On June 27, 2023, the European Commission, in relation to the EU Taxonomy, adopted the new Environmental Delegated Act and amendments to the Taxonomy Climate Delegated Act and Taxonomy Disclosures Delegated Act. Effective 1st January 2024, non-financial and financial organizations must report taxonomy eligibility for six environmental objectives. This triggers the question: What steps must organizations take to ensure preparedness and compliance with these requirements?

The EU Taxonomy is a powerful stride that aims to establish a universally applicable classification system for companies and sustainable financial products. It provides a clear definition of what constitutes sustainable and environmentally friendly business activities, supported by threshold values set by the EU Commission. These values ensure the credibility and validity of sustainability assessments.

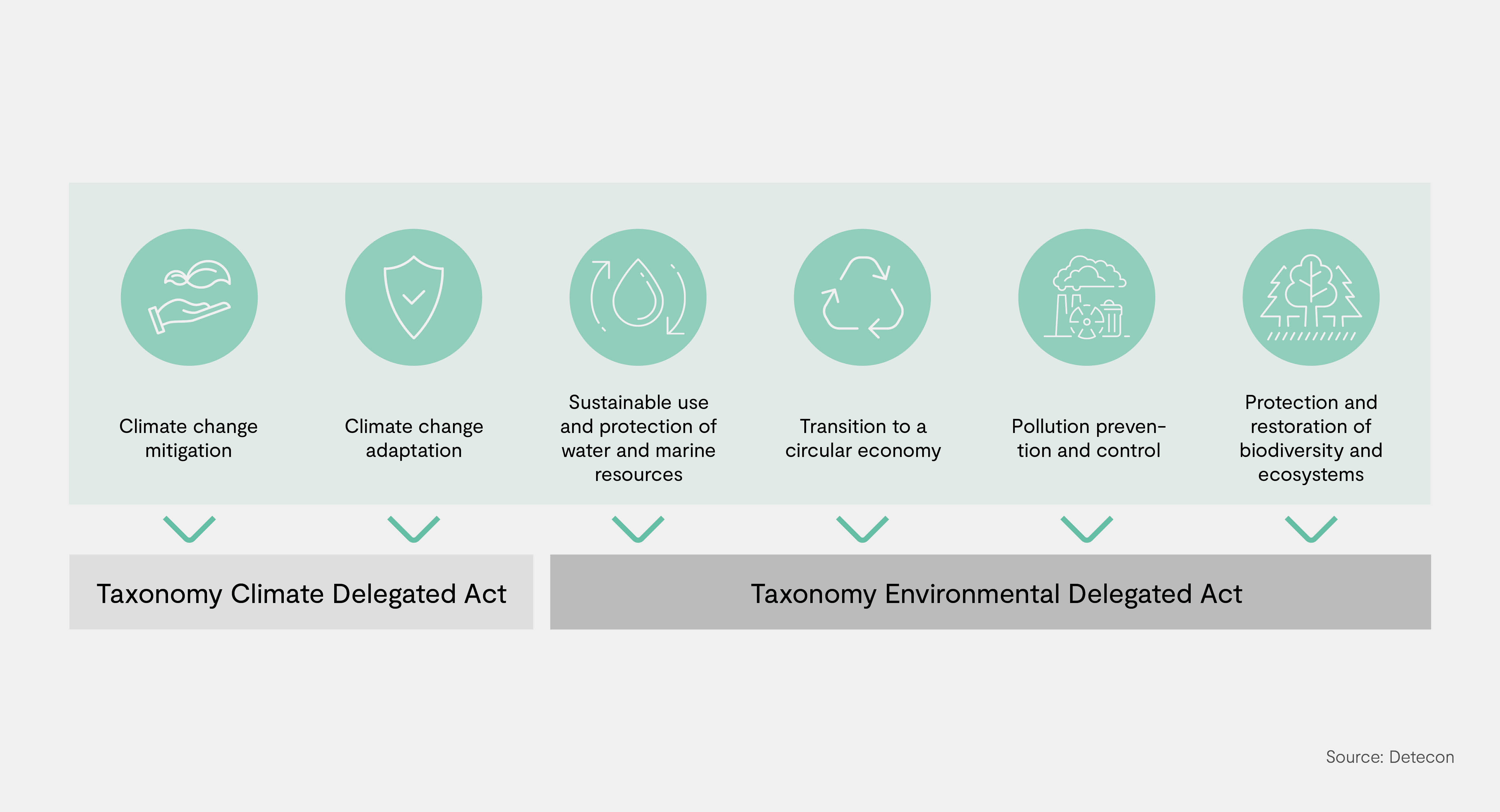

With its six core objectives (Figure 1), the EU Taxonomy sets a comprehensive framework for driving sustainability across various sectors, ranging from manufacturing to information and communication to environmental protection and restoration.

The first two objectives, directly related to climate change, were covered by the Climate Delegated Act adopted in 2022. The other four objectives were adopted in mid-2023 by the new Environmental Delegated Act. Together, they define under what conditions an economic activity can be considered a significant contributor to driving sustainability. Such activities can encompass, for example, sustainable farming practices in agriculture, transportation companies investing in green technologies, eco-friendly building designs in the construction industry, or businesses engaging in conservation and reforestation projects to promote biodiversity and ecological balance. Recent amendments include a wider range of such activities and a broader spectrum of sectors.

Towards sustainable investments and greenwashing prevention

On the positive side, this expansion increases the coverage of activities eligible for sustainable investments, amplifying the potential of companies in more sectors to align with the taxonomy and promoting environmentally conscious initiatives. Moreover, the expanded criteria contribute to addressing greenwashing, facilitating sustainable investments, and stimulating companies to transition into more sustainable operations. The disclosure requirements imposed by the EU Taxonomy provide companies with an opportunity to improve their environmental performance over time. By disclosing the proportion of EU Taxonomy-eligible and non-eligible activities in their financial reports, companies can track progress and identify areas for enhancement, fostering a culture of continuous improvement and sustainability. Financial entities play a vital role in supporting non-compliant companies by identifying opportunities in new activities and changes to existing ones, assisting them in meeting the EU Taxonomy's criteria.

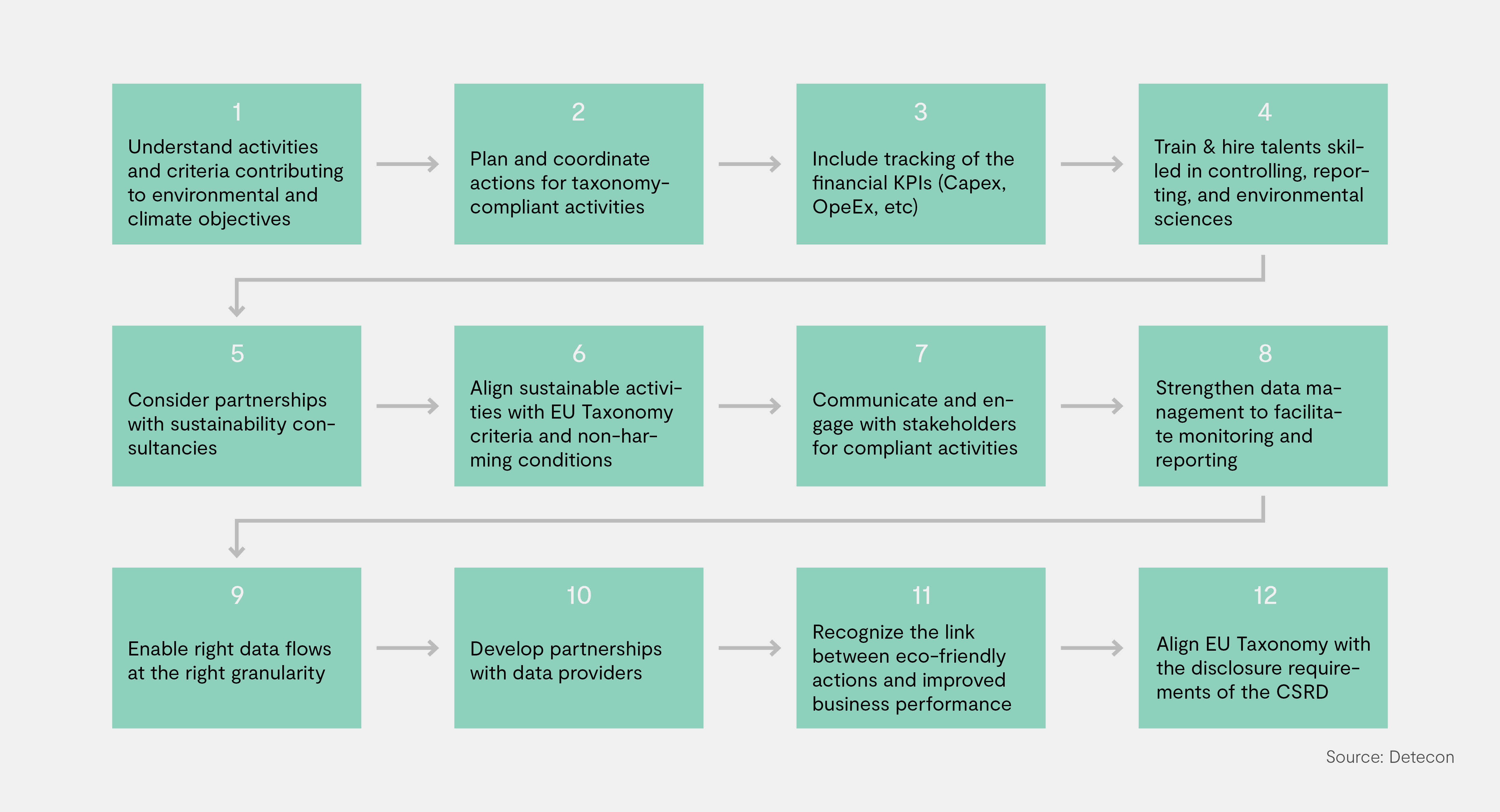

However, challenges lie ahead for companies subject to the Non-Financial Reporting Directive (NFRD) or the Corporate Sustainability Reporting Directive (CSRD). They must adapt their reporting processes to incorporate the new environmental performance disclosure requirements. This includes monitoring financial key performance indicators (KPIs) related to the EU Taxonomy and aligning their activities with the screening criteria and non-harming conditions. Therefore, a specialized workforce and collaboration with advisory will be required to help advance the efforts of the companies to be ready to disclose their financial performance in eligible and aligned activities.

Overall, the EU Taxonomy's expansion and disclosure requirements represent a significant step towards achieving sustainable investments and combating greenwashing. This will require companies to prepare a fast response in a coherent manner along the following twelve steps for action (Figure 2).

Sustainability Data Intelligence for Empowering Compliance with Emerging Regulations

The newly expanded EU Taxonomy prompts several companies to fundamentally reconsider their business practices and to incorporate taxonomy-compliant activities into their operations. Organizations should enlist sustainability experts to navigate the EU taxonomy's expansion and guide transformation of business practices. Quality data is one crucial element for regulatory compliance, including EU Taxonomy requirements. Utilizing the power of digital transformation and AI, digitainability practices can generate timely insights aligning with global reporting standards and business needs. To achieve this and shape the green digital twin transition of businesses, we advise that organizations should:

- Identify data requirements for eligible activities under Climate and Environmental Delegated Acts.

- Integrate necessary data for key performance indicators (Capex, Opex, turnover) and establish data pipelines and controls.

- Develop analytical methodologies for reporting and computing KPIs.

- Conduct quality checks and assessments to identify data gaps and explore alternative solutions.

- Review regulatory requirements and translate fragmented data into consolidated actionable insights.

- Extract relevant data through sampling activities with accountable financial information.

- Evaluate operations for alignment with the EU taxonomy and strategize for business advancement.

- Implement updated processes and consolidate data for disclosure in non-financial reports.