“This metaverse is going to be far more pervasive and powerful than anything else. If one central company gains control of this, they will become more powerful than any government and be a god on Earth.” Tim Sweeney, Epic Games.

The Metaverse – a complex, emerging ecosystem

Within the last months and driven by the increasing shift in online behavior due to Covid 19 as well as the technological advancements in XR technologies, we have witnessed the appearance of the term ‘Metaverse’ in the headlines of many well-known news outlets such as Forbes, The Washington Post or The Economist. Simultaneously, tech giants worldwide have begun proclaiming ‘the Metaverse’ as a new and indispensable part of their strategy.

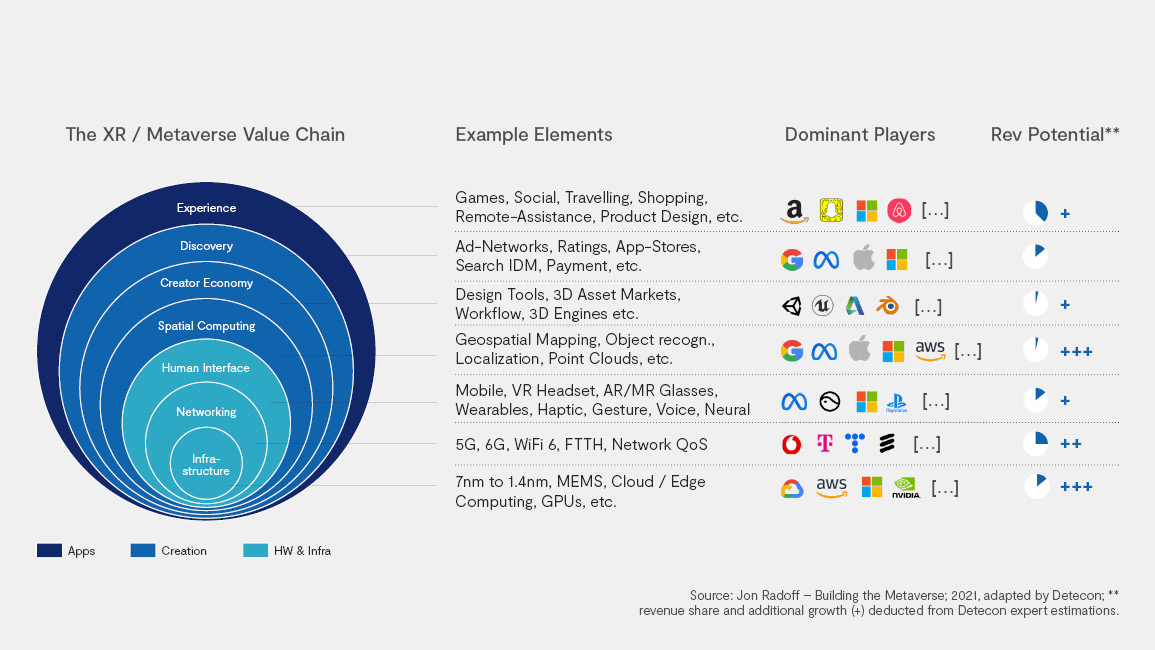

However, behind the buzz is a complex technological ecosystem (see figure 1) that is currently emerging. To ensure finding the viable business model and right strategic approaches of tomorrow, a deep understanding of the complex dependencies between all ecosystem actors is crucial. This is especially relevant for communication service providers (CSPs) which have been struggling to define their role in the last two decades of the internet revolution but are currently enticed by the opportunity to monetize their future metaverse-ready networks as 25% of the global population is expected to spend at least 1-hour in the Metaverse by 2026 (Gartner, 2022).

The Metaverse ecosystem readiness and the next great connectivity challenge

Given the multi-layered structure of the Metaverse ecosystem ranging from user experiences to creator economy and hardware / infrastructure components, it is evident that a single firm is not capable of developing and commercializing the metaverse entirely on its own. It is rather an ecosystem of actors combining individual contributions around a new value proposition that will bring forward its existence.

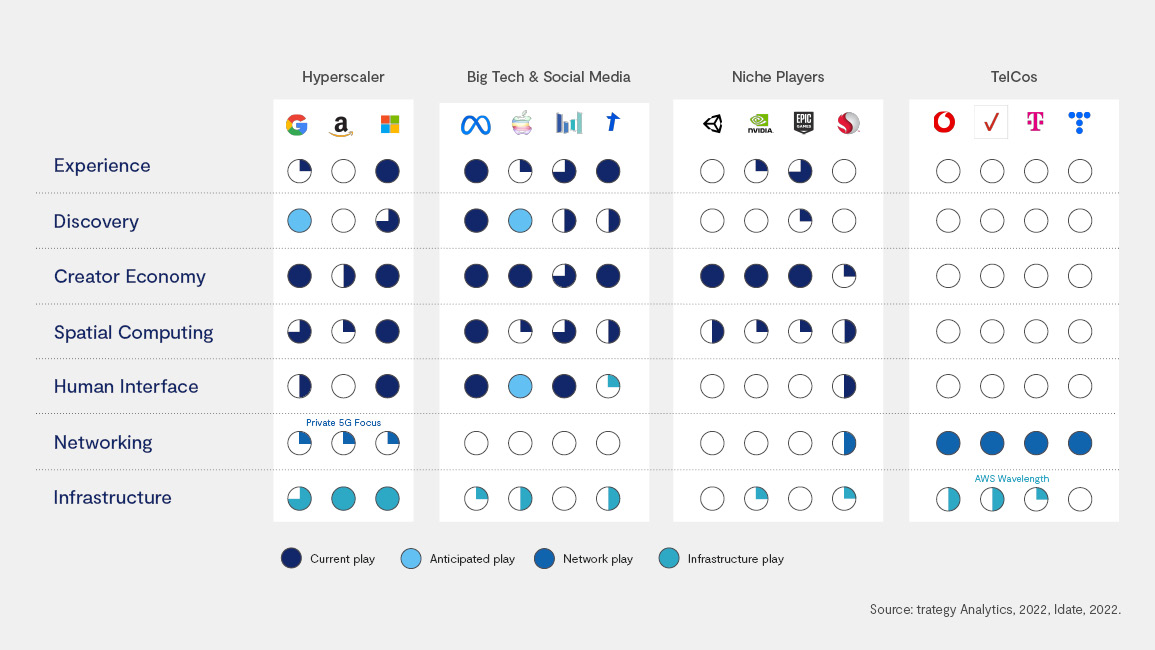

However, a closer look at the individual value chain depth of some companies reveals that hyperscalers and big tech companies such as Google, Amazon & Meta already cover a majority of the ecosystem elements (see figure 2). An essential factor for the dominance of these companies is the vertical integration of value chain elements over the last decade while creating synergies with their existing organizational capabilities and strengths.

For example, Microsoft’s intended acquisition of the Activision Blizzard game studios for $69 billion should ensure their ability to provide exclusive content while leveraging their existing Xbox brand and Hololens / Cloud Computing technologies. In reverse, TikTok’s parent Bytedance acquired the hardware manufacturer Pico early in 2015 for $772 million which enables them today to go head-to-head with Meta’s Quest XR glasses while adding their strength in software, social media, and advertising.

Detecon has conducted a research based on interviews with several leading technology & management consultancies, Metaverse start-ups, IT and Telco companies with the key questions: What are the crucial dependencies among the Metaverse ecosystem actors and how can they be leveraged to identify potential avenues to shape the strategic role and subsequent monetization option for Communication Service Providers?

In essence, most of our experts agree that early metaverse ecosystem stages will be dominated by big-tech platforms mirroring Apple’s smartphone-era success by integrating hard- and software as well as platform and content components. Meta’s app store charging fees of up to 47.5% for creators (Business Insider, 2022) is a first example of the current attempts at monopolization of the emerging ecosystems.

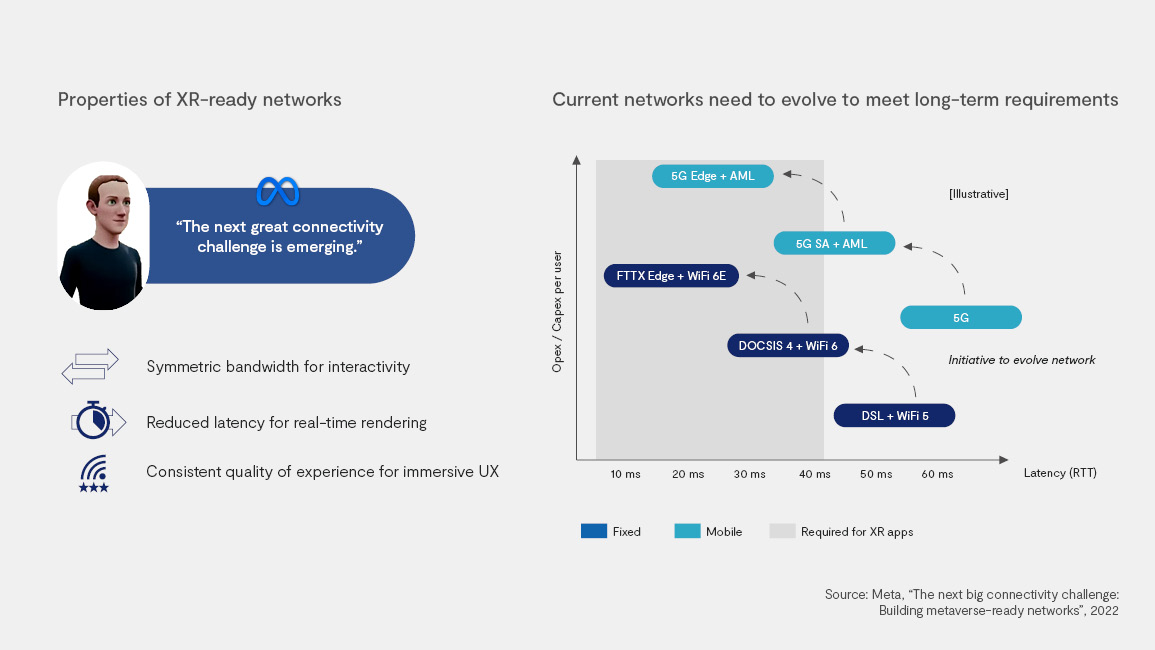

Yet, Figure 2 also reveals that even the most complete value chain coverage leaves one key shortcoming: Networking or as Meta puts it: “The next great connectivity challenge is emerging.” (Source: Meta)

The statement refers to the notion that remote rendering of Metaverse content is key to drive down the price, form-factor and weight of XR-devices while ensuring the best possible visual UX. “Enabling remote rendering will require both fixed and mobile networks to be re-architected to create compute resources at a continuum of distances to end users“ (Dan Rabinovitsj, Vice President, Meta, 2022). Hence, a widespread and Metaverse is considered only achievable as combination of network, cloud, and edge solutions (see Figure 3).

Transforming ecosystem dependencies to monetization opportunities

With today’s connectivity infrastructure not yet ready and facing several challenges, it acts as a potential bottleneck for the metaverse, resulting in an overall ecosystem dependency on CSPs. However, these dependencies can be understood as drivers for joint monetization models and may promote collaborative innovation efforts among ecosystems participants.

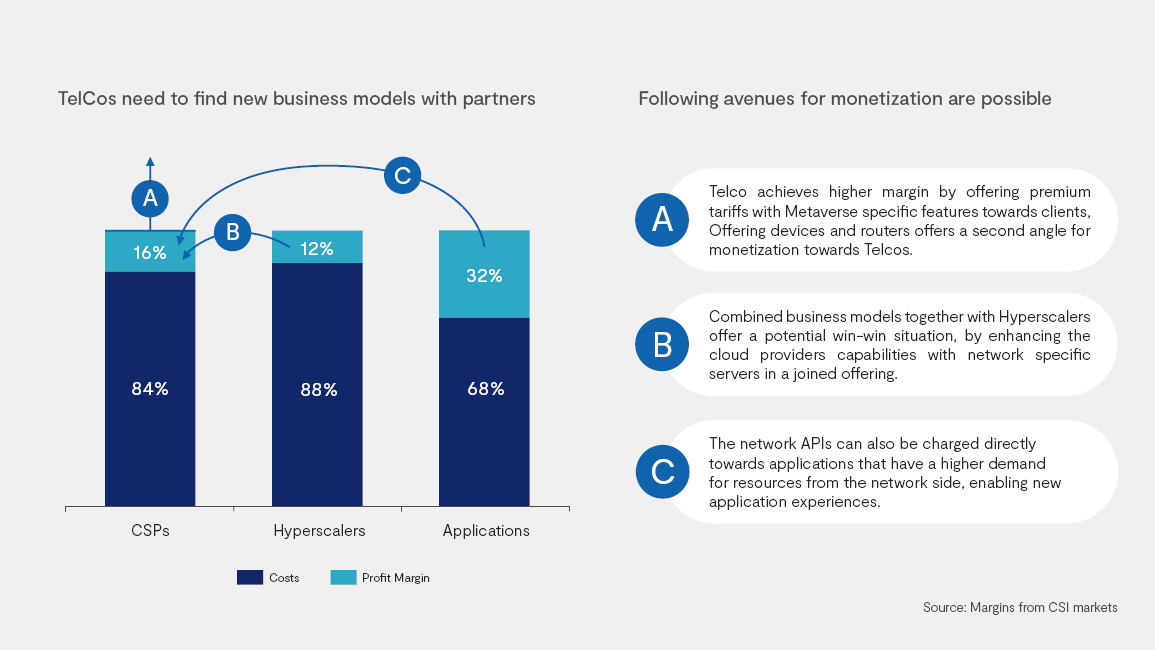

According to our experts, a more proactive partnering with big tech & hyperscalers is inevitable for CSPs while there are three concrete ways of (joint) revenue generation (See figure 4):

- Via customer: CSPs offer dedicated tariffs that allow access to metaverse-ready networks while bundling XR-devices as well as connectivity equipment such as specialized routers (e.g WiFi 6E).

- Via hyperscaler / big tech: CSPs integrate TelCo edge cloud infrastructure within the ecosystem of hyperscalers (either via colocation or proprietary setup) while agreeing to a revenue share model.

- Via Developer: CSPs offer dedicated network APIs to developers (of big tech Platforms) which in turn will be monetized as usage occurs. Currently regulation towards network neutrality is preventing any prioritization. Therefore, this option will require active regulatory and political dialogue to succeed.

Outlook & Recommendation

While current XR devices & applications are designed to be high-end substitutes for gaming consoles such as the PlayStation 5, future device generations will increasingly cater to everyday use cases such as virtual shopping, holographic calls and furniture fitting as well as granting capabilities for collaborative outdoor use – thereby significantly raising the total addressable market. Hence, CSPs need to engage in proactive collaboration today and validate the potential monetization opportunities to capture this market potential.

From our perspective, all three identified monetization models will be used in combination. To address developers and customers on a global scale, metaverse-ready networks need to be integrated with the leading application platforms which will – according to the view of the experts interviewed - be inevitably owned by big tech & hyperscalers. However, without CSPs joining these ecosystems, the Metaverse will have a difficult time getting off the ground. Yet, without a fair monetizing scheme for CSPs, there will be little incentive for them to get involved, and without regulators and politicians willing to rethink the 20-year-old regulatory framework, market dynamics might be stifled or happen in other global regions.

Hence, we believe, that it is key to build on the lessons learned from the evolution of the internet and embrace the potential synergies between hyperscalers and big tech players on the one hand and CSPs on the other hand by finding mutually beneficial avenues for monetization. Following this path, the interdependencies between firms in the metaverse are not only beneficial for innovation and creation of new business models but also foster diverse and open markets and prevent the emergence of a power dominance of individual firms, as feared by Tim Sweeney (Epic Games).

Many Thanks to Paul Florian Rusch for his remarkable work during his internship at Detecon