Beyond and within the telecommunications industry community, the special approach of Turkcell was followed with curiosity and a certain sceptiscism. Actually, the approach is to quite an extent based on similar strategic insights and conclusions that Detecon manifests since 2014 in its Future Telco publications. This is one of the obvious reasons to have a closer look. In this article, we’ll highlight what is unique about Turkcells approach – and the role of partnering in all this.

In its multi-national footprint and national home market Turkey, Turkcell offers class leading digital services to its customer base. What is so special about it?

Turkcell offers the very typical range of services, as carriers across the world just do: services called “BiP” (instant messaging), “fizy” (music), “TV+”, “Dergilik” (digital publishing) and “lifebox” (storage) – which were the most preferred Turkcell applications in 2019. The difference is: unlike other carriers, Turkcell has developed these services mostly on their own resources and with national partners. And - also unlike many others who went this road - the adoption in and beyond their customer base (mobile customers in Turkey: 33 million in 2019) is significant: BiP received 42 million downloads worldwide, making it one of Turkey’s most downloaded apps. According to Turkcell, “BiP differentiates from other global players with several features including lost messaging, group video calls up to 10 users, fast and secure money transfer as if sending messages and also the option of using of two phone numbers on a single mobile phone, called Second Number at BiP”. (Sources: Turkcell Annual Report 2019, p. 62). This app also features a marketplace to attract software developers and business partners – following a typical approach of partnering to enhance the ecosystem’s attractiveness. Overall BiP can be seen as a multi-purpose platform that has evolved from pure messaging – partially comparable to WeChat. We wonder, if and when Turkcell is going to extend its offering to (cloud) gaming, an offering that could help to gain and retain (younger) customers and create commissions revenues.

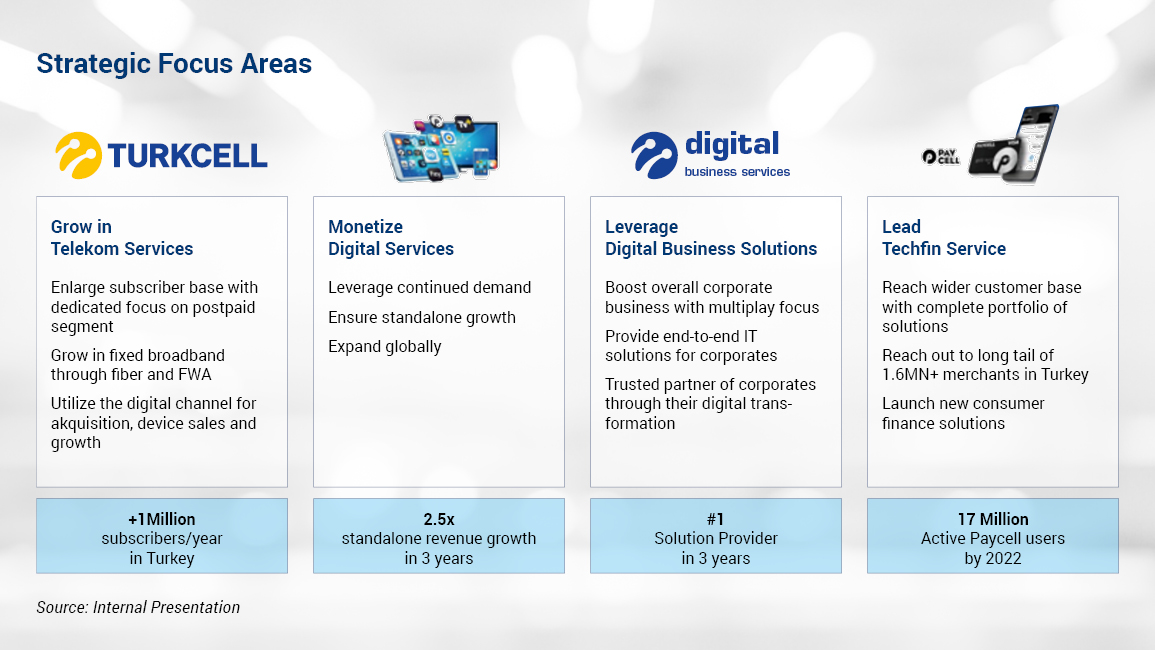

Financial services – or “Techfin” as Turkcell calls it, is of paramount importance as one of the 4 strategic focus areas: Turkcell sees a clear trend towards a cashless society and a growing need for intelligent payment solutions - which would also be facilitated by a changed regulatory framework (e.g. adoption of the PSD2 EU directive in Turkey). Under the label “Financell”, Turkcell bundles a variety of financial services. Since 2016, Turkcell has been offering the comprehensive "Super App" “Paycell”, and aims to reach 17 million users by 2022 - and to address 1.6 million retail partners. Paycell supports online payments, P2P money transfer, QR code payments and micro credits - also based on credit scoring. It allows millions of people without a bank account to participate in digital payment transactions (31% unbanked population). The partnership with Visa allows Paycell Card users to make transactions worldwide. In 2020, user numbers and sales have increased rapidly due to the rapidly growing demand for cashless payment: e.g. by 97% to 3.3 million 3rd Party Bill Payments.

A range of further digital services rounds-up the offering: “Yaani”, a mobile browser and search engine, “Fast Login” a mobile customer ID service, a range of SME targeting services and the support of the Turkish beehive crowd funding platform – all this illustrates Turkcells range of innovation activities – and how strongly these are related to the Turkish society and economy.

What makes the difference? Seeking ingredients for Turkcells success formula…

All the above seem as an outcome of the Turkcells radical vision decided in 2016, gripping and driven from above: aiming to become a "digital operator" whose relationship will no longer last only 32 (telephone) minutes, but will last the whole day, 1,440 minutes. It becomes immediately clear that this requires a broad range of services. It also seems, that Turkcell was successful in keeping on par in their innovations with global competition when it comes critical factors as usability and key features. The size of population, growth dynamic and creative skills of its Turkish home market surely provided them with a very favorable, highly productive environment. The fact that Turkish language is less in the focus of global player might partially help in competitiveness. Keeping customer data in Turkey has been and continues to be a key positioning statement of Turkcell – clearly setting it apart from its global competitors. Putting clear priority to local software and product development, support of local business and social initiatives – creates further credibility and trust from private and institutional customers. Overall, Turkcell did walk their visionary talk and actually made smart use of the internal and external assets – putting them in a strong local position and a largely digitally transformed company.

Scaling its innovative power globally – a case yet to be proven

Atac Tansug, Vice President of Digital Services and Solutions at Turkcell, claimed, "As Turkcell, we are the flag-bearer of digital export through our digital services offered to other telecom operators in the world.” Cooperations with network operators and platform licensing are mentioned as explicit factors for the predicted 2.5x revenue increase of digital services (2019 vs 2022). Lifecell Ventures is the corresponding subsidiary of Turkcell. Its business purpose is to provide Turkcell's services and technologies in its home markets and globally, either as a white label solution or licensed. As references, some regional players are mentioned with whom the group has often been cooperating for a long time. Network operator Digicel recently took advantage of this and launched 3 major platforms (TV&VoD, IM&calling, personal cloud storage) and the service login in 32 countries. This can be seen as a major step – however, given Turkcells vast ambitions, there is still a longer way to go. With its high level of activity and visibility in industry leading associations like the GSMA, we’d expect more carriers to become aware, interested and follow this track.