study.

- Alternatively, a fiber optic company could issue low-interest ESG bonds. DELTA Fiber Nederland, for example concluded agreements involving a loan of $1bn in September 2022 to link the financing of its fiber optic rollout to sustainability objectives. The better DELTA Fiber performs in ESG in this area, the lower the interest rate. While not formally acknowledged in the EU, fiber optic is considered “green technology.”

Despite challenges, long term outlook is positive

Fiber optic is the access technology with the brightest outlook for the future. It offers (almost) unlimited capacity, lasts for decades, and is the most climate-friendly technology (at least from an energy-use perspective).

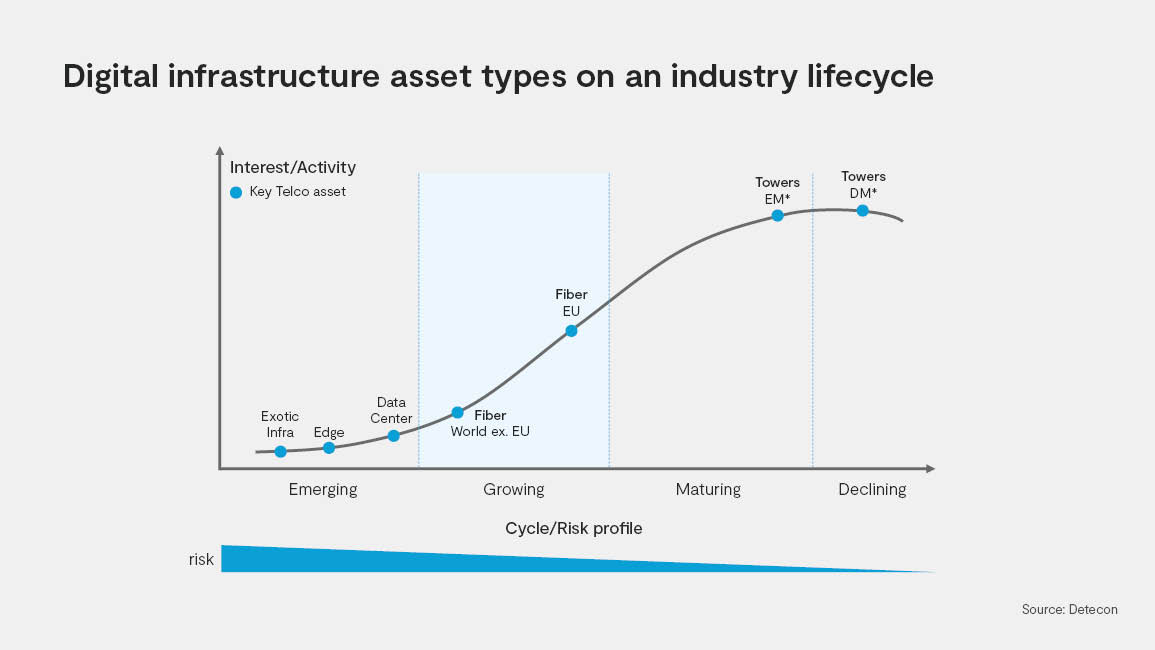

In this sense, the demand for fiber optic will be stable for years to come. In view of the prospects of solid demand, fiber optic investments have lost their high-risk appeal as the technology and business model has matured over the last decade, driving up valuations.

However, while some fiber optic deals climb to an EBITDA of 20x, their valuation continues to be lower than that of tower companies or data centers at 26.5x and 28.3x, respectively. Compared with the latter two, fiber optic (particularly FTTH) investments are in the risk-reward sweet spot (Figure 6).

So it is no wonder that some analysts go so far as to see fiber optic broadband access market value eclipsing even that of the tower companies, at least in Europe.

However, as economic (inflation) and financial (interest rate) conditions become more constrictive, profits on mature markets will face higher pressure than elsewhere. Rising costs in conjunction with sluggish demand intensifies competition for sweet spots. As financing becomes more expensive, liquidation risks rise, and striking bankruptcies such as that of HelloFiber occur.

For existing projects, matching cost spend with secured demand is of utmost strategic importance. Classic blueprints of aggressive rollouts prior to sales (colloquially known as the “if you build it, they will come” approach) are detrimental to ROI and IRR. New projects will require innovative financing schemes upfront as well as the management of competitive pressure. Fiber optic investors must be careful and diligent in their selections of investment opportunities.

Tough times, while catastrophic for some, may reveal tremendous opportunities for others. Exploring opportunities outside of Europe and the USA today may give a smart investor a head start once the economy rebounds. Decisions must not be made without a clear assessment of market, geography, and the regulatory regime, an evaluation of the commercial model, and the availability of a reliable and skilled technology partner beforehand.

If short to middle-term terms risks are diminished, we believe that the market for a fiber optic company will remain highly attractive in the long term.