It is not an easy year for the mechanical engineering sector. The Corona crisis caused demand to slump and the cold season continues to give rise to fears of bad things to come. According to the German Engineering Federation (VDMA), order books in the German mechanical and plant engineering sector had fallen by 15 percent by September. In 2020, the VDMA expects a total of 38,000 jobs to be lost compared to the previous year. In neighboring Switzerland, new orders in the MEM industries have actually declined for nine consecutive quarters since mid-2018. In addition to Corona, the foreclosure of international trade markets and the upheaval in the automotive industry are just some of the reasons why the industry is facing major structural challenges. What to do now?

So what is behind the massive slumps in this industry? What can be done to stop the downward trend and achieve rising yields again?

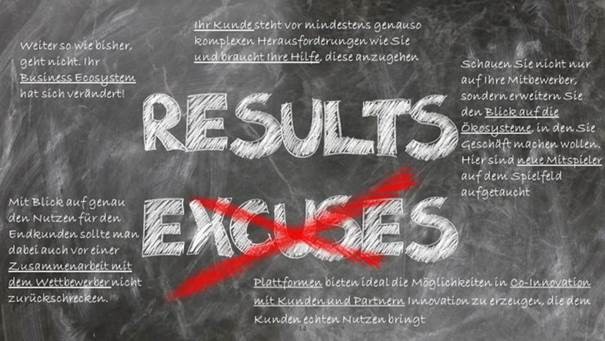

It helps to take a look at the customers of machine builders. Their business environment has also changed dramatically. Today, they have to solve complex problems that they can only master on their own - if at all - with a great deal of effort. The pressure to change is simply too great. Long-standing partnerships are no longer a guarantee for future business relationships if there is no innovation there to solve problems. If you want to survive, you have to align your business strategy with the business environment of your customers and pay attention to the balance between competition and collaboration. So the environment is widening.

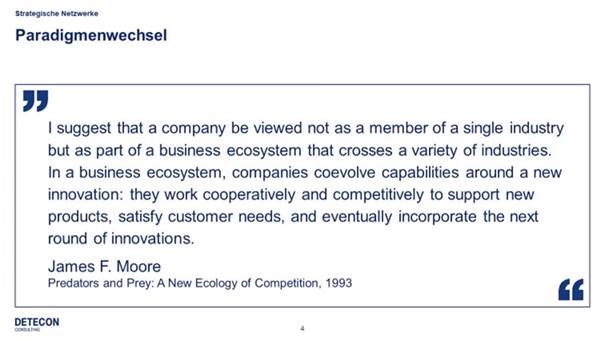

From vertical industrial silo to business ecosystem

As early as 1993, James F. Moore described in his article "Predators and Prey: A New Ecology of Competition" that companies should no longer see themselves as part of a single vertical industry. Companies move in different ecosystems and decide with whom they want to develop new capabilities, or with whom they want to develop new products and services in the area of tension between collaboration and competition, thereby satisfying customers or perhaps even ushering in a new round of innovation.

The complex tasks on which the customers of machine builders are working cannot usually be solved with competence from one industry. What matters is the interaction of all solution modules. However, this interaction should not only be technically possible, for example by supporting integrated processes. Planners must also be able to use their holistic knowledge to translate business requirements into a lean portfolio of measures and select suitable solutions and service providers.

As a german-language study by the VDMA shows, machine builders are reluctant to be first movers. In other words, they are reluctant to be the first to develop such a holistic solution so that they can offer it when needed. What this can mean for a customer is illustrated below by an example from consulting practice:

Project example: Digital transformation "Cellular Manufacturing”

Our customer is a globally operating company. For a new product, which is to be one of the central products of this company in the future, one of its production facilities was to be made more flexible according to Industry 4.0 aspects and thus batch size 1 was to be realized very simply and efficiently. The company wanted to switch from the previous line production to a cellular manufacturing for a decisive part of the value creation.

As usual, the processing steps and plant planning were divided among several planners. This was the case for the plant sections of the classic line production as well as for the new areas with new manufacturing stations, new logistics concept and new driverless transport systems. It was clear that new software was also needed for planning and controlling production, so a suitable provider was also selected here. An integrator was then to integrate the plant components as before.

Unfortunately, it had to be determined that the complexity of the project was significantly higher than that of previous planning. Starting with the planning, to the procurement of the components up to the system integration, new procedures and criteria as well as more and new knowledge would have been necessary. When it became clear during the start-up that the planned figures could not be achieved due to permanent disruptions, the decision was then made to switch back to classic line production. Keeping the launch date had priority.

This example makes it clear that everyone suffers in the event of such a failure. Both the customer, who wanted to become more successful with a new concept and machines, but did not have enough up-to-date knowledge. As well as the suppliers and system integrators who managed to work together with their solution components.

Ecosystem Platforms

But how do you find the right scenarios for which you are positioned accordingly and which are also in demand by target customers in the selected ecosystem? Platforms are closely linked to ecosystems if you understand them as a place where all the participants in an ecosystem come together. Isn't that what associations are? Not as a rule, because people there usually only exchange information within a vertical sector. However, disruptions usually have a cross-industry impact.

The last disruption that triggered the massive disruption in our manufacturing ecosystem was the onset of digitalization. The end customers, i.e. the users of the machines, suddenly have unimagined opportunities to develop products together and with a lot of feedback from customers, to make their production more flexible, and also to tap into new added value in after-sales with digital services.

The obstacle is often that the data on the basis of which new business can be developed is not available, or can only be obtained with difficulty from the production machinery in the jungle of data formats and manufacturer information, as well as the company's own IoT support measures.

Some mechanical engineering companies have already taken up this topic, and tried to expand their business with digital product enhancement and services. The success is there in many cases, but not resounding. There has been a strong focus on technology, and less on the overall benefit to the customer.

Digital Ecosystems

And that's where the new participants in the "manufacturing" ecosystem come in - the tech giants from the US and other software experts from around the world.

Microsoft and AWS, for example, have managed with considerable effort to establish the tone-setting platforms of the automotive ecosystem together with major customers and are growing continuously. According to their own statements, they are independent of technical platforms with the jointly developed solutions. Together, the participants are creating many innovations for the ecosystem of tomorrow. Important examples of such platforms include the Open Manufacturing Plattform, on which Anheuser-Busch, BMW Group, Bosch, Microsoft and ZF Friedrichshafen AG, among others, are working on jointly scalable innovations for the manufacturing industry. Another example is the Industrial Cloud from Volkswagen and Amazon Web Services with Siemens as integrator.

What does this mean for a mechanical engineering company in the current situation? Should it join one or more platforms? Found its own platform? Are there perhaps already corresponding experiences - good or bad? In Germany, the German Engineering Federation, VDMA, has also asked itself precisely these questions and conducted a corresponding study, published in September 2020. The german-language study „Kundenzentrierung als Chance für den digitalen Durchbruch“ examines three core questions in order to derive specific recommendations for action:

- Where do machinery and plant manufacturers stand today in terms of digital platforms and value-added services? Which strategies are considered promising and what are machine and plant manufacturers still missing for the "digital break-through?

- What requirements do the customers of machine and plant manufacturers place on the functionalities of digital platforms and the benefits of value-added services? And which market player can best meet these customer requirements?

- What roles can machinery and equipment manufacturers play convincingly and successfully in the various end-customer industries, and how should they think strategically about and drive the development of digital platforms and value-added services?

The following statements from the german-language study are particularly noteworthy:

1. Machine and plant builders primarily rely on a fast-follower strategy

As the study shows, only 20% of the companies surveyed pursue a first mover strategy. This means that the others wait and learn from the successes/mistakes of the others. This can work, but it is risky. The study also states that, precisely because there are hardly any first movers in Europe, this vacuum is being filled by non-European companies or startups.

Our recommendation: It is important to consider the relevant ecosystems in a timely manner as part of the digital strategy! How do you want to get involved and contribute? "The winner takes it all" is how an observation in the platform economy is described. What is meant by this is that often one of the first platforms reaps the success and occupies the ecosystem. Consequently, relying on a follower platform later on is also very risky.

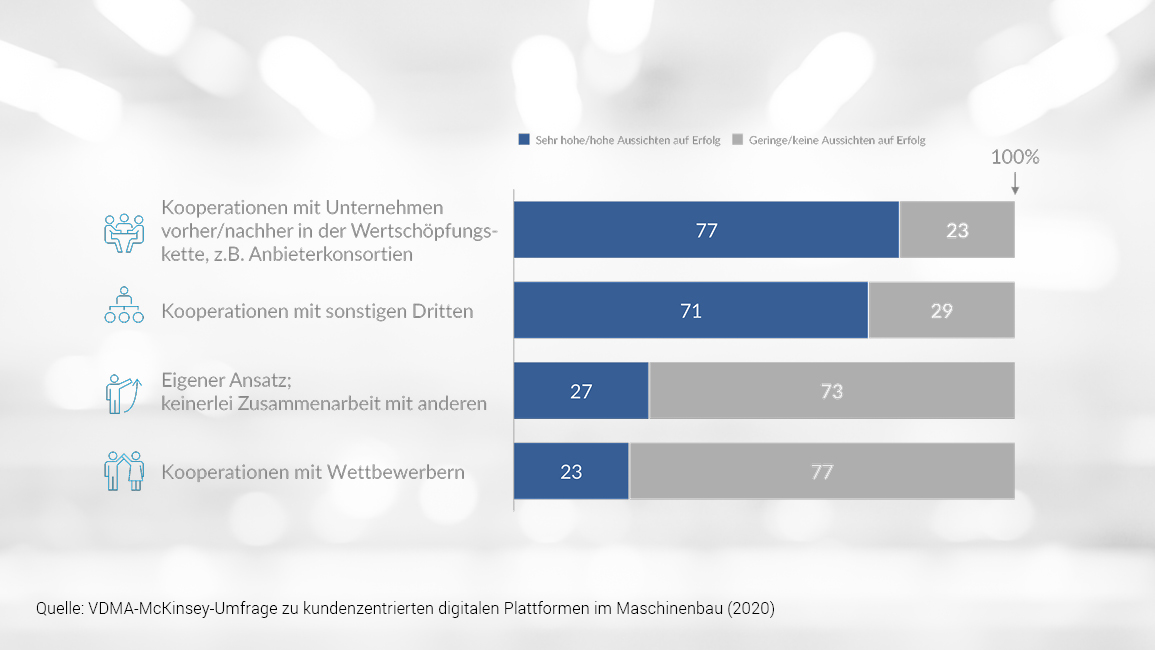

2. Cooperations as a key factor for successful digitization in mechanical and plant engineering

Cooperation with providers of complementary offerings is seen as the most promising strategy, while 27 percent of respondents still believe in their own approach. However, this is countered by the lack of required new skills identified in the industry worldwide. This gap cannot be closed at the moment. Because the war for brains is tough, and is decided not only by salary, but also by location (Silicon Valley), image (cool and innovative) or career prospects. Where you can learn a lot quickly and increase your own market value is the preference of many graduates and professionals.

The skills challenge is so explosive that the World Manufacturing Forum has dedicated the 2019 Annual Report entirely to this topic. In addition to the situation and evaluations of concrete changes and economic consequences, specific guidance on skills and roles for the future is also provided. In general, the skill gap is an important driver and great advantage for collaboration on an ecosystem platform. If everyone there concentrates on what they do particularly well, this will in all likelihood result in jointly delivered top performance and thus also satisfied customers.

How can Co-Opetition succeed?

What is striking about the results of the VDMA survey is the skepticism regarding cooperation with competitors. Only 23% see successful prospects here. However, as part of its 365Farmnet approach, the agricultural machinery manufacturer Claas has taken precisely the same approach of also bringing products from competing manufacturers onto the common, digital platform DataConnect for the exchange of machine data. The decisive factor here is the realization that in reality, farmers almost always use products from different manufacturers in their machinery. In order to provide them with a complete overview of the position, tank level, machine condition and much more of all their production equipment in real time, they have coordinated with competitors. The vehicle data of all participating partners can be viewed in their entirety on all portals.

A nice example of how co-opetition - the simultaneous existence of collaboration and competition create new value for the customer.

We thank Uwe Weber for the work on this article.