The role of finance, and with it the role of a CFO, is currently undergoing major changes. The reasons lie in an increasingly complex economic and technological environment. In this context, data makes finance powerful.

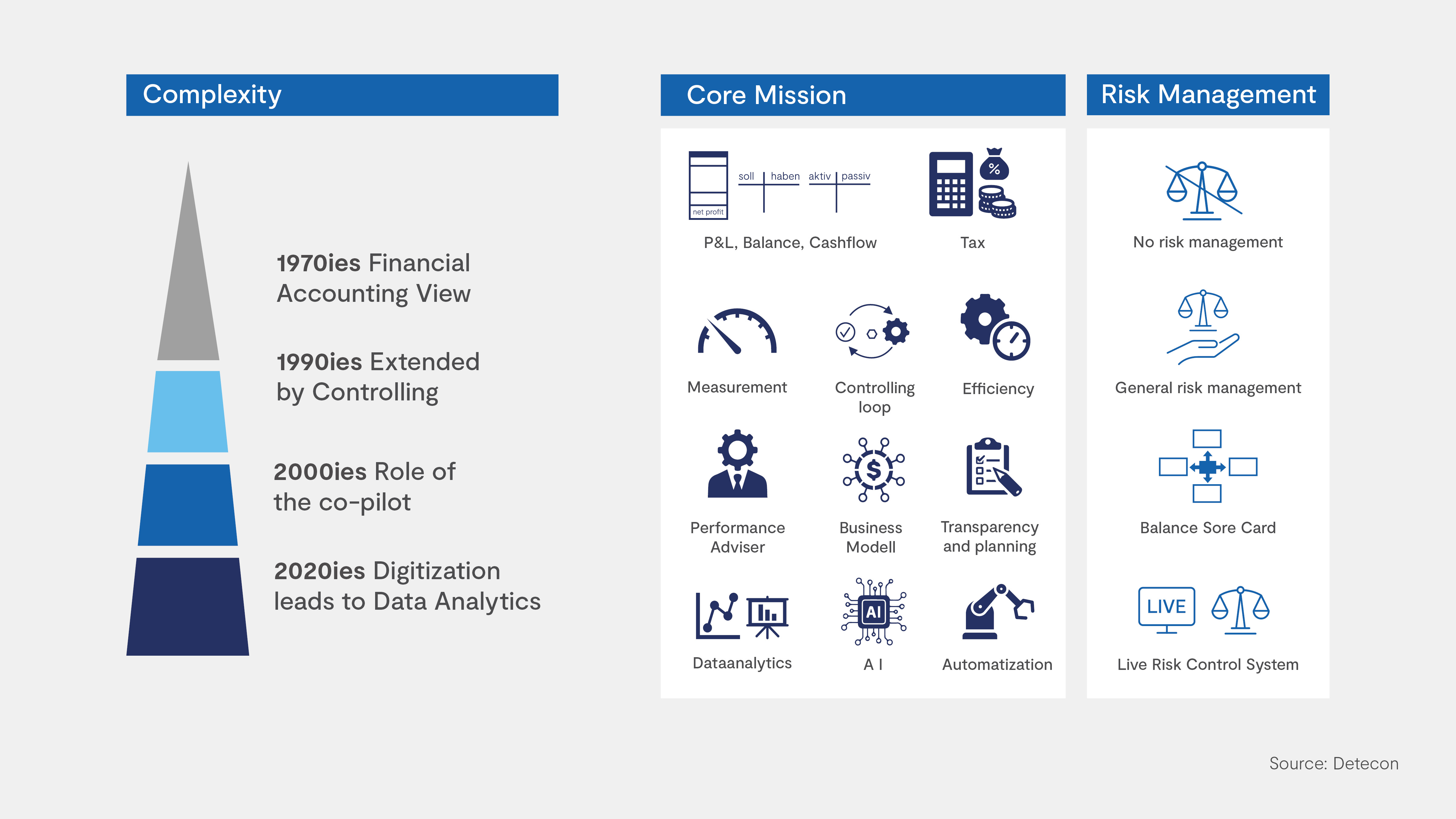

If you look back about 30 years - about a generation - you will see a very traditional role model: financial accounting in the sense of external accounting, where the view of past periods dominates and formal aspects, charts of accounts, laws, tax and corporate finance are in the foreground.

Development into an entrepreneur in the company

This role has been expanded to include internal accounting: "Controlling" creates transparency for all managers of a company about the financial situation and the detailed planning of financial and, above all, non-financial parameters. Today, it is impossible to imagine corporate management without the so-called controlling loop of planning, reporting and counteracting. Although the focus of the finance role was still on developing targets for the company, the perspective has turned to shaping future periods, achieving efficiency goals as well as external goals derived from the capital market and shareholder management.

The next development step led to the assumption of an overall co-responsibility for the business success in the role of the "co-pilot", the internal advisor and coach. Based on a deep knowledge of the company's specific business model, the finance department becomes a proactive supporter of the colleagues on the board responsible for the business as well as their employees. The complexity of the financial world is translated into simple and understandable words to ensure acceptance in the departments. Planning takes on a new dimension, as the task is now to think ahead and take responsibility. Finance becomes a "business partner", which is reflected in the job title of many a finance department in the company.

The consequence of this development is a strong focus on the creation of a uniform database that allows a focus on content. This marks the next step: the CFO becomes a data officer (see also our article "The role of the CFO in a data-driven organisation"). Digitisation is a game changer, especially when it comes to the availability of data. The number of available, non-financial parameters that can provide essential input for the qualitative analysis of business performance in the context of corporate management and control is increasing rapidly.

The data comes from customer relationship management (CRM), social media or is generated by digital "machines" in production. To be able to perform this role, it is necessary to also take responsibility for the content management of the data in the company and for the consistent and stringent definition of key figures. Artificial intelligence applications create opportunities for identifying new business opportunities based on this data.

Thus, it is the task of the financial organisation today to provide orientation in the data jungle and to establish a reliable, plausible and consistent comparability of data over time.

Corporate management on the basis of data as a central task

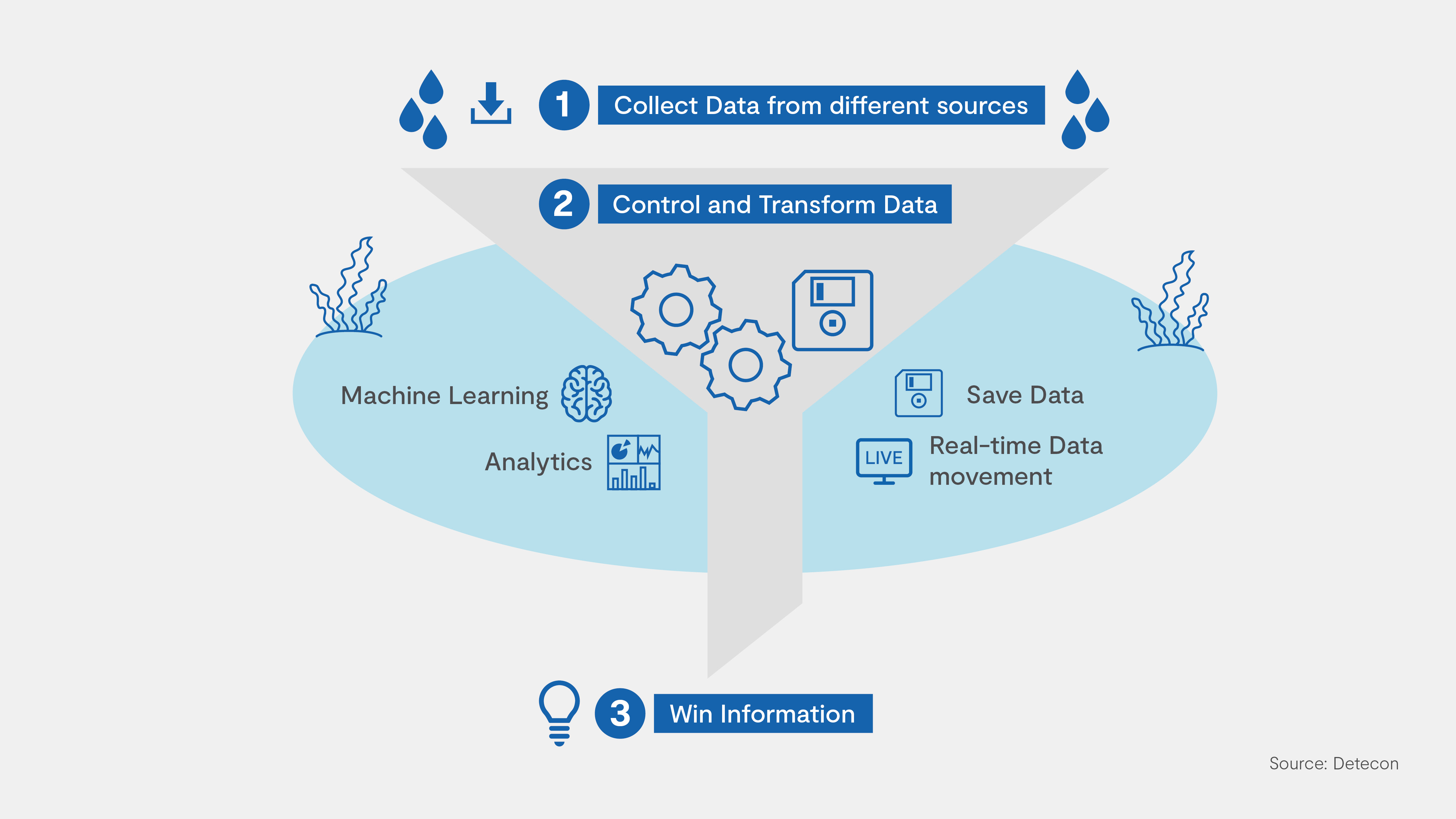

Today, the finance department has access to a very large amount of financial and non-financial data from all areas of the company, which is not only contained in the classic Business Intelligence (BI) of the finance department itself, but which comes from a wide variety of sources, including customer and supplier contacts, and initially ends up in a "data lake".

The challenge now is to store and analyse the data in a meaningful way. Questions have to be answered such as: Which data is relevant for the narrower management of the company, which for the development of new business areas? How do you keep an overview?

This requires the transformation of the classical, descriptive and diagnostic analysis into a predictive analysis based on sophisticated financial analytics with the help of statistical tools. The framework conditions of the finance organisation to work efficiently and to be as lean as possible in terms of "lean overhead" remain in place. A solution approach that aims at simply increasing the number of employees in the finance department is therefore too short-sighted.

The tasks themselves move into the centre: The focus must be on the distinction between "must have" tasks and "nice to have" tasks, as well as on the courage to do away with what has grown historically, sometimes what has become dear to us. But how do you find out which tasks fall under this category? How do you transform your own organisation without jeopardising the core tasks of the finance department? How can you make the way you work more agile?

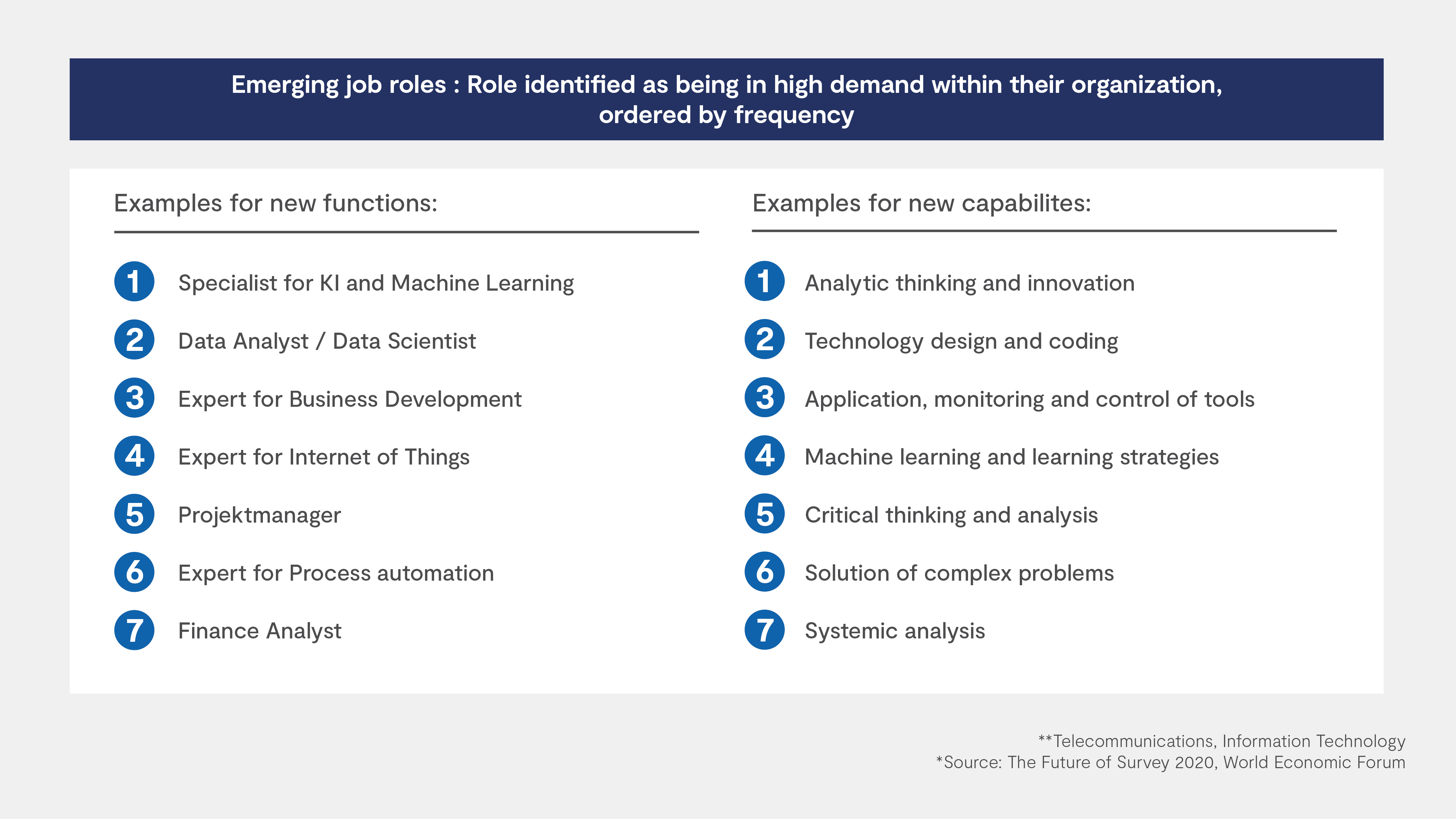

Taking into account the digital possibilities, especially the trend towards remote working, skills and requirement profiles must continue to change step by step (see "The Future of Jobs Report", World Economic Forum 2020). This includes the greater division of existing tasks between humans and machines. The integration of machines, whose algorithms can process information and data automatically, opens up new scope for organising work: employees are increasingly relieved of routine administrative tasks ("monkey work") and are given more time and freedom for qualitative work in the form of consultation, communication, interaction and decision-making.

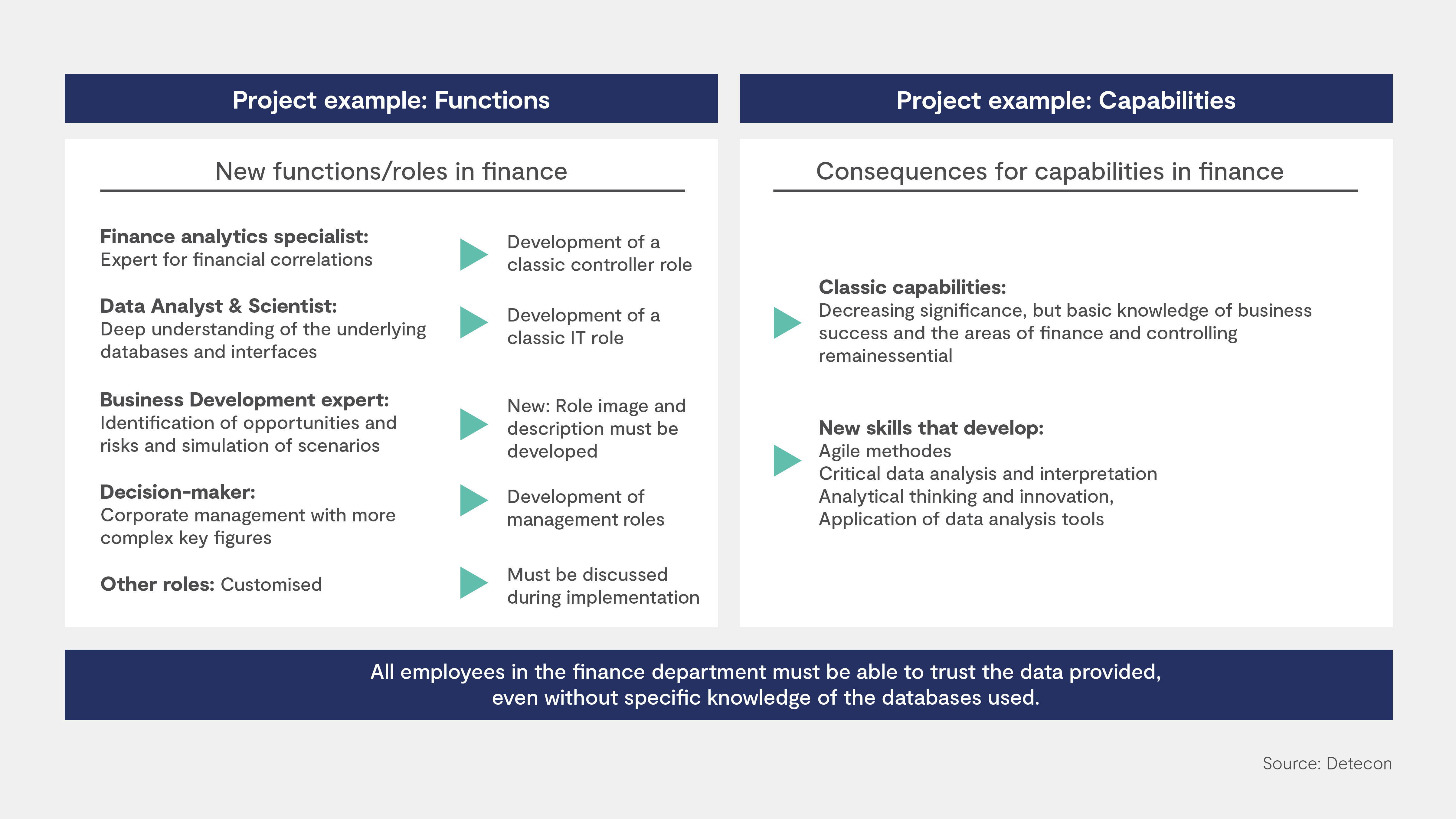

This means that not only are existing roles within finance evolving, but new roles are also emerging. Collaboration with stakeholders, especially IT and management of other departments, is also changing. In the course of the requirements for understanding and applying the new offers from the finance department, the required skills ultimately change - not only in the finance department, but also in the other departments of the company.

Implementation requires change management

These changes are profound. We recommend starting with a look at the operating model of the finance department. This defines which functions and capabilities are served by which process and supported by which IT applications. The revision of the job descriptions is a first step and requires the consideration of which function can be expanded and which new functions need to be introduced in order to achieve the set goals. In addition to the future orientation, the orientation towards the needs of internal customers is relevant. A consistently high quality of the core tasks must be guaranteed.

Support is provided by a correspondingly flexible system architecture that optimally supports the work and enables the user to quickly and independently create changing analyses. The division of work between classic IT and BI activities as well as the contribution of employees from the finance department must also be defined - after all, the latter should not become IT professionals, but rather be able to utilise the potential as users. An excerpt from a project example explains this:

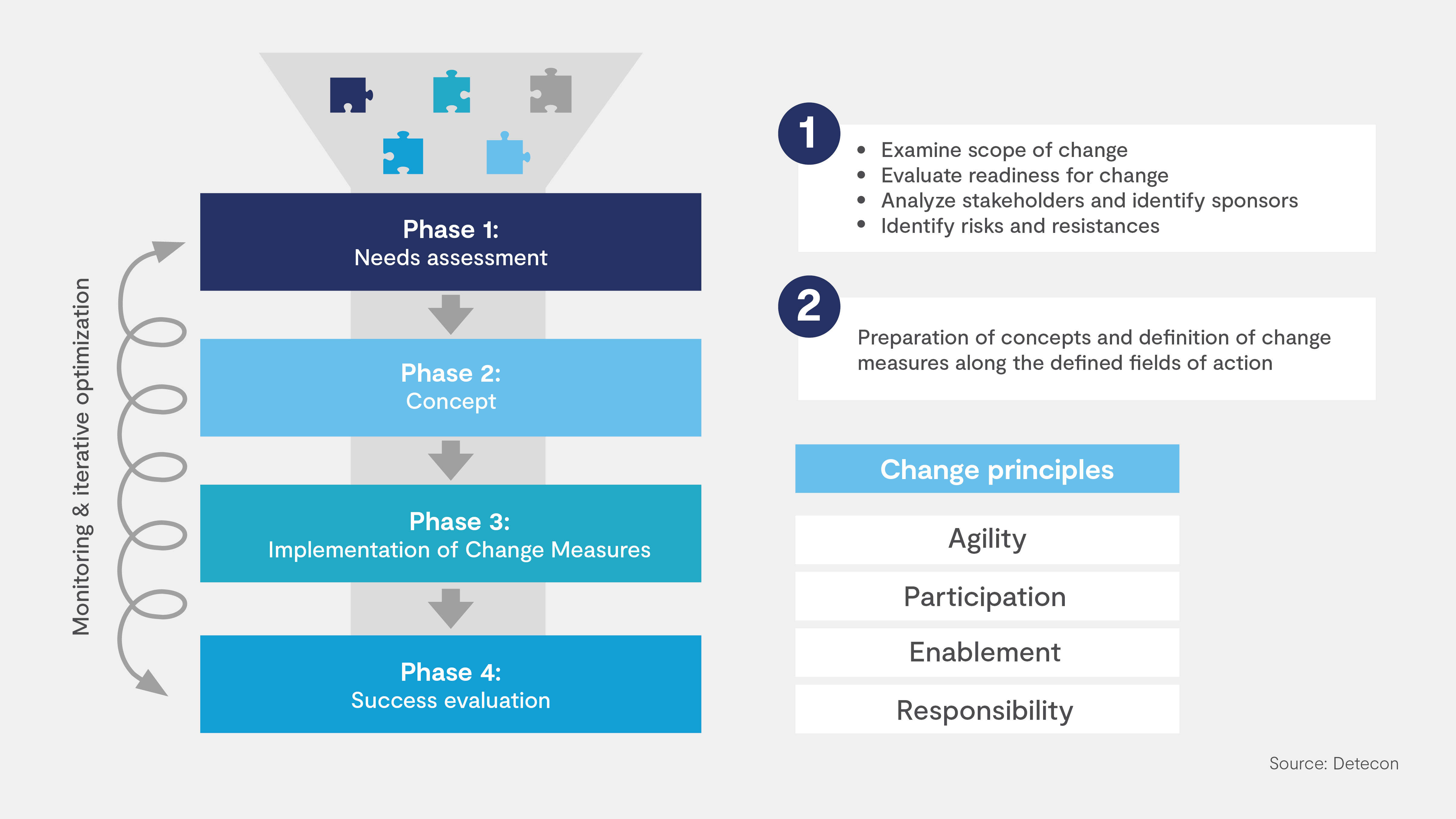

For the implementation of such a major change, the so-called "Responsive Change Model" is a good choice. It combines classic change management with an iterative process approach. Active monitoring of the progress of change enables the targeted adaptation of measures in iterative loops. In this way, a high level of effectiveness as well as resource efficiency is achieved through needs-based adaptation. Undesirable developments can be recognised at an early stage and counteracted. Although the direction and framework are set, there is enough room for optimisation during the process based on feedback from internal customers or from the company's own employees who are involved in the change process.

The success of the change is ensured through continuous learning and the constant optimisation of the project organisation.

The „new finance“ – a competitive edge

The ongoing transformation of the finance function and further development of its role secures a position for the function that is of crucial importance for the efficient and effective management of companies in times of digitalisation. It also gives the division significantly greater power influence. The greater involvement of the finance department with its information systems leads to a better understanding of the resources required in the individual business areas and thus to better financial data, which enables early identification of future opportunities and risks. This leads to a competitive advantage that must be exploited.