Despite initial successes the ecosystem of open RAN is still in its infancy. Detecon Consultant Nikolay Zhelev has identified key challenges and key factors for the success of Open RAN.

15 years ago 3G was just starting to see large scale rollouts and high speed data (HSDPA) was hitting the market. Operators had a choice to choose from at least a dozen (yes, 12) reputable network vendors to source radio access network (RAN) equipment. 5 years ago that choice has been reduced to about six. Fast forward to 2020 where only three major vendors are holding 80% of the market for advanced 4G and 5G RAN products, such that the ecosystem is facing three key challenges – vendor lock-in and hence limited competition, constraints on RAN technology advancing, and increase in Total cost of ownership (TCO).

How we got here and what are the main problems

Nowadays at least 50% of mobile network CAPEX is attributed to RAN, and it is not expected to decline with 5G deployment. Adjusting for civil works, antenna-feeder components and passive equipment, the portion going to network vendors for active RAN equipment (software and services) is about 20-30%. That percentage was even bigger in the past when each generation of RAN technology was deployed with different vendors – e.g. 2G from vendor A, 3G from vendor B and 4G from vendor C.

Due to the heavy invest in RAN, operators’ focus was to obtain the best technology within their available budget in the early 2000s. That resulted in multivendor deployments (e.g. 3G as overlay). At the same time 3G technology proved (too) complex and required substantial R&D investments, vendors had to start investing in LTE technology. This approach proved not sustainable for many vendors most notably for Nortel which filed for bankruptcy in early 2009.

In the early 2010s, operators started to look for cost efficient deployment especially in the outset of 4G rollouts. During that time the idea of single RAN emerged and took traction from 2015 onwards. In a single RAN deployment, the operator could deploy equipment at any given site from one single vendor. The cost pressure at operators reverberated at network vendors where massive consolidation took place and resulted in a market dominated by three RAN vendors.

The current major RAN vendors have highly sophisticated, feature rich and high performant solutions as a result of years of continuous R&D investments, consolidations and being most active 3GPP members. In addition, these vendors do not only deliver the RAN software and hardware but also deliver end to end services including system integration i.e. “plan-build-run”.

As a result of high market concentration certain issues are present:

- No interoperability between vendor products due to closed interfaces

- Constrained flexibility to adapt roadmaps to market needs

- Non-competitive prices due to limited competition

- Vendor lock-in effects

Ecosystem creation and growth

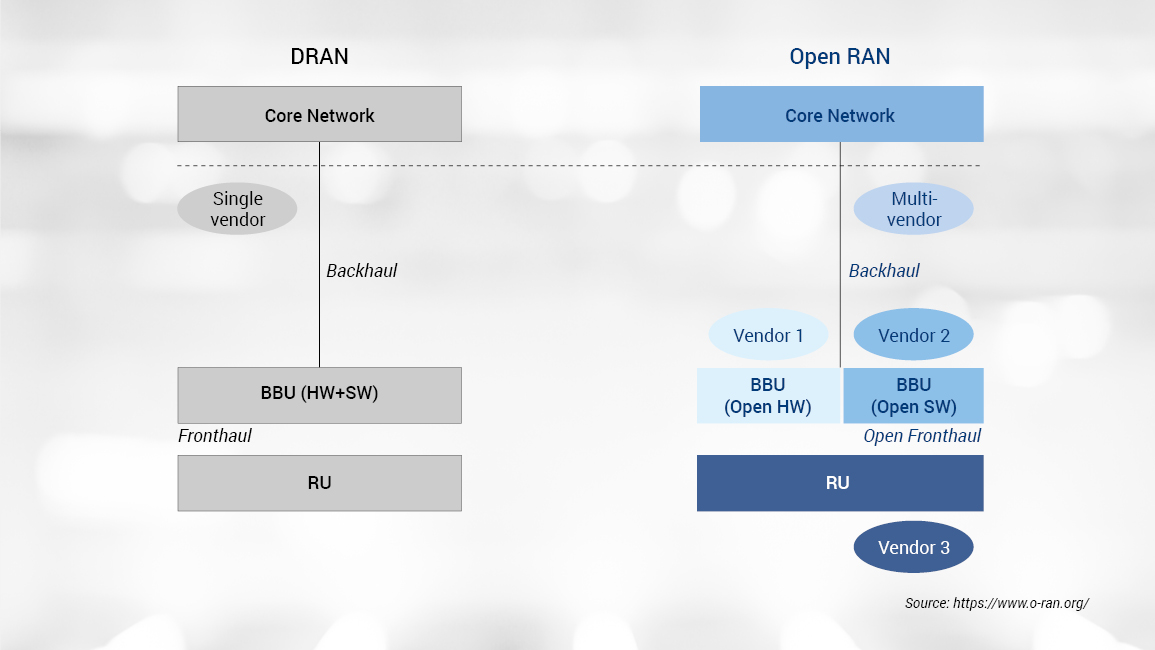

To counteract the challenging RAN market development, operators and relatively smaller ‘challenger’ vendors have started initiatives around the “open RAN” theme. Examples are O-RAN Alliance, TIP OpenRAN, and vRAN, in which some of those initiatives dated back to 3 to 4 years ago. Main objectives of the initiatives are open interfaces, open software designs, increased use of commercially available off-the-shelf (COTS) HW and SW, possibilities to perform interop testing and plugtests to test mix and match across different vendors. Combining solutions from various vendors will be possible as illustrated on Figure 1. Hardware and software of main components such as radio unit (RU) and baseband unit (BBU) could be sourced from various vendors.

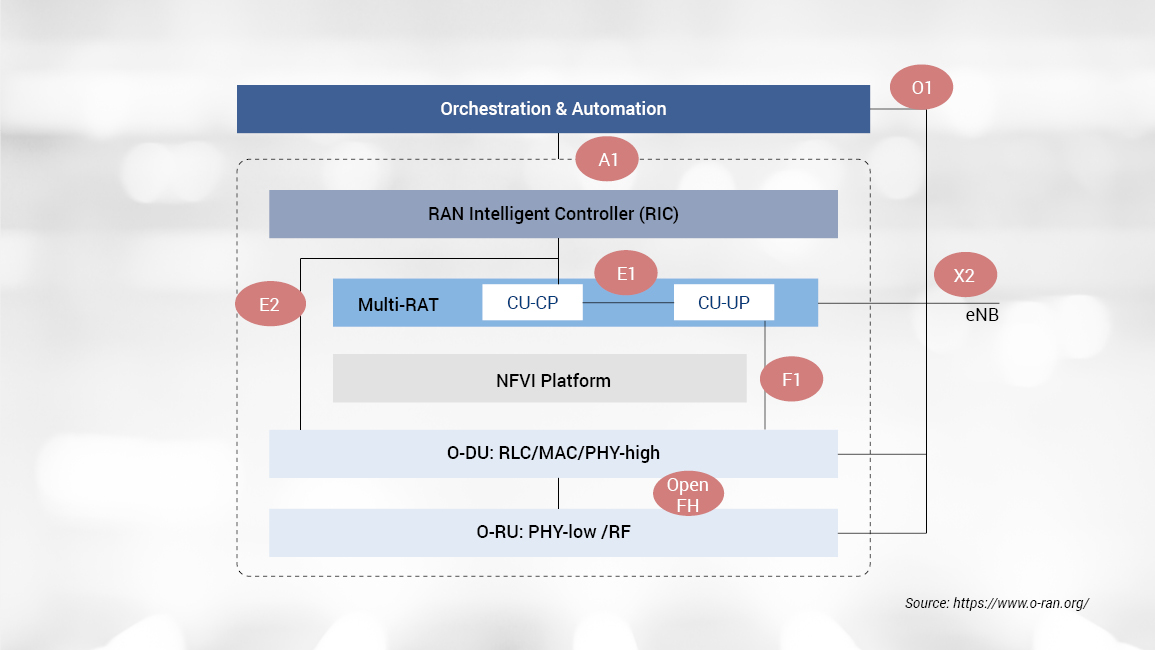

The openness in RAN is safe-guarded by allowing disaggregation across defined interfaces as shown on Figure 2. Interface A1 and E2 is supported by RIC between management and the ORAN Distributed Unit (DU). Interface F1/E1/X2 is supported by the multi-RAT CU stack. The open fronthaul was specified by O-RAN that aims to enhance eCPRI to ensure full interoperability. Those open interfaces are expected to provide the basis for different vendors to interoperate without complex and costly integrations, thus bring both technical and economic benefits.

In Japan, Rakuten Mobile is very active and has started mass deployment using open RAN components - hardware and software from different vendors. Several companies are jointly working on 4G/5G open vRAN development and deployment, based on the O-RAN alliance specifications with Rakuten acting as the prime system integrator. To date thousands of macro, small cell and active antennas for greenfield 4G and 5G mobile network have been rolled-out.

Some operators in Europe have started to take action following the example of Rakuten Mobile. Vodafone announced in 2019 to start trials in UK and Africa, as well as RfQ for open RAN. Worldwide first O-RAN TIP lab was founded in Berlin for O-RAN test and certification. At present there are more than 100 vendors of various size actively collaborating in the alliances.

Despite these successes, there are still many challenges ahead – to start with – there is still not one aligned view of the ecosystem going forward. The cooperation between the alliances is in its infancy. Further momentum is needed in order to advance the current efforts from trials and testing to commercially viable Solutions.

All stakeholders in RAN industry could consider some of the following in order to reach the ultimate goal of establishing a sustainable, innovation rich and competitive ecosystem:

- Define and reach minimum performance requirements for products suited for urban and rural deployments, for brownfield and greenfield Operators

- Define and enable standardized testing for all components of RAN solution, in multivendor Environment

- Acquire system integration competence to be able to build together a carrier grade solution

- Identify responsibility and roles definitions across the supply chain, invest in risk management to ensure overall solution conforms to requirements within acceptable risk Limits

- Stimulate investment with support by major stakeholders (operators, vendors, institutions)

Key success factors to Open RAN

Detecon believes that open RAN is a very meaningful transformation step in the RAN industry. We have been investigating the advances for the last 5 years hence we see that some step up in momentum is needed to be able to depart from the hype and start delivering on the promises. The following success factors are identified for each major stakeholder in the ecosystem.

Operators (various tiers):

- Specify open RAN requirements in RAN RFQ/RFP

- Start medium to large scale pilots, validate functional and non-functional requirements, as well as service capabilities of vendors

- Assess internal organization for fitness to adopt open RAN – staff skillset (DevOps), processes to deal with multivendor solution, in-source responsibility and ownership; adopt necessary changes

- Lead system integration of multi-vendor solution

Vendors (challengers):

- Ensure supply chains are in place to deliver at scale

- Ensure performance and quality match state of art products on the market

- Setup in-house or establish partnerships to enable an organizational structure able to deliver commercial projects for the complete lifecycle (plan-build-run)

Vendors (incumbents):

- (re) consider position towards open RAN and join alliances to work together

- Identify viable business models leveraging IPR, production leadership and e2e capabilities.

Many thanks to Dr. Xiaowei Zhang for her collaboration on this article.