A data-driven organisation supports the CFO in a coherent and clear decision-making at all times. But what is the role of the CFO in this context and what does it mean for CFO governance processes?

Data-driven organizations are reshaping the way they gather, manage, synthesize and monetize data. Digitalization is further being accelerated by the Covid pandemic, in which more traditional aims of efficiency and revenue growth are being challenged by agility, faster time to market and greater understanding of internal and external customer needs.

Data in itself is not the answer, but data is a starting point

Modern chief financial officers are faced with the task to manage these moving parts and come to cohesive and clear decision-making that impacts the current and future business. A greater number of organizations are understanding that a data-driven organization is simply not a luxury anymore, but a priority. For example, data drives their customer value proposition, expands growth potential and assists in restructuring legacy businesses once deemed unsalvageable.

From this, the following hypothesis can be discussed. In modern organizations, the CFO can play a significant and large role in data science and ultimately governance of all relevant data domains.

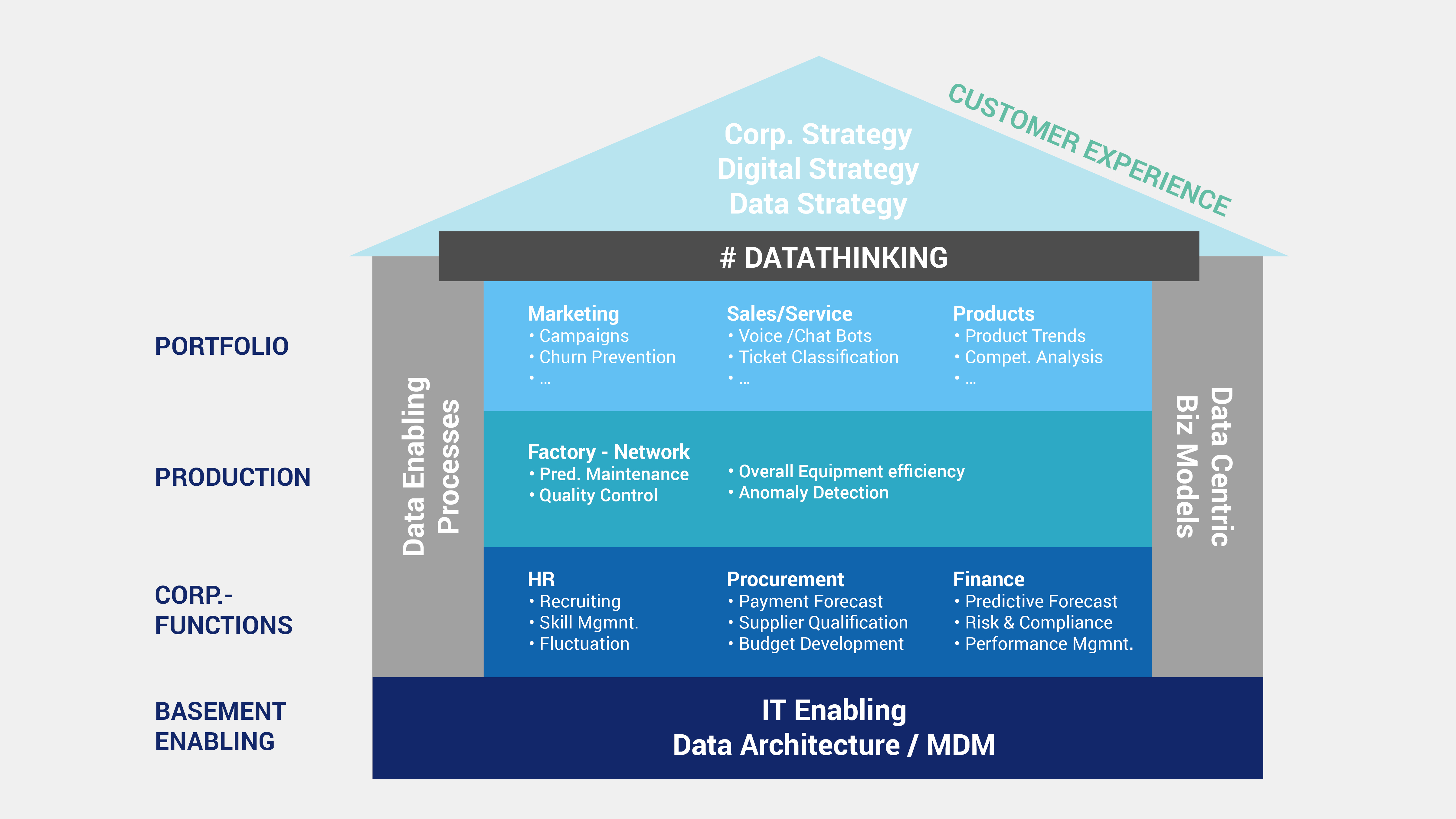

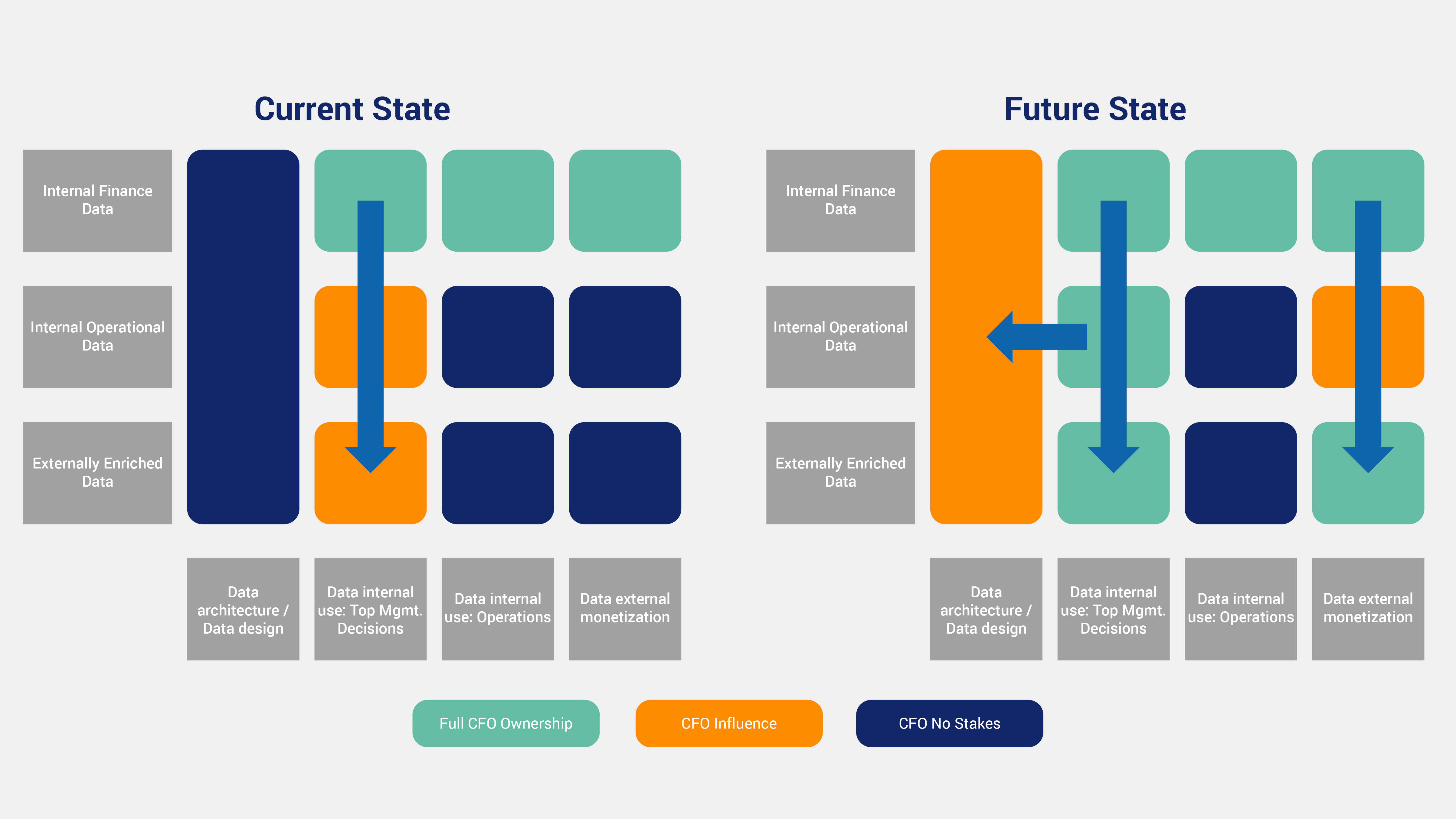

Data becomes the cornerstone and foundation of any sustainable operations, management and financial steering. Most CFO governance is still limited to core domains, such as internal finance data to make key management decisions, drive operations and to monetize that data, be it with marketing campaigns, revenue business case decisions and headcount improvements.

The CFO domain has traditionally been heavily involved in handling and managing data for steering, reporting and decision-making. In this context, the CFO domain has always been subject to the strictest regulation and supervision (for results and processes); for instance, SOX being only one of the many facets of this. At the same time, the CFO is one of the first in an organization to formulate and enforce two major requirements of modern data science:

For any data or KPI there is only one single source of truth

and

Data only becomes valuable if is tied to or leads to an action.

In their own domain, the modern CFO already lives up to these requirements. In a modern organization, the role of the CFO can therefore expand and improve the overall quality, responsiveness, and reliability of the data universe.

Future impact expands with time both externally and internally. In this development, the CFO can be in the position to take further ownership (governance) and assume greater responsibility and visibility over data through the use of automation, machine learning and other technologies to drive top management decisions.

Internal Use of Data

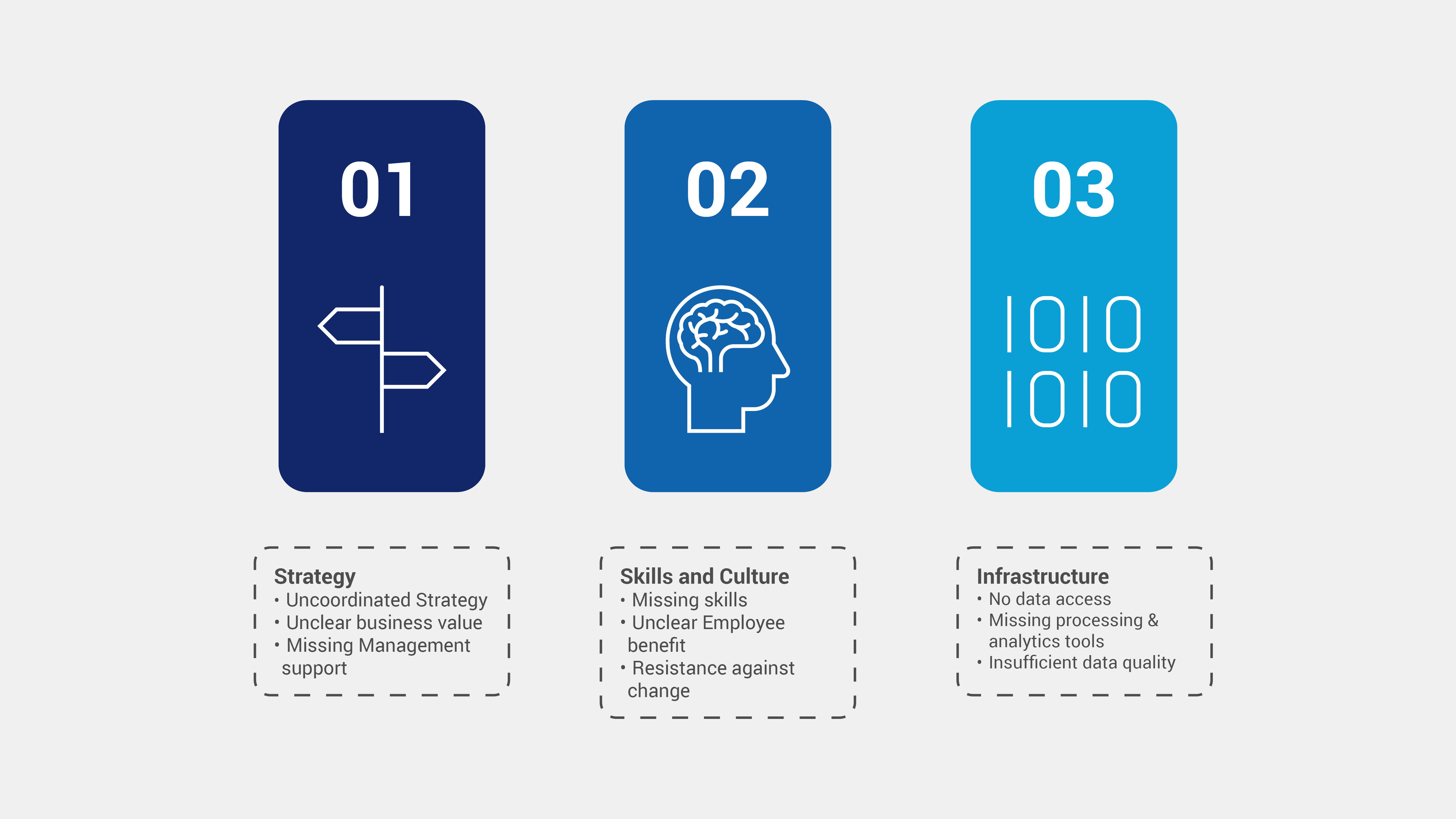

Organizations are aware of the potential of data, while believing in an even accelerated transformation to a data-driven organization due to the Covid pandemic. The main challenges of organizations for data-centricity are a lack of skills and sufficient infrastructure to support that transformation.

In general, many organizations do not fully exploit their data potential or fail to routinely use data to guide business decisions, for example:

- 84% of all organizations want to put data at the center of their strategy and crucial business decisions;

- 58% of organizations adopting data intelligence are more likely to exceed revenue goals than non-data intelligent organizations;

- 43% of all organizations however routinely fail to use and exploit their data to derive strategy and business decisions;

- Every 3rd expert expects data analytics and business-intelligence to become more relevant due to the pandemic (see Handelsblatt.com; TechRepublic)

From an internal view, the CFO uses company internal data for financial and operational decision-making. The CFO may experience a vast amount of over-reporting through a multitude of KPI’s and dashboards, which thereby increases complexity.

Data sources while increasingly becoming automated may not talk to each other in the organization. The CFO is increasingly challenged to find the right balance. Infrastructure investments, including software systems, processes and people (headcount) have to be right-sized to fit the needs of the CFO and data-driven organization.

By interlinking and aligning different data sources, the CFO is in the best position in an organization to enforce the paradigm of “Single Source of Truth”.

The greater challenge is for data to become real-time and even predictive, so that the CFO can make quick top management decisions impacting the organization’s operations.

Key examples of internal use cases (involving financial and operational data) may cross over the commercial, financial and technical domains.

One such internal use case is to improve the level of data capture and monetization via improved CRM and other data-driven technologies.

External Monetization of Data

The use of company-internal data for or on behalf of external parties and even external clients has typically been only an afterthought for most organizations.

External use covers for instance:

- Exchange of internal data with external parties for tangible, but non-monetary benefits, for instance in benchmarking

- External monetization of internal personal data

- External monetization of internal anonymized or process-based data

In many organizations, the operational departments shy away from these approaches due to the perceived complexity and potential impact on daily operations.

The CFO department already has experience with sharing of (typically anonymized) internal performance and process data with external parties in benchmarking exercises. Based on this, it can be construed that the CFO domain might be in a good position to take a leading role in other external monetization initiatives as well.

Monetizing (internal) personal data has always been the cornerstone of the business model of the large international groups and hyperscalers (“FAANG”). For companies in Europe (and comparable jurisdictions) this is subject to strict and demanding GDPR regulations, upcoming regulations on DA, DSA and DMA and are therefore not an immediate opportunity.

Additional potentials can be generated by monetizing anonymized, aggregated and process-based data. Examples for this could be for instance aggregated and anonymized telco operator data, here shown for network analysis, network optimization, movement pattern analysis and market analysis:

These are only some basic examples for how internally produced data can be monetized externally. Moving this kind of monetization initiative into the CFO domain reduces the impact on operations and at the same time supports standardization and efficiency measures in data structure and data architecture.

Putting data under CFO governance

Enabling the CFO to assume greater responsibility in managing data generated or procured within an organization allows greater standardization, maximizing monetization opportunities and improves quality and transparency of management steering.

The CFO has traditionally long-standing experience in getting to the core of issues. Key objectives of data science, adding analytics and thereby adding value, gaining insights and deriving actions, all match with the interests, objectives and know-how of the CFO domain.

Our recommendation is therefore: For modern organisations, it is worthwhile to further explore which data and also topic complexes around the topic of data should be placed under CFO governance. A standardised methodology for establishing data-driven structures can be used to bring together goals and capabilities in a formalised and standardised way.