In a world characterised by uncertainty and complexity, agility is becoming, agility and thus the ability to adapt quickly to changing requirements is becoming increasingly important. Therefore, more and more companies organize themselves in an agile way to cope with the constantly changing environment and conditions. Generally, the agile mindset however, has not been equally well adapted throughout all company divisions. Finance organizations for example, due to their role, strive for a certain continuity and predictability. Agile organizations on the other hand give teams a lot of freedom to develop products with uncertain scope – intuitively, this does not necessary fit well together. However, an agile approach in finance offers many opportunities.

One of the main goals of agile organizations is to shift the responsibility for the design and development of new products to the experts within the company while remaining as flexible as possible. Flexibility is key to react to changing circumstances and is achieved through short development cycles and quick feedback loops.

Why organizations need to go with the “agile trend”

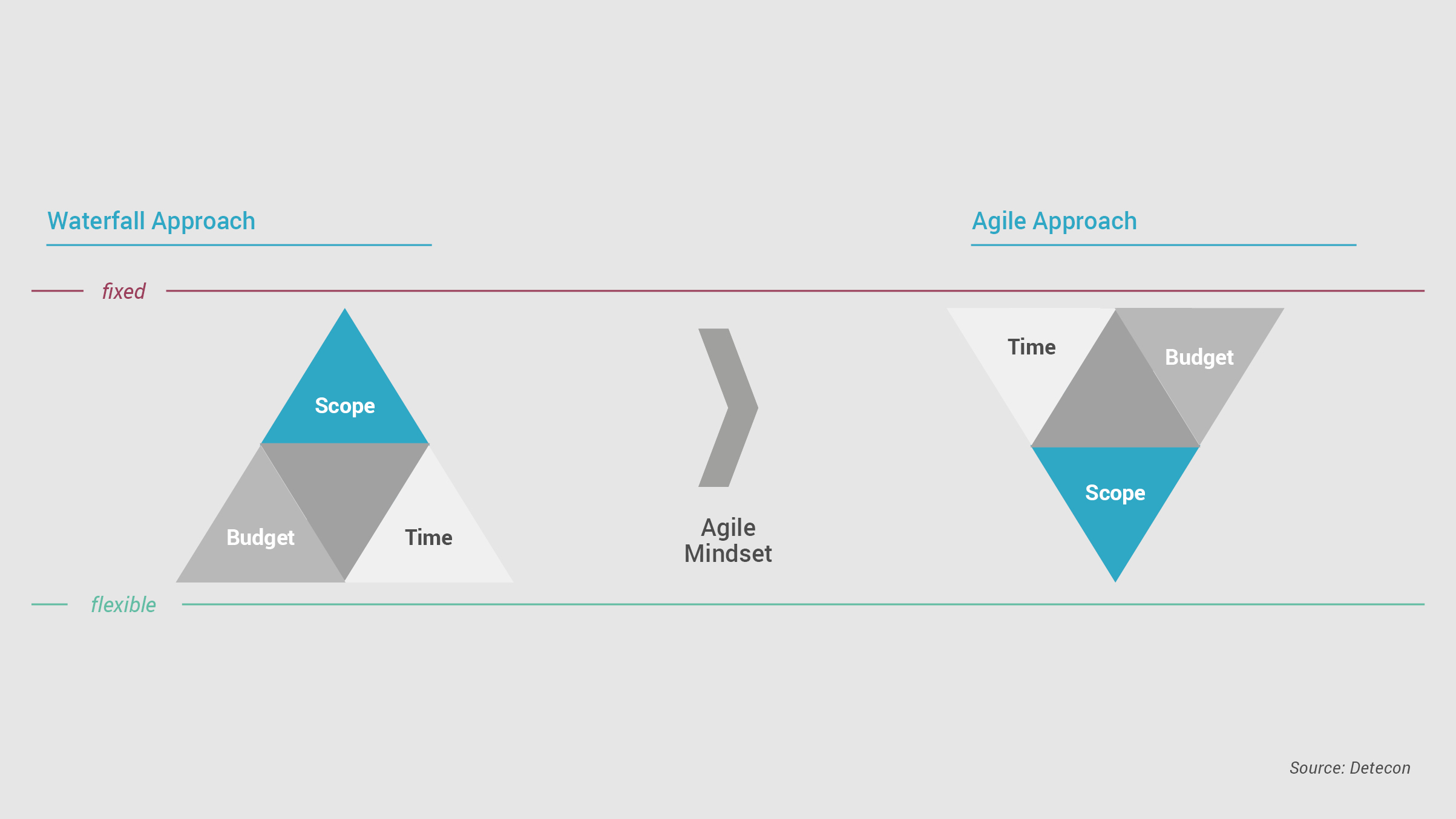

IIn contrast to traditional organizations, the agile approach sets clear limits for time and budget. The scope (outcome/deliverable) is not clearly defined in the beginning but rather an outcome of what the team is able to develop with the given resources (time and budget) and what they believe is in line with the market demand and the customer’s needs.

From an organizational perspective, this paradigm shift requires a revised way of thinking and a change of culture. While agile organizations are characterized by rigorous customer centricity, cyclical sprints and incremental improvement, finance organizations often remain operating in the traditional waterfall logic.

When transforming an organization from waterfall to agile, the finance department cannot be left behind and needs to be part of the transformation. Finance must broaden its role to become an active business partner, generate synergies and exploit the organization’s full potential.

The finance department as an agile finance business partner

Based on our experience with agile transformations, we identified four main areas, in which finance needs to support the agile organization with their services:

Become an agile finance organization

To understand the concept of agile and the needs associated with it, the finance department needs to be supported in becoming agile itself. There are numerous frameworks and concepts that can be applied to establish an agile environment. Based on our experience, those frameworks often are quite similar. Therefore, we believe that a common understanding and wording within the company is crucial. Besides the terminology, agile working also means a lot more collaboration on tasks. Therefore, it is important that the agile tools to manage the daily tasks such as for example Jira or Aptio Target Process are introduced. Until the whole organization is set up in an agile manner the finance department has to cope with the needs and requirements of different stakeholders (for example the needs of the business versus the needs of the board of directors). Therefore, a hybrid form of working seems to be practical.

In other words, working agile means to tackle some of the daily tasks with an agile approach without neglecting the recurring, more waterfall-driven tasks. Recurring tasks, for instance monthly closings, should be handled in a traditional manner to ensure continuity while agile tasks, such as report development or system enhancements should be handled applying new agile ways of working to keep up with the pace and strategic orientation of the business.

Value-based steering logic

Agile organizations contain many scattered teams formed across different departments, cost centers or even business units and work on various topics. Due to very limited hierarchical structures of agile organizations, the steering logic must be rethought accordingly. In traditional, waterfall-driven organizations, budgets are assigned to specific cost centers. The cost center managers control the budget and determine how the allocated budget is spent.

Due to their budget sovereignty, cost center managers have an overview of planned and actual budgets and incurred costs. Agile organizations, on the other hand, are characterized by diverse and interdisciplinary teams which are assigned to overarching value streams. Budgets are directly allocated to value streams and later on broken down and assigned to agile teams depending on prioritization of the corresponding topics (mainly driven by the business needs during the sprints). Because the formation of agile teams does not necessarily follow the organization´s cost center structures and the distribution and allocation of budgets to the value streams is highly influenced by value stream managers, budget sovereignty is shifted from the cost center managers towards value stream managers.

Consequently, finance needs to reevaluate and adapt established logics and processes. In agile organizations, budgets are primarily used to fund people (through value streams) rather than cost centers or projects. Due to these profound changes, the expertise and role of the finance department is changing. In an agile setting, finance should contribute its specific financial knowledge and provide support and coaching to the value stream managers. Finance enables them by providing procedural knowledge and data insights to improve decision making and the allocation of resources. Finance therefore takes a consultative role and acts as a companywide business partner.

Value stream controlling

Due to the allocation of budgets on value stream level, financial information in an agile organization is no longer available in the same granularity as in traditional organizations. The finance organization must therefore rethink its cost center logic and, if needed, either adapt the current structure or create new value stream cost centers and/or release train cost centers representing the value streams, which are situated on a much higher hierarchical level.

The fact that financial information is no longer available in the same granularity can lead to tensions between stakeholders across the organization: The agile organization for example needs as much financial freedom and decision-making power as possible to be able to act in an agile way – meaning the ability to work in sprints with the focus on customer centricity. On the other hand, the finance department needs detailed information on financial performance for reporting purposes.

To cope with the needs and tasks of all involved stakeholders, the finance organization must act as a link and mediator between the various parties. In other words, the finance department positions itself as a facilitator in terms of financial reporting and supports cross-functional teams with its knowledge (e.g. during value stream planning/forecasting). Therefore, we see a strong need for the finance department to be involved throughout all steps of agile value streams – either as a financial consultant within the teams or as a close advisor to the value stream manager.

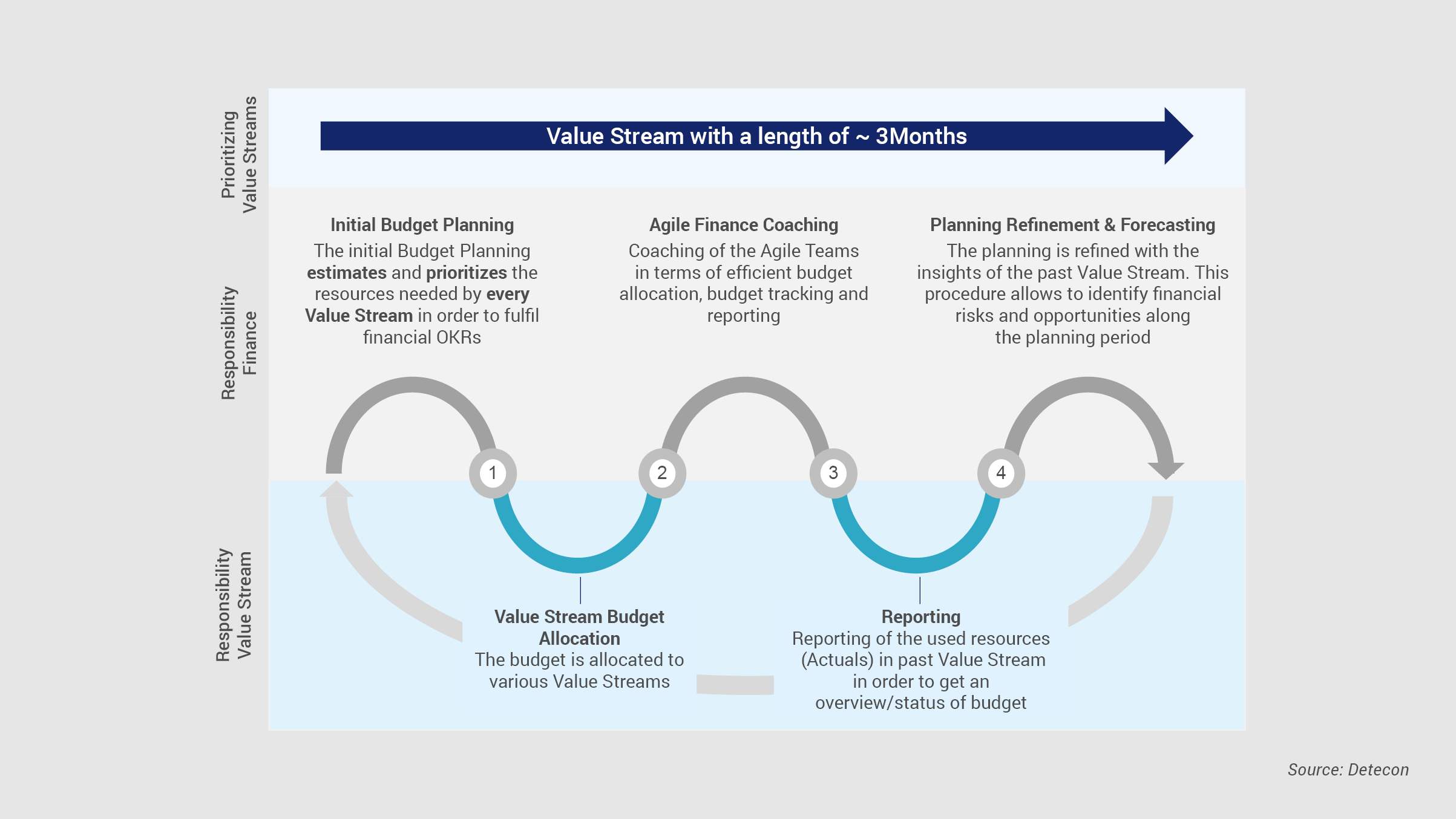

The involvement throughout all steps of agile value streams

This involvement can be divided into three main activities:

1. Budget allocation

Before the sprint, the agile finance business partner supports the agile organization during the initial budget allocation process representing other stakeholders such as the board of directors or shareholders to ensure that the budget allocation is economical. This initial budget allocation includes, to a certain degree, prioritizing the value streams in terms of business value. However, the finance business partner is limited to an advisory role and advises colleagues from a financial perspective. Budgets are allocated to achieve both the non-monetary and monetary goals of each value stream derived from strategic OKRs (Objectives and Key Results). Therefore, the initial budget planning estimates and prioritizes the needed resources by every value stream in order to fulfill the monetary and non-monetary OKRs and allocates budgets accordingly.

2. Agile finance coaching

During the sprint, the agile finance business partner acts as a consultant to each of the diverse teams and the value stream owners, supporting the business with its knowledge on budgets, reporting, and other finance related questions.

3. Planning refinement and forecasting

After every sprint the finance business partner refines the budget planning made at the beginning based on new insights gained during the sprint. This refers to both, the allocated budget within the value streams (some teams might need less resources than expected and the budget should be allocated elsewhere) as well as the yearly budget planning and forecasts. Through the iterative learning process, budgets can be planned more and more precisely, and forecasts can be improved accordingly.lang="EN-GB">

So what is the benefit for finance to become more agile?

The transformation of the finance department into a business partner is crucial to be able to financially steer agile organizations. The higher involvement of finance leads to a better understanding of needed resources and therefore to better financial data, enabling the early detection of future opportunities and risks.

From our experience, the following success factors need to be considered to master the agile transformation:

- Understanding agility and using a common terminology helps to overcome barriers between the finance department and the agile organization itself. The company wide and overall understanding of agile procedures and attitudes bears a great chance to scale agility over the whole organization und use synergies.

- The understanding and perception of finance´s role within an agile organization needs to be reconsidered. Finance needs to play an active role in the agile cycles or sprints contributing financial knowledge and providing solid decision-making basis for value stream managers.

- Finally, finance departments should not be afraid to break rigid structures and change outdated procedures. The fear of the uncertainty often holds back major innovations and improvements.