Network sharing was intensively in practice during deployment of all previous generations of mobile networks, thus the trend is reasonably expected to continue with 5G deployments. Sasa Nedeljkovic takes a look at how 5G network sharing looks like in practice.

Network sharing is becoming increasingly common among Mobile Operators and it is almost a standard element of their operational model in the last decade. High competition in Telco markets in recent years compelled infrastructure sharing among different network types, thus there are many cases of Mobile, Fixed and Cable Operators network sharing where operators are offering a convergent triple-play and quad-play packages to their end customers. Main network sharing driver for operators is reductions of their Capital and Operational Expenditures and the Total Cost of Ownership, usually in a range of 20-30%. At the same time operator´s network quality and global reach are significantly improved, creating them potential for higher competitiveness and enriched service offerings.

Operators usually share their passive infrastructure such as towers, power supply, cabinets, site security, or active infrastructure, radio, backhaul and core equipment, sometimes radio spectrum. Network sharing was intensively in practice during deployment of all previous generations of mobile networks, thus the trend is reasonably expected to continue with 5G deployments.

Importance of network sharing for 5G

As deployment of 5G networks requires significant investments from spectrum acquisition to construction of more radio sites for small cells with high capacity fiber network, due to expected slower return on investment, operators are forced to find a way to ease their 5G investment burden. For the desired rapid and cost-efficient 5G network deployment, network sharing and partnerships with other operators are becoming more important factors than before.

Investment saving potential for operators is particularly significant in case of greenfield deployment of 5G sites as there are minimal costs for own network consolidation and adaptation to other operators´ infrastructure. Operators tend for rapid deployment of 5G infrastructure, thus it will be difficult to justify their own 5G network deployment without opting for network sharing with other TelCos, particularly in urban areas where will be a large number of small 5G cells to deploy.

5G network sharing in practice

Mobile operators worldwide are largely considering their strategies for 5G deployment and potential network sharing scenarios and partnerships. The scene setup is different in various markets worldwide, but a very common approach of the market leaders is to try to advance with deployment due to existing network superiority. On the other side sub-scale operators are trying to secure sustainable scale against market leaders and provide greater flexibility and influence in the market by joining forces in network infrastructure deployment.

Europe

- 5G network sharing agreements are materializing worldwide and they are particularly frequent in European markets.

- Swedish company Net4Mobility, jointly formed by Tele2 and Telenor, was a basis for deployment of operators´ 2G and 4G network infrastructure. Swedish operators aim to continue with the common 5G network deployment during 2020.

- In the UK, Vodafone and Telefonica have agreed to share passive and active infrastructure during 5G deployment. Expected benefits out of 5G network sharing are more available investment for customer services due to lower rollout costs, but lower impact on the environment as well.

- Orange and Proximus in Belgium are planning to merge their mobile networks for rolling out the 5G network across the country and sharing overall investment.

- In Spain, Vodafone and Orange have agreement for mobile and fixed network sharing, with the aim of enabling a faster deployment of 5G across the country. This agreement includes shared broadband access on FTTH network.

Asia

- In leading Asian markets for 5G development, China, Japan and South Korea, the governments encourage the joint construction and sharing of 5G infrastructure.

- Three largest mobile operators in China own a common tower company, China Tower Corp, which will be used for building out hundreds of thousand base stations for their 5G network deployments.

- South Korean operators SK Telekom, KT, LG U+ and SK Broadband carried out an initiative for shared infrastructure with the main aim to avoid redundant investment in 5G deployments.

- In Japan, there is a network sharing partnership between mobile operators KDDI and Softbank in a form of common ownership of the new infrastructure company, 5G Japan Co. Operators will through this company predominantly reach out into rural regions and provide suitable 5G network coverage.

Wholesale 5G network sharing opportunities

In addition to passive or active network infrastructure sharing, 5G gives a much more opportunities for wholesale network sharing models in comparison to previous generations.

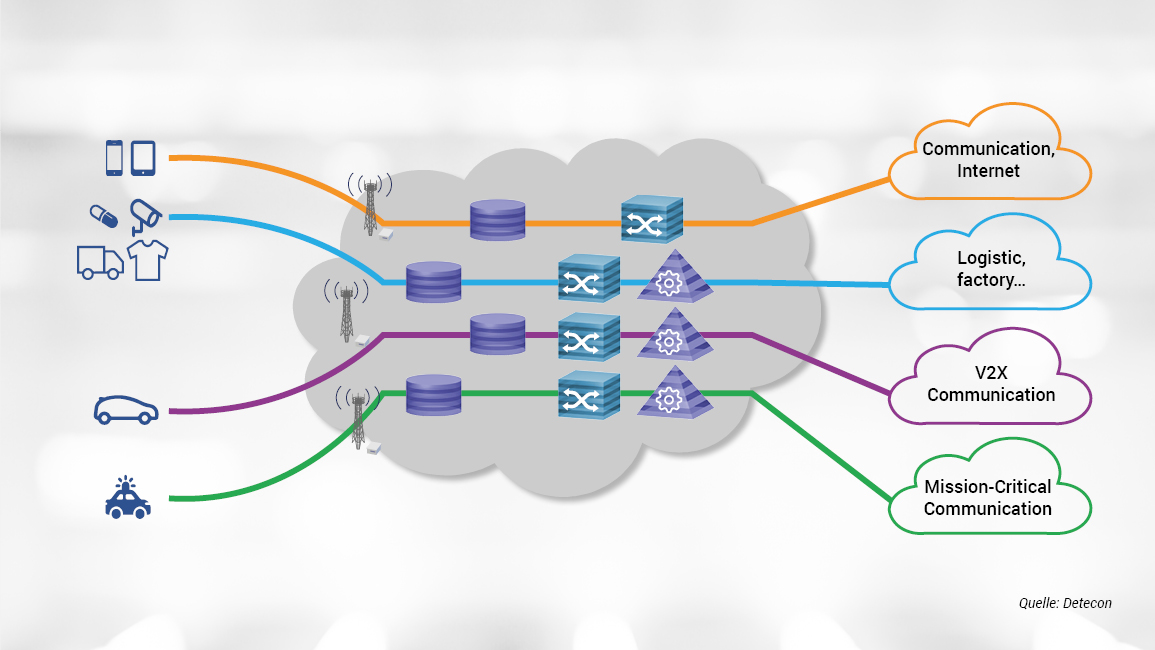

The mostly exploited model in 5G is expected to be wholesale of enhanced broadband. New network capabilities enabled by 5G, such as virtualised core & radio with network slicing are opening new possibilities for wholesale business models. Network slicing is an ideal mechanism for the creation of end-to-end private networks with customized services and functionalities at a certain quality level, which creates a potential for wholesale models that will address different market verticals with particular service performance packages.

Figure: 5G networks divided into vitual networks dedicated to one business case

Besides those 5G wholesale opportunities that are coming in a later stage, once the network is up and running, the immediate use of wholesale models is for support of 5G network deployment. Major opportunities during network deployment are wholesale of fiber backhaul for small 5G cells and radio infrastructure sharing.

Mobile operators and other 5G market entrants that aim to ease their 5G investment burden are expected to join initially network infrastructure sharing or to whole-buy 5G assets from other market players. Various MVNO models for leasing 5G network assets are also expected.

The key challenge for wholesale of 5G network resources is the development of new pricing and bundling schemes as they will be quite different from previous models used for wholesale of network resources.

Due to all new technical capabilities that 5G brings and the more intense expected sharing of 5G infrastructure, wholesale is undoubtedly becoming an increasingly important revenue stream for 5G services.