Outsourcing models are disappearing as a result of increasing digitalization. Robotics Process Automation (RPA) already offers a real alternative. However, there is even greater potential in Intelligent Process Automation (IPA).

As a result of growing cost and efficiency pressures, companies have in the past outsourced repetitive, labor-intensive tasks abroad. The primary aim was to become more efficient and leaner, freeing employees from repetitive tasks and saving costs in the process. The idea was to replace expensive labor with cheaper employees in emerging markets in response to rapidly increasing cost pressures.

However, with rising wages in traditional offshore countries and the emergence of true digital alternatives, e.g. Robotics Process Automation (RPA), such scenarios are becoming less attractive. Finally, in addition to rising costs, outsourcing is always associated with a loss of knowledge regarding business contexts and processes, as well as communication and culture issues. Furthermore, the loyalty of employees is relatively low due to a lack of commitment to the company, so that they are quickly ready for a change if the offer is financially more attractive.

RPA has thus become a real alternative to outsourcing structured business processes. The robotic software systems build on existing system landscapes, work non-stop and are almost infinitely scalable. Furthermore, process steps can be seamlessly documented and tracked at any time.

What is RPA and where can RPA be used?

RPA is a software to automate structured business processes with the help of a software robot. Accordingly, RPA is an automated task or process. In contrast to conventional process automation, the robot accesses the various applications via its own user interface. As a result, RPA is compatible with most systems and can be implemented in a relatively wide range of applications. RPA behaves similarly to a human worker and connects applications and systems that do not have an integrated interface without having to adapt them. In addition, due to its own user interface, tasks and processes can be traced back to the robot.

The benefits of RPA can be summarized as follows:

- Cost savings: The automation of repetitive tasks offers great potential for reducing costs. Recent studies suggest a savings potential of up to 80%.

- Increased efficiency: A software robot is an extremely reliable virtual employee who can take over unpleasant work from 3-5 FTEs. It does not know breaks, vacations and illness.

- Increase of employee satisfaction: While the software robot takes over the unpopular routine tasks, the employee can focus on interesting fields of application.

- Increase in quality: Work is performed strictly according to rules.

- Compliance: Every step is fully documented and can be traced.

- Compatibility and time-to-market: In most cases, RPA can be implemented within a few months. The robot is virtually built on top of the applications and is thus relatively system-independent.

RPA can develop its full potential where tasks are repetitive, rule-based and scalable. Rule-based tasks can be performed by RPA without making mistakes.

The prerequisites and advantages make the use of RPA very exciting, especially in financial organizations, which are subject to high audit and quality requirements and are strongly rule-based. Regulatory requirements and so-called audit trails can thus be fulfilled alongside and maintained accordingly. RPA supports companies to meet regulatory requirements and at the same time enables significant efficiency advantages in the operational business.

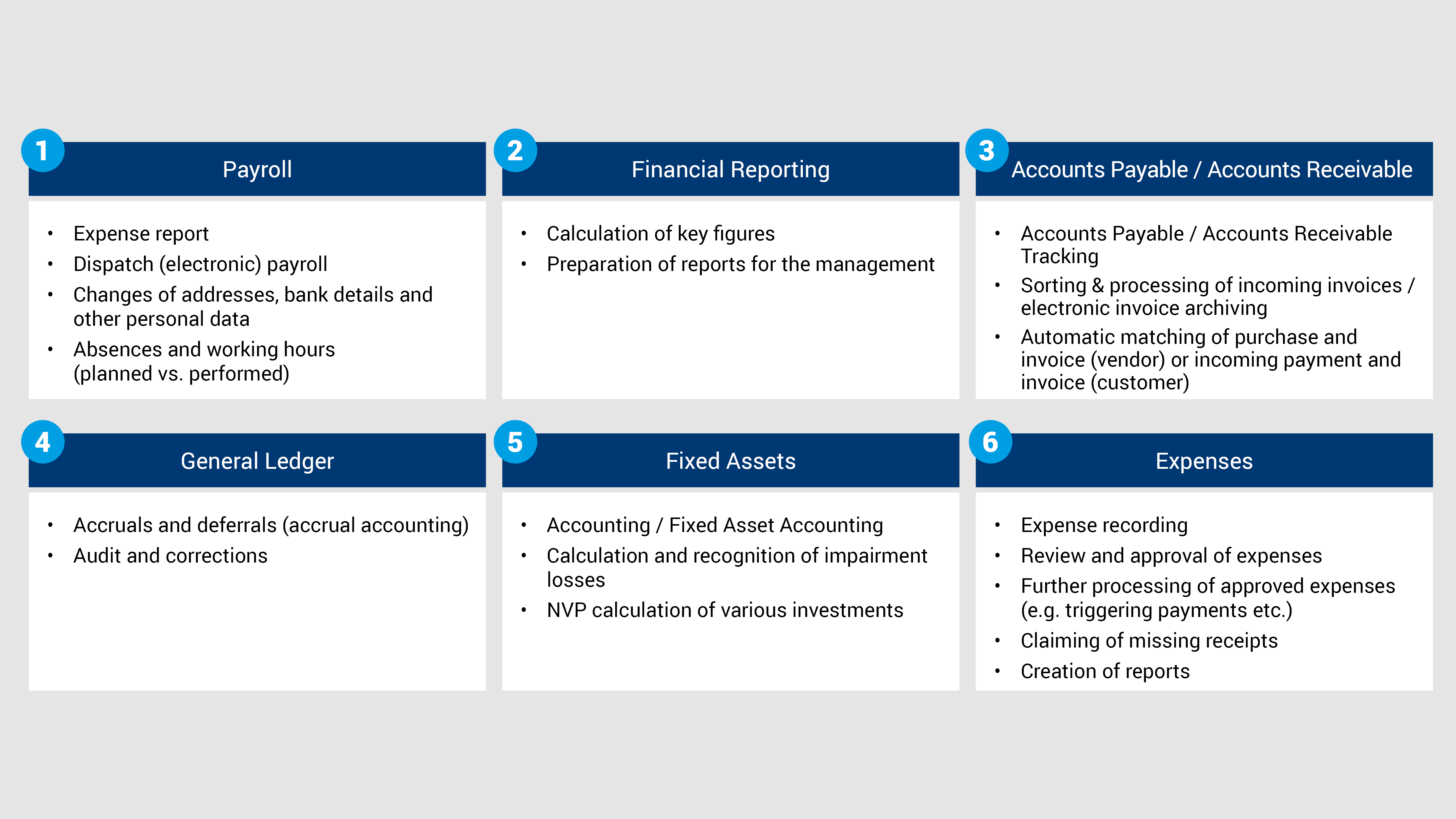

Figure 1 shows a list of possible fields of application for RPA. The examples are by no means to be seen as a conclusive list, but are intended to provide an understanding of suitable areas of application.

As our empirical studies have shown, international companies focus on tasks - such as intra-group (account) reconciliations, automated monthly or annual financial statements, or order processing. The added value of these use cases lies in the automated connection of several different systems that previously had to be bridged by humans.

This may seem obvious at first glance, but discussions with decision-makers in financial organizations have shown that identifying potential use cases in companies is often not that easy. This is mainly because the critical set of tasks for RPA is not reached or existing processes have many exceptions.

Our interviews have shown that automation projects do not bring the greatest benefit when isolated in individual organizational units, but rather across departments. For example, a finance organization can work with purchasing to build automated order processing, from goods receipt to payment, and improve efficiency across departments.

Limitations of RPA and the high expectations of Intelligent Process Automation

Our empirical study has shown that many companies are reluctant to invest in RPA because the critical amount of corresponding tasks (volume) is missing or processes are insufficiently standardized. Often, resource-intensive tasks are small-scale, which means that the scalability and savings potential through RPA is small or eliminated altogether. In such a case, it may make sense to train in-house personnel to develop RPA bots, e.g., in a so-called "digital workforce." Such digital centers of excellence allow the company to deploy RPA more independently and flexibly. A Digital Workforce can adapt RPA to individual requirements without much additional effort and thus becomes profitable even for smaller tasks.

We could also observe this development in our surveys in various industries. The spectrum of RPA knowledge development ranges from small special teams with IT-affine colleagues to a "Digital Center of Excellence".

When we talk about RPA, we are talking about automated processes and tasks without their own "intelligence". Tasks are processed as if "learned" by the robot, and there is neither a critical review nor further development of the processes. Thus, automated processes are relatively susceptible to changes within a predefined process. Rule-based applications can thus be processed without any problems and extremely accurately, but the robot quickly reaches its limits with the slightest change in the process.

Despite the many advantages that RPA brings, the companies we surveyed hope that Intelligent Process Automation (IPA) will bring about a far greater increase in efficiency. RPA is seen more as a temporary workaround to temporarily connect old and new systems. For companies, the primary goal is not just to automate existing processes, but to make processes more intelligent.

Things only get really exciting for companies when RPA can be combined with artificial intelligence (AI). This combination is known as IPA: IPA adds technologies such as advanced analytics to RPA, giving the RPA software cognitive capabilities.1 With the help of advanced analytics, the robot is able to extend its capabilities through statistical methods and perform tasks beyond what it has "learned." The cognitive component allows the robot to pass on new knowledge to the human user via recommendations. By adding such technologies to RPA, process automation becomes not only more efficient, but also more intelligent.

The application fields of IPA are largely visions, but are likely to become more and more likely in the future:

- Automation and machine learning: Learning robots, which, like humans, become increasingly intelligent in their activities and constantly optimize workflows and processes.

- Proactive corporate management: Corporate data and information are constantly prepared and processed. Management thus has real-time information at its disposal and can intervene immediately and at any time if necessary.

1 By cognitive capabilities, we mean the ability to learn from data sets (e.g., advanced analytics), derive decisions from them, and communicate the results at the end.

To what extent is RPA or IPA an issue on the CFO agenda?

In the course of the digitalization of finance organizations, RPA will certainly also be an important topic on the agenda of CFOs. The pressure on organizations to be efficient will not diminish in the future, which will result in fewer and fewer FTEs being assigned broader and broader areas of responsibility. Employees will only be able to cope with this development if existing tasks are reduced through outsourcing or automation.

As mentioned earlier, the decision-makers in financial organizations we interviewed expect really big leaps in efficiency only through the use of IPA. One possible scenario would then be for software robots to independently perform monthly closings and, in the event of discrepancies, inform controllers of deviations and carry out further clarifications. The use of IPA is perceived as a big change with far-reaching implications for roles within finance organizations. As a result of such automation efforts, typical finance job descriptions are expected to change in the near future. Processual tasks are likely to disappear in the long term, ideally allowing finance organizations to focus on analyzing the numbers.

The biggest challenge for managers will be successful change management. Indeed, success and failure will largely depend on whether managers succeed in convincing their employees of the benefits of RPA. The problem is that companies need the expertise of their employees to develop software robots. These employees must be relieved of the justified fear that they will rationalize away their own jobs by co-developing RPA.

What next?

We believe that RPA will prevail over offshoring in the medium to long term. The weaknesses of these models are too great compared to RPA solutions (among other things, high administrative effort to set up and manage offshoring locations, the loss of knowledge, lack of flexibility). It can be assumed that RPA will find its way into offshore centers in the short term in order to further improve existing outsourcing models. However, the goal of the vast majority of companies must be to bring back the outsourced activities in the medium to long term.

RPA is a concrete and practical step in the direction of digitalization that brings with it noticeable increases in efficiency. The task now is to build up expertise in the use of software robots so as not to miss the boat later on for end-to-end solutions, e.g., IPA.

The cornerstone for a successful implementation is the elaboration of a digitization strategy and the examination of possible use cases.

Now it's your turn, don't miss the train for a more efficient finance department - we are happy to support you!