The rapid pace of digitization in the financial sector is creating significant challenges for organizations. Effective talent management is needed to stay at the forefront of technological advancement while attracting, developing, and retaining the right people with the right digital skills.

Digital technologies have already brought about a number of transformations in the financial sector. Whether it is artificial intelligence (AI), machine learning or integrated blockchain, the use of advanced technologies is fundamentally changing the delivery of financial services. Routine tasks, such as collecting and analyzing large amounts of data, are becoming increasingly automated, freeing up space for more sophisticated tasks.

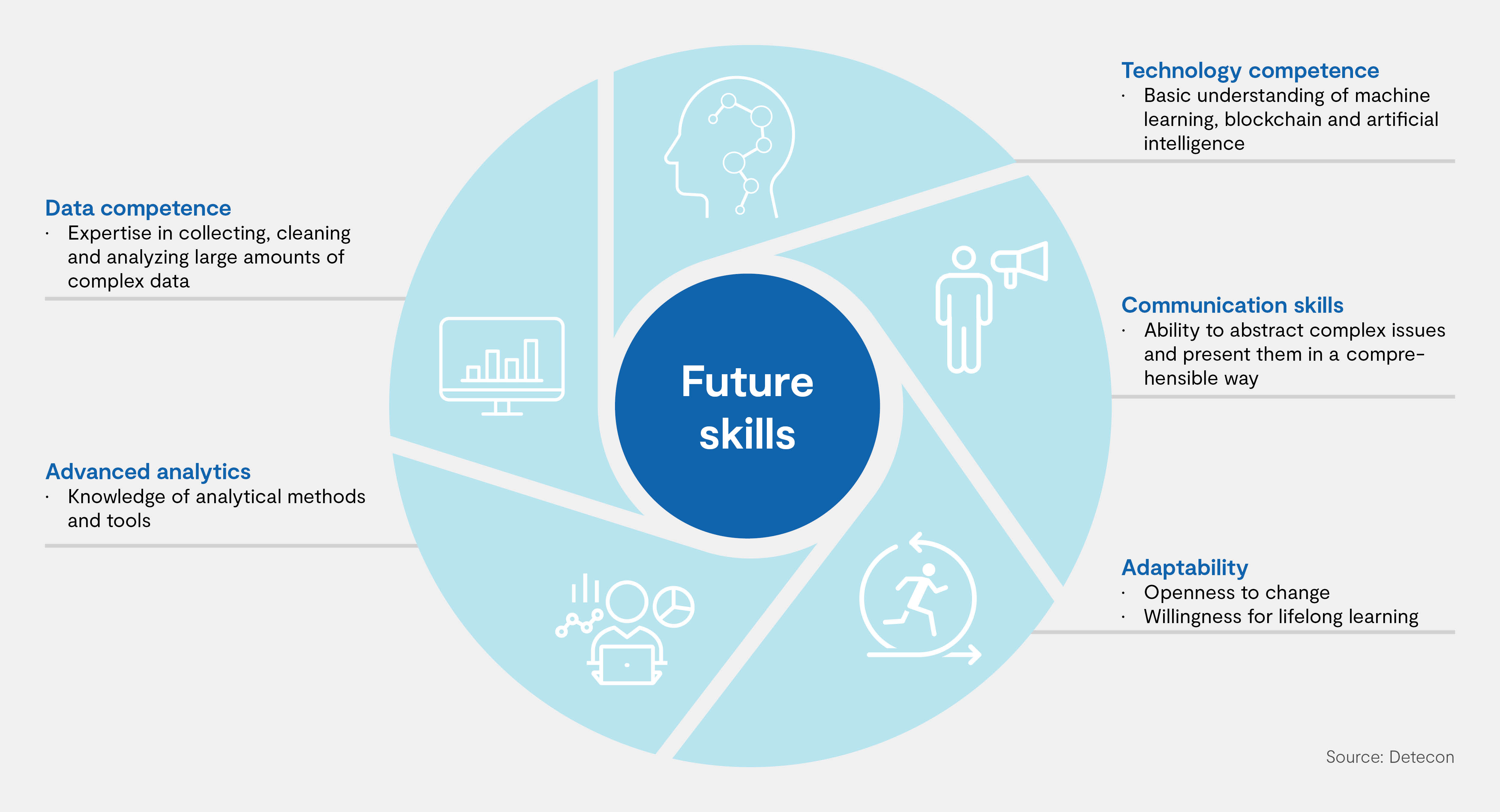

CFOs in particular are facing new challenges. They need to develop concrete plans for digital and AI-based financial management, which requires an active reorganization of team structures and skills. According to Gartner, approximately 40% of finance roles will be reshaped by the influence of financial technology by 2025. Currently, 64% of finance leaders are not using digital technology effectively in their teams, while only 23% of employees have sufficient core digital skills. Finance leaders predict that the digital skills gap in their teams will continue to grow. The goal is an adaptable finance department that cultivates digital and AI skills to thrive in the digitized world of finance. Organizations need to encourage their finance talent to learn digital skills to create an adaptive talent portfolio. The figure below illustrates the specific skills required:

Skill Gap Analysis

Skills gap analysis is a key element of strategic workforce development. It enables the early identification of skills gaps. It involves identifying the skills needed, creating job profiles, and defining target requirements. With the help of the analysis, targeted measures can be introduced to develop and adapt skills in order to close existing gaps and improve effectiveness in specific areas:

1. Training

- HR managers develop customized training programs

- Webinars and internal learning academies promote digital literacy

- Hands-on and interactive approach takes individual learning paths into account

2. Recruitment

- Traditional digital recruitment methods such as social media and mobile strategies

- Additional strategic partnerships with universities for early positioning and development of new collaborative learning content

3. Employee Retention

- Employer branding to position the company as an attractive employer

- Flexible working models and individual development promote satisfaction

- Longer employee retention through cross-industry offerings

Digital transformation requires an agile transformation strategy. Companies must not only be responsive, but also develop a shared vision to succeed in the new digital landscape. It is crucial to develop talent with both traditional finance skills and strong technology skills, and to make room for agile methods. This is the only way to realize the full potential of digital evolution in finance.