The IT landscape is changing to a cloud landscape. But how do you monitor, control and optimise your cloud IT service costs in this landscape? We have four recommendations for you.

One of the main advantages of cloud is to flexibly increase (and decrease) IT resources to fulfil immediate needs. This flexibility, however, can lead to the risk of uncontrolled increases in IT costs. The classic IT capex control mechanism, to calculate a business case, plan the IT Budget and split it on a time series contradicts IASB regulatory requirements as well as agility and other cloud paradigms.

According to IFRS 16 and IAS 38, a cloud with IaaS, PaaS and SaaS is generally classified as non-lease (Right of use assets) and non-activatable intangible asset. Traditional, self-contained IT data centers in turn, are classified as capex investment – due to its tangible and depreciable nature. In a cloud transformation scenario, moving this data center to the cloud would thus shift costs from capex to opex. From an accounting point of view, this results in an immediate and significant EBITDA reduction. But how to monitor, control and optimize the cloud IT service costs and cloud IT opex costs?

So how can cloud IT service costs and cloud IT opex costs be monitored, controlled and optimised?

1. Recommendation: Enable a Cloud Financial Management Team in the organization

To enable innovation cycles, the controlling department should extend IT-controlling capabilities towards financial management aspects of the cloud. The cloud financial management role or team should become a part of a cross functional team to help the Cloud Center of Excellence.

The FinOps Foundation (#FinOps) describes a financial operations model for the cloud. This framework is certainly in the early stages of its development, but it is a good start to reconciling the different views on cloud technology and finance. The FinOps Framework describes several principles of which the following two are key elements:

-

“Take advantage of the variable cost model of cloud”

A company's cloud costs will remain fixed if business demands are very static. But business demands can be quite variable and so should be the respective cost model to control cloud opex costs. Such a variable cost model can rightsize cloud resources and correctly allocate demands, in order to optimize cloud costs for the organization. A variable cloud cost model could also be aligned with a value-based steering model.

-

“Everyone takes ownership for their cloud usage”

Different business and IT departments should have the ability to expand cloud resources. Therefore, cloud financial management should enable these departments with reports, to monitor and optimize the costs. IT controlling should act as owner to such optimization initiatives, as it drives cost optimization within the organization.

2. Recommendation: Performance management of cloud usage and costs: More transparency through cloud

Understanding cloud usage and cost

Cloud service providers usually offer embedded tools and services to analyze and monitor cloud costs. With such embedded tools (e.g. AWS Cost Explorer, Google Cloud Billing Reports or Azure Cost Management) or an independent cloud performance management reporting tool (e.g. Apptio or Jedox), it is possible to analyze and forecast cloud service costs. One key element to understand cloud usage and costs are cost allocation tags.

All cloud resources can be labelled with tags (e.g. server, storages or databases). By defining the name of a tag (e.g. cost center) and its corresponding value (e.g. cost center number), cloud service cost controlling can be performed with a high degree of detail.

As a starting point, the Cloud Financial Management Team should define “must-have” cloud tags. The Cloud Center of Excellence should then publish a guiding principle defining tags for mandatory implementation on all cloud resources (automated with Infrastructure as Code). Untagged resources should be analyzed and updated on a regular basis.

Examples of cloud tags:

- Company code

- Cost center

- Business capability

- Owner

- Business Unit

- Stack / environment (dev, test, production)

- Application identifier

- Security level

- Dedicated or shared cost

- The embedded figure above and bullets here are redundant

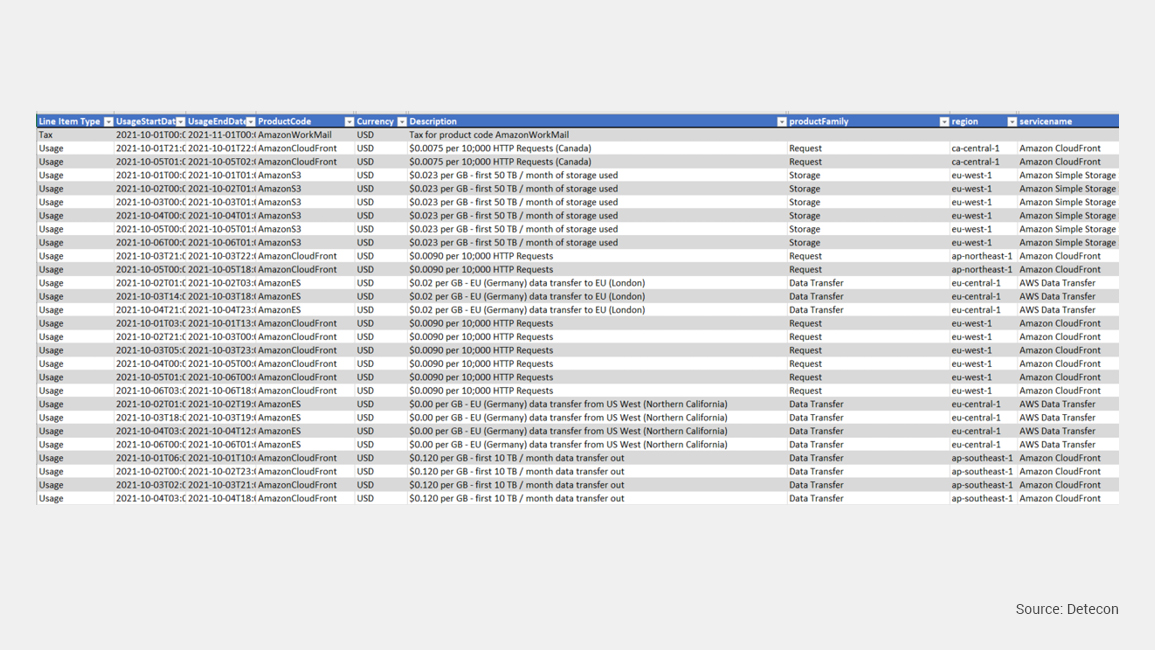

Embedded tools will add some dimensions automatically, which can also be used to analyse and monitor cloud service costs:

- Region/Location (e.g. eu-west-1: EU Frankfurt)

- Product Family (e.g. Storage / Data Transfer / Backup Snapshot)

- Product Service (e.g. Amazon S3, Amazon DynamoDB, Amazon Relation Database Service)

- Item Type (Tax, Usage)

- Time interval

2.2 Cloud Performance Management Reporting

All cloud service costs can be exported on a detailed level and can be analyzed either with an independent reporting tool or directly with cloud embedded tools. An advantage of embedded tools is the capability of standard reporting and automated dashboards. These dashboards provide a good overview of cloud costs and usages, which is great for initial orientation.

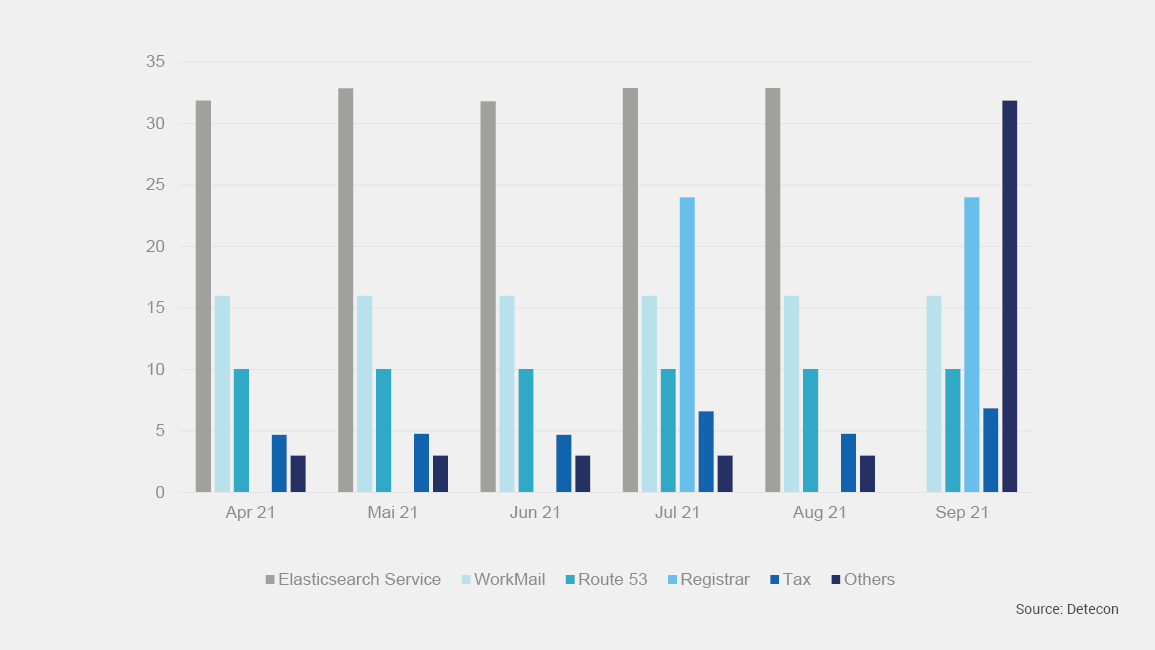

The following picture is an example of the AWS Cost Explorer.

Report examples from embedded tools are:

- Daily / monthly costs of cloud services

- Marketplace costs and usages

- Reserved instances utilization

- Deep dive analysis of cloud services

Cloud service cost anomaly detection

The cloud financial management team should develop the ability to analyze cost anomalies for prevention of cost surprises. Hereby, Machine Learning (ML) technology greatly simplifies the identification of anomalous costs and their causes. ML – technology can be utilized with both standalone reporting tools and embedded services from cloud service providers. AWS, for example, provides “AWS Cost Anomaly Detection” which defines anomaly detection by services, cost categories, cost allocation indicators and linked accounts.

An example of an anomaly with significantly increased cloud traffic and thus cloud costs is the misconfiguration of network services which causes uncontrolled outbound network traffic. Different installed services (e.g. databases for reporting) which cause an indirect data transfer outside of the cloud rather than within separated cloud networks

3. Recommendation: Cloud service costing and Enhancement of the IT service costs

Cost allocation with managed shared costs

There are some cloud financial performance measures such as defined KPIs across the infrastructure, a sharing cost model or own software license costs, that cannot be integrated. To seamlessly integrate such measures, an independent cloud performance and cost allocation reporting and planning tool is needed.

Cloud service costs can be differentiated between dedicated and shared costs over multiple business demands. Dedicated resources can be tagged directly one-to-one to a cost driver, whereas shared costs should be allocated to a shared cost model.

For the reader and more precisely, what is the distinction between tagging and allocation?

Examples of dedicated and shared costs are:

- Marketplace software license

- Servicer (and reserved server) instances

- Databases, such as Database as a Service “DynamoDB”

- Storage

- Load balancer

- Container / Kubernetes

- Network usages

Additional costs outside, but related to the cloud, should also be considered:

- Bring-your-own-software license

- FTE costs of the Cloud Center of Excellence and cloud financial management team

- Commitment discounts

Cloud budget thresholds & alert management

To minimize the cloud cost risk, it is possible to set up budget thresholds on accounts and service levels. With a defined budget, the alert management of the cloud service provider will send a budget alarm notification to a defined responsible contact in real time. The cloud service will not downscale automatically by a threshold notification if not coded and designed by a customer.

Cloud usage and costs optimization

Cloud Financial Management should regularly analyze actual cloud usage to identify optimization potential. For example, pay-as-you-go instances could be analyzed by usage and time series. Optimization strategies can avoid overprovisioning and changing the pricing model can reduce cloud costs. The elasticity and pricing model strategy should be developed in conjunction with the Cloud Center of Excellence.

For example: Depending on business needs, software environments (i.e. dev, test, prod) should be automatically scaled down in terms of time and hardware usage. Another example is to analyze alternative usage options. Shift pay as you go to saving plans, database with IaaS to Database as a Service or application resources to serverless capabilities.

Optimization examples are:

- Autoscaling: Dynamic launch and termination of instances as needed

- Instance scheduling: Defined schedules for instances to compute optimization

- Storage lifecycle rules: Definition of automation rules with a predefined period to shift / archive data for storage optimization.

Cloud Pricing Models are:

- On-demand model: Pay-as-you-go resources, depending on customer demand

- Saving Plans: Commitment to a specific amount of usage for a certain period

- Reserved instances: Commitment to a specific instance type and amount for a for a certain period

- Spot Instances: Spare compute capacity request

4. Recommendation: IT Controlling Excellence with Cloud Financial Management

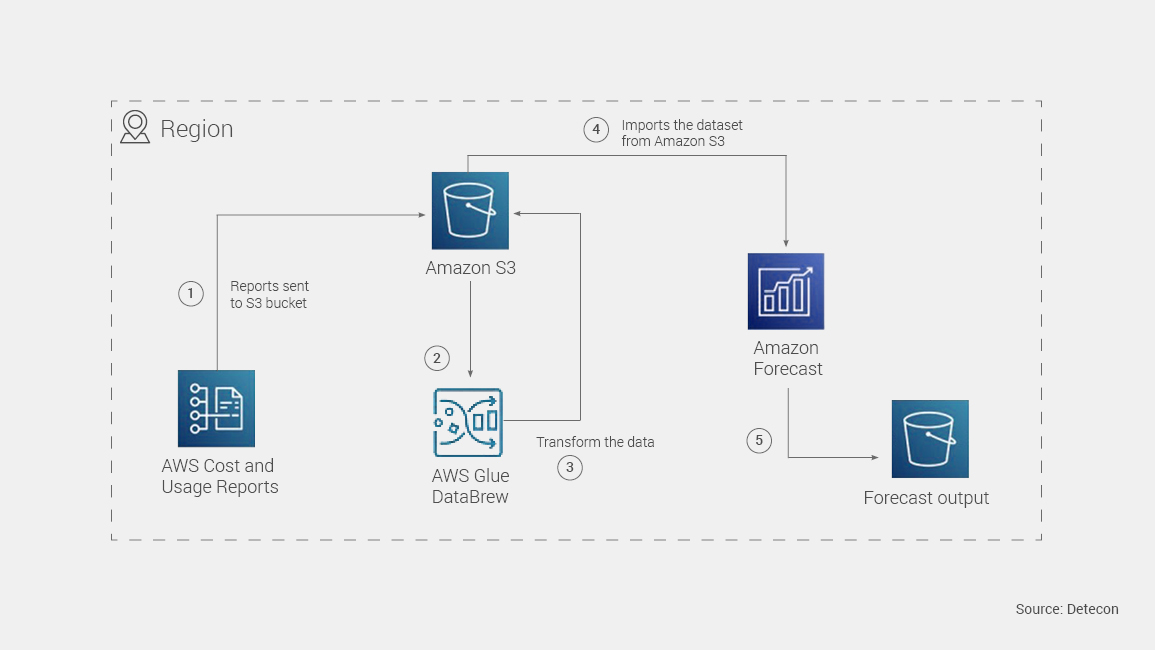

Cloud Forecasting with ML

Agile Cloud Budgeting and Planning Process

Establishing an agile mindset in a finance organization requires an alignment of different perspectives and expectations. The Cloud Financial Management Team should enable the delivery teams to dynamically allocate budgets. To enable this, the controlling department should enhance the steering logic towards a value based steering model. Initial budget planning will then estimate and prioritize the required resources for every value stream to fulfil financial OKRs.

Conclusion

At the forefront of the cloud landscape are standing cloud service providers such as Amazon AWS, Microsoft Azure and Google GCP. Meanwhile, IT departments are moving storage, servers and databases to the cloud to improve their IT landscape. In this sense, business departments can look forward to new opportunities such as machine learning, Big Data, and IoT use cases.

The IASB Board (IFRS) will continue to address the cloud issue in the future. A few years ago, IFRS 16 recognized lease costs as a lease liability and right-of-use as an asset. The mix of pay-as-you-go, savings plans and reserved instances over a defined period could also be reassessed and re-evaluated by the standard setter.

IT controlling should improve cloud financial management capabilities for both internal and external views in the future. To enable innovation cycles, cloud financial management should align long-term investment planning with a variable cloud cost model and a flexible cloud service costing model.

To increase cloud cost transparency, IT controlling should track cloud usage and costs, publish timely cloud performance reports and detect cloud cost anomalies. Cloud cost allocation with managed shared costs, cloud budget thresholds & alert management and cloud usage & cost optimization functions will additionally increase the maturity of cloud financial management.

Using machine learning to predict cloud costs and an agile cloud budgeting and planning process, the cloud financial management team could support the agile value-based management model and reach financial OKR excellence.