Digitalisation in the financial sector enables the CFO to make the management of the company fit for the future, in order to be able to react faster to new business challenges. However, the CFO operates in a very tight financial framework with a comparatively small organization in the background, which he must set up and transform more efficiently in order to meet changing business requirements.

In traditional finance departments, the focus often lies on analyses of the past. The heterogeneous system landscapes with missing interfaces often lead to numerous manual processes, which are characterized by delays as well as a lack of flexibility in the changing business requirements. The system landscapes act as passive recording systems and the limited resources are mostly involved in data processing. Manual correction changes, data verification & consolidation of reports are too slow for the fast-moving business models and are no longer viable.

The focus of the finance departments is increasingly shifting to real-time control, based on various future scenarios, which is based on logically structured and automated analyses of internal and external data. In the future, cross-system analysing software solutions will shape the advantages of a networked world with future-oriented analyses for controlling. Automated and networked IT systems will make data analysis processes more efficient and employees will be supported by more meaningful data bases for sophisticated corporate management.

Understanding digital trends and using powerful and future-oriented technologies in a targeted manner in order to set up their own organization more efficiently and at the same time provide more meaningful and reliable data sources and scenarios for business management is therefore critical for CFOs.

Transformation Challenges, Trend Radar and New Work Force

There is great uncertainty about the direction of development - both from a technical and a business point of view. There is also a need for clarification about which approaches and solutions are suitable for meeting company-specific requirements and at the same time using them to make your own organization more efficient.

But how can these uncertainties be countered?

Detecon recommends the continuous use of trend radars and functional maps to drive forward the digital transformation in the financial sectors. The aim here is to identify the right efficiency potentials in the ongoing processes and to expand the necessary functions in order to provide the best possible support for the management of the company.

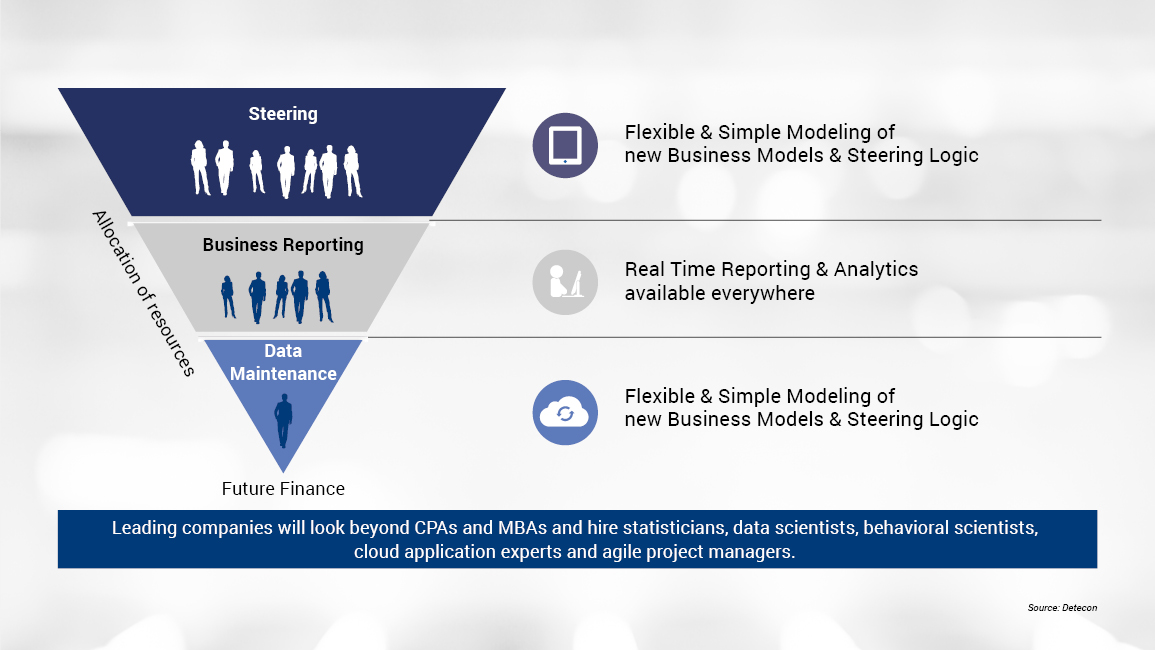

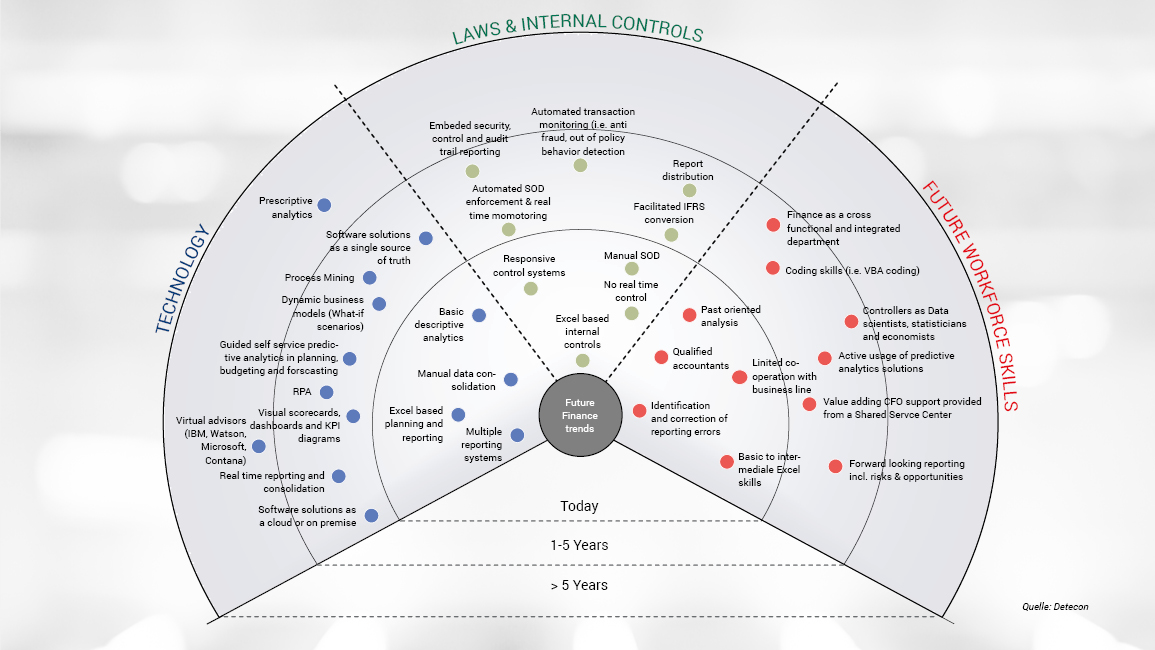

The trend radar displays the development within the dimensions of technology, regulatory requirements and future employee qualifications over a time axis of several years. In addition to modern technologies, the right mix of employees and qualifications is also crucial for the transformation of the finance department in a modern organization.

For example, the CFA (Chartered Financial Analyst) or the MBA (Master of Business Administration) will continue to play an important role. In addition, there are qualifications for dealing with new technologies and IT systems, as well as the skills of statisticians, data analysts, behavioural researchers and economists.

The Trend Radar provides insight into current trends and the underlying software solutions that are currently available on the market. But what really makes sense for the individual company and where the finance department needs to take action and increase efficiency is best answered by structured analyses based on functional maps.

Development of a digital function map with efficiency improvement potentials for CFO’s

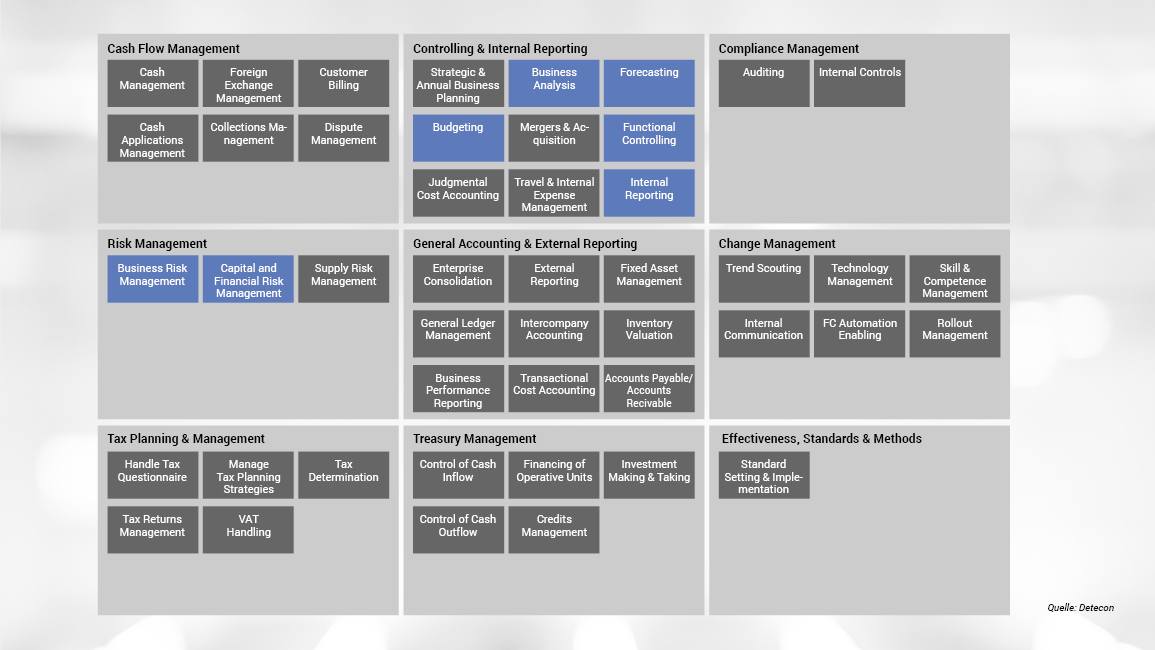

The digital function maps fully depict the functions, processes, organization and underlying software solutions of individual finance departments and serve only as a strategic starting point for the analysis of individual finance departments. They help to translate the business models as well as the technology trends into company-specific functions, processes and organization and form the basis for preparing recommendations for actions of digital transformation through new technologies.

The advantages of digital function maps are that they first focus on what needs to be fulfilled (function) before it comes to how it should be fulfilled (processes, software solutions, organization). Thus, analyses are evaluated independently of existing processes and organizations and are digitally mapped (e.g. in LeanIX).

On a higher level, the following functions of the finance departments are to be analysed via function map:

- Cash Flow Management: The management of free capital and financial flows.

- Controlling & Internal Reporting: The internal reporting and management of the company on the basis of key financial figures.

- Compliance Management: The review of internal processes and minimization of compliance errors.

- Risk Management: The identification, analysis and assessment of risks, both financial and operational.

- General Accounting & External Reporting: The external reporting as well as for the complete recording of data within the framework of general accounting based on HGB, IFRS/IAS, U.S.GAAP, etc.

- Tax Planning & Management: The legal juridical reporting of taxes.

- Change Management: The continuous improvement of the F&C area and employee skills.

- Treasury Management: The recording and management of cash flow-oriented financial resources for internal and external financing.

- Effectiveness, Standards & Methods: The implementation and measurement of effectiveness, efficiency as well as the definition and compliance with standards.

Departments and work processes are confronted with the actual requirements of a company's finance department in a company-specific functional map and are always a tailor-made product for each individual company.

The first step is to create the current functional map for the finance department and to map the underlying software solutions and employee qualifications. Then the required functions of individual departments are identified on the basis of the business model independently of the current function map and software solutions. These are first compared with the current functions as well as work processes, software solutions and qualifications and then with the trends and required qualifications. The deltas between current and required functions show the fields of action of the finance departments.

Finally, the levers for increasing efficiency are examined and identified. This approach pursues the goal of simplifying processes and organization for the required functions and making them more efficient, as well as identifying potential savings that can be reinvested in digital transformation.

On the basis of the company-specific functional map and the levers of efficiency improvement, a target software-architecture and -organization for the finance department must be set up, the transformation effort must be planned and the profitability of the investment must be examined.

Special attention must be paid to the selection of software solutions and providers. Here the course is set for the flexibility and efficiency of the functions to be fulfilled.

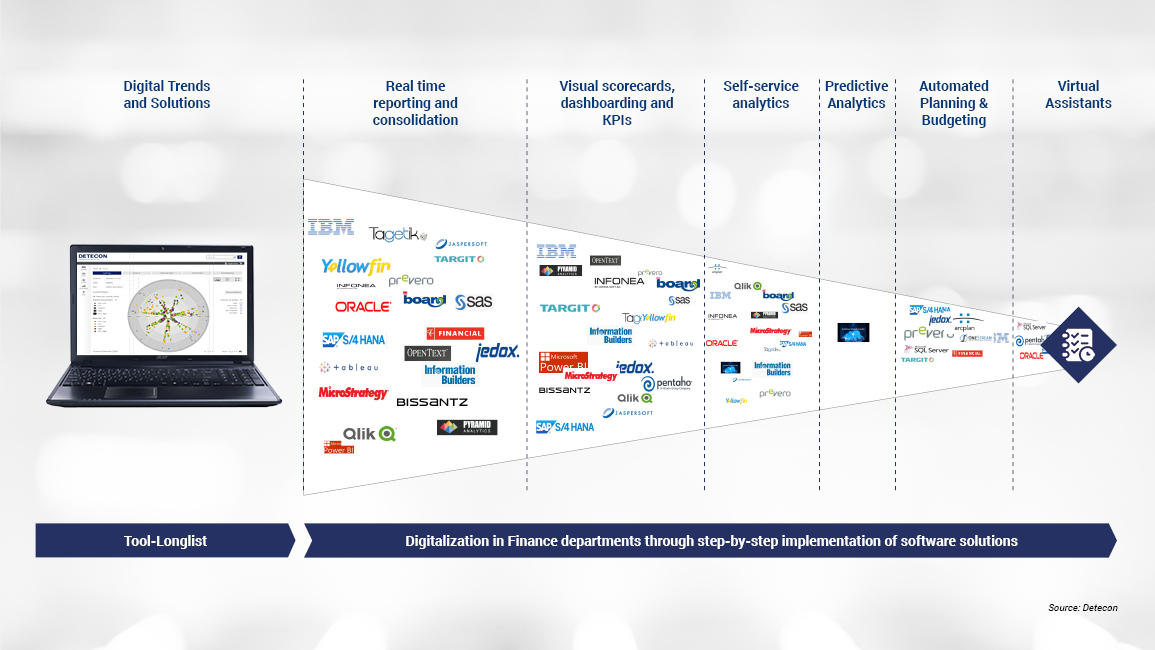

Many software solutions that require containment and decision

A characteristic feature of the software market is the high number of solutions. In recent years, it has become apparent that even well-known software manufacturers are facing increasing competition and are outperformed by relatively small companies in terms of suitability for everyday use and functionality. For this purpose, the software solutions must be carefully examined and narrowed down on the basis of the newly defined and company-specific functional map.

The figure below shows an exemplary classification of different software solutions according to requested functions and trends:

In order to combine the front-end solutions preferred by the end user and the data generated from them, a high-performance ERP (Enterprise Resource Planning) basic system is best suited, which can be accessed by any software solution.

High-performance ERP systems as the basis for efficient control

With SAP HANA as the basic system, the interdependency in the process chain makes it possible to quickly identify which data must come from which module and where this data should flow to, after processing. One problem, however, is that these front-end solutions often have different data storage locations, which means that the data has to be moved back and forth manually, resulting in inefficiency.

This is where API (Application Programming Interface) and RPA (Robotic Process Automation) solutions come into play, which can automate the manual interfaces relatively quickly and cost-effectively.

Although the source data of the front-end solutions are then stored in various SAP modules, SAP HANA Finance is nevertheless a uniform system in which automated data exchange can take place in real time via a central database. Here, data processing speed plays a major role, which SAP, for example, wants to solve with its new SAP HANA in Memory technology. This is the foundation for artificial intelligence, which can prepare various decision scenarios for business management in real time by accessing structured and non-structured data in the form of a virtual assistant.

The CFO as a driver of competitive advantage and efficiency improvement

The instruments described above can therefore provide excellent support to the CFO in his task of digitizing and efficiently structuring the financial department. At the same time, the CFO can reduce complexity and improve decision-making through the increased use of digital technologies and innovations, as relevant data is available for management in real time from a harmonized IT landscape in a more reliable and networked form. This enables the company to react flexibly and quickly to market challenges and to expand its competitive advantages in the right areas (e.g. customer loyalty, business model, pricing, portfolio, technology, employees, cash flow, CAPEX, etc.).

The CFO takes a leading role in this process and, together with his finance department, drives the increase in efficiency and market-related adjustments in all areas of the company on the basis of new technologies and data analyses. The modern CFO is the digital pioneer in the company and provides the basis for the tailor-made digital transformation of the company with the necessary return on investment.