Media Information

Detecon Spotlight: 5G Becomes the Driver for M&A Transactions in the Telco Industry

Gesamttransaktionsvolumen sinkt, während Zahl hochwertiger Deals steigt

Konsolidierung hin zu Multiplay und Converged Services

Investments in angrenzende Branchen steigen

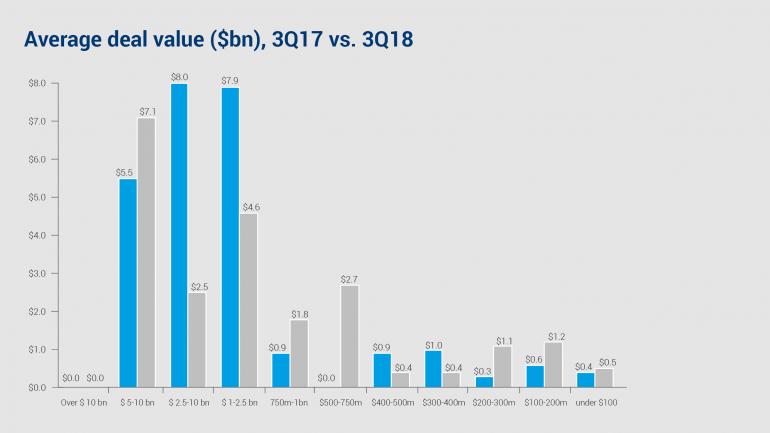

Cologne, May 28, 2019 - A recent Detecon study shows that there were fewer mergers and acquisitions (M&A) in the telecommunications industry overall in 2018 than in previous years. However, it was a record year for high-value M&A deals, as a comparison between the third quarter of 2017 and 2018 shows.

"This is due to consolidation of smaller telecom operators in previous years. A review shows that there are currently three dominant trends that can explain this phenomenon: the rise of 5G technology, consolidation in the multiplay and converged services sector, and increasing investments in adjacent industries," says Björn Menden, Managing Partner and Head of the Global Practice Core Functions and Optimization at Detecon.

The new Spotlight issue addresses these three currently most important M&A trends in the telecommunications industry and explains exemplary transactions for each trend:

1. 5G technology could become the biggest driver of M&A deals.

Most notable is the rise of 5G wireless technology, which promises faster connection speeds, lower latency, accurate centimeter-level positioning and network slicing capabilities to accommodate the latest technological developments such as the Internet of Things (IoT), autonomous driving or complex automation controls. Network operators are trying to acquire the necessary industry know-how and infrastructure to do so in order to secure a better position in the race for 5G rollout and related services. Consolidation in this area is likely to focus on fiber and cable companies, as they own much of the network infrastructure that will play a critical role in the rollout of 5G technology in the first stage. Further down the line, core networks will need to adapt. Today's infrastructure will have to evolve further toward software-driven switching, which means a major reorientation in terms of content. Due to the nature of these infrastructure-driven mergers, we could see even larger M&A transactions in the future.

2. consolidation towards multiplay & converged services.

Consolidation toward multiplay and converged services, i.e., bundled offerings of television, telecommunications, and broadband Internet, was another trend observed last year. This also means vertical integration of network operators with complementary capabilities such as fixed and mobile. This is because customers are increasingly demanding seamless connectivity both at home and on their mobile devices. When we extend this to industries, there is an expansion of the portfolio with a view to the requirements in the industrial market - starting with content-rich Campus Network Offerings.

3. investments in adjacent industries.

The year 2018 saw increased investments in adjacent industries. The desire of telco companies to diversify their product portfolio while expanding their customer base was the reason for many acquisitions in the Internet of Things (IoT), software and applications, advertising platforms, analytics, cybersecurity, and even healthcare sectors. This shows that telecom companies are actively using M&A transactions as leverage to mitigate the risk of increased market uncertainty and improve their position in the global battle for market share, growth and sustainable profitability.

Outlook: Global M&A activity to decline further

For the coming years, Detecon experts expect the slowdown in global M&A activity in the telco industry to continue for mainly three reasons:

- Lower investments are expected due to increasing financial and political uncertainty. Especially in the U.S., traditionally the country with the highest number and volume of transactions, economic conditions deteriorated and a significant economic slowdown is becoming more likely. In addition, presidential elections will be held there next year, while in Europe the approaching Brexit is causing concern and limiting planning certainty.

- Historically, the volume of M&A transactions has increased before general market conditions deteriorated. 2018 was a year of already declining transaction numbers compared to 2017 (which was a record year for completed deals), which would also confirm the impending decline in M&A activity.

- The large M&A transactions that have taken place in recent months and years must first be digested before new transactions can take place. If necessary, open mergers in new markets will still take place on the market size.

"However, certain focused M&A activity within the telecom industry seems likely due to the introduction of next-generation 5G technology. This is already evident in the announced and large-scale 5G-driven mergers and the supportive stance of regulators in this regard," Menden concludes.

The entire M&A Spotlight with all graphics is available for download at this link.

Your Contact