The corporate divisions headed by CFOs are just as affected as the other departments and units by the changes that digitalization and other disruptive influences are having on their environment and business models. The future of the finance division and its role and importance within the company will depend heavily on how well it responds to these changing conditions and requirements and how successfully it exploits and seizes the opportunities to add value and secure a position for itself in this situation.

Our Special Finance Transformation is a contribution to the discussion, analysis and evaluation of this thesis.

Based on our experience from dialogs and joint projects with our clients in the finance divisions as well as in others, we argue that the current changes in the corporate environment - essentially, but not exclusively, digitalization - will be a driver for further growth in responsibility and strengthening of the role of the finance departments in the enterprise, both in the phase of the necessary transformation of the companies and in their new target structure.

Our Special Finance Transformation is intended to take an in-depth look at changes and approaches to solutions from the perspective of the finance services.

Factors influencing the CFO division

The surrounding circumstances in the CFO division are subject to constant change. The triggers are many and varied, and the volatile and uncertain market environment resulting from these changes forces organizations to be more flexible so that they can respond as quickly and effectively as possible to the constantly changing environment. While these circumstances certainly impact the role of the CFO division itself, they also result in shifts in the demands on the staff members in this area.

Although the country has not been spared from tensions and upheavals, the political situation in Germany since World War II has remained largely stable. To be sure, there have frequently been changes in foreign and trade policy or forces triggered by new legislation, regulation, and amendments in tax law and accounting; nevertheless, these factors have been more in the nature of reform than of revolution. The COVID-19 pandemic has required politicians to intervene for the first time in the lives of citizens and in working and economic life in Germany and to an unprecedented extent. The associated restrictions have had major impacts on markets, prices, and supply chains.

At this very moment, we are experiencing how the economic situation and outlook can change unexpectedly, profoundly, and in the long term owing to unexpected events such as the Russia-Ukraine war. Expected inflation of as much as 10 percent and the resulting uncertainty about future import opportunities from crisis regions will change the consumer behavior of the general population. This will in turn lead to reactions on the foreign exchange markets and have a direct impact on the exchange rates and balance of payments of the affected countries. Changes such as these can trigger a chain reaction on the market with consequences that are difficult to assess and for which companies are only partially prepared, accustomed as they are to the stable framework conditions of the past and the utilization of a classic set of instruments. Disruptive events such as the COVID-19 pandemic have already demonstrated what happens when the ability to respond is too slow. This raises the question of the extent to which previous business models of many companies and their operational implementation will assure the resilience required to secure future business operations. In addition, the pressure to switch to new or more flexible business models is increasing as new competitors emerge from the ongoing digitalization.

Demographic change also demands a change in how we think. Present projections indicate that the total population in Germany will decline by five million (-6 percent) by 2060 with the concomitant reduction in the size of the workforce in the long term. But that is not all. The age distribution is also changing; even today, one in three people in Germany is older than 58 and one in four is older than 62. The average age in Germany in 2020 was 46. The related fall in the working-age population cannot fail to impact economic performance and public budgets and will place considerable demands on employee recruitment and retention.

The value system and motivating factors of future employees and customers are also changing and forcing us to rethink our positions. At the moment, the largest share of the workforce comes from Generation Y (born between 1980 and around 1995) while people from Generation Z are entering the labor market. The aspirations of these generations differ significantly from those of their predecessors. The desire for classic status symbols is fading into the background, and drivers such as a good work-life balance are gaining in significance. Companies are faced with the challenge of being organized as efficiently and productively as possible on the one hand and taking into account the changed motivational structure of employees on the other hand. The changed value systems also offer opportunities for companies, however. For example, embracing the “sharing” concept, i.e., sharing rather than owning resources, presents a possibility to cut costs by reducing office space, company cars, etc.

While the “gender shift” trend has become increasingly relevant for the current generation, the diversity requirements related to Generation Z’s entry into the labor market go far beyond the traditional images of women and men. Diversity management will become an increasingly important success factor for companies in the battle for qualified specialists.

Technologies are developing at breakneck speed. Just as new market entries put pressure on established business models, they also create opportunities for companies to reduce costs and increase efficiency. Cloud and edge services offer the chance for on-demand use of resources and the consequent reduction of IT expenses in particular while automation and blockchain technologies accelerate processes and make them less resource-intensive. The “metaverse” based on AR/VR technologies, while still in the very early stages of its development, has the potential to open up gigantic opportunities to companies for gains in revenues and efficiency.

At the same time, however, the demands on the CFO division are intensifying as the growing technological possibilities also change the expectations of stakeholders. For instance, the need for information is rising because of the vast quantities of available data. As a result, the focus of the CFO division is shifting from that of financial management and moving in the direction of a strategic partner/advisor, leading to changes in the skills required of the finance staff. While it is true that more and more digital natives — people who have been socialized and raised with digital devices, electronic media, and the management and interpretation of data since their earliest childhood — are appearing in most companies, they remain for the present a minority.

As business processes become increasingly technologized, the risk of cyberattacks on companies also rises. For instance, financial data or even production facilities can be hacked, negatively affecting the quality of products or disrupting the sensitive interaction in production and supply chains. It is estimated that in 2021 cyberattacks Germany-wide resulted in losses totaling €223 billion (in comparison with €103 billion in 2019).

Along with the effects of the COVID-19 pandemic and the Russia-Ukraine conflict, climate change and dealing with countermeasures for its mitigation certainly represent the greatest business challenge. The demands and wishes of both customers and employees on companies related to the topic of sustainability are rising in intensity as is regulation by legal directives, e.g., the CSRD (Corporate Sustainability Reporting Directive) and the EU taxonomy “Sustainability.” Sustainability is becoming part of corporate strategy and needs to be addressed in all areas of the company; action plans for climate neutrality and sustainability reports will become “daily business” in all corporate units in the future.

Ideas for possible solutions

But the changes in the operating situations of companies and finance divisions pose not only new challenges for the finance divisions; at the same time, they include possible approaches for mastering the issues.

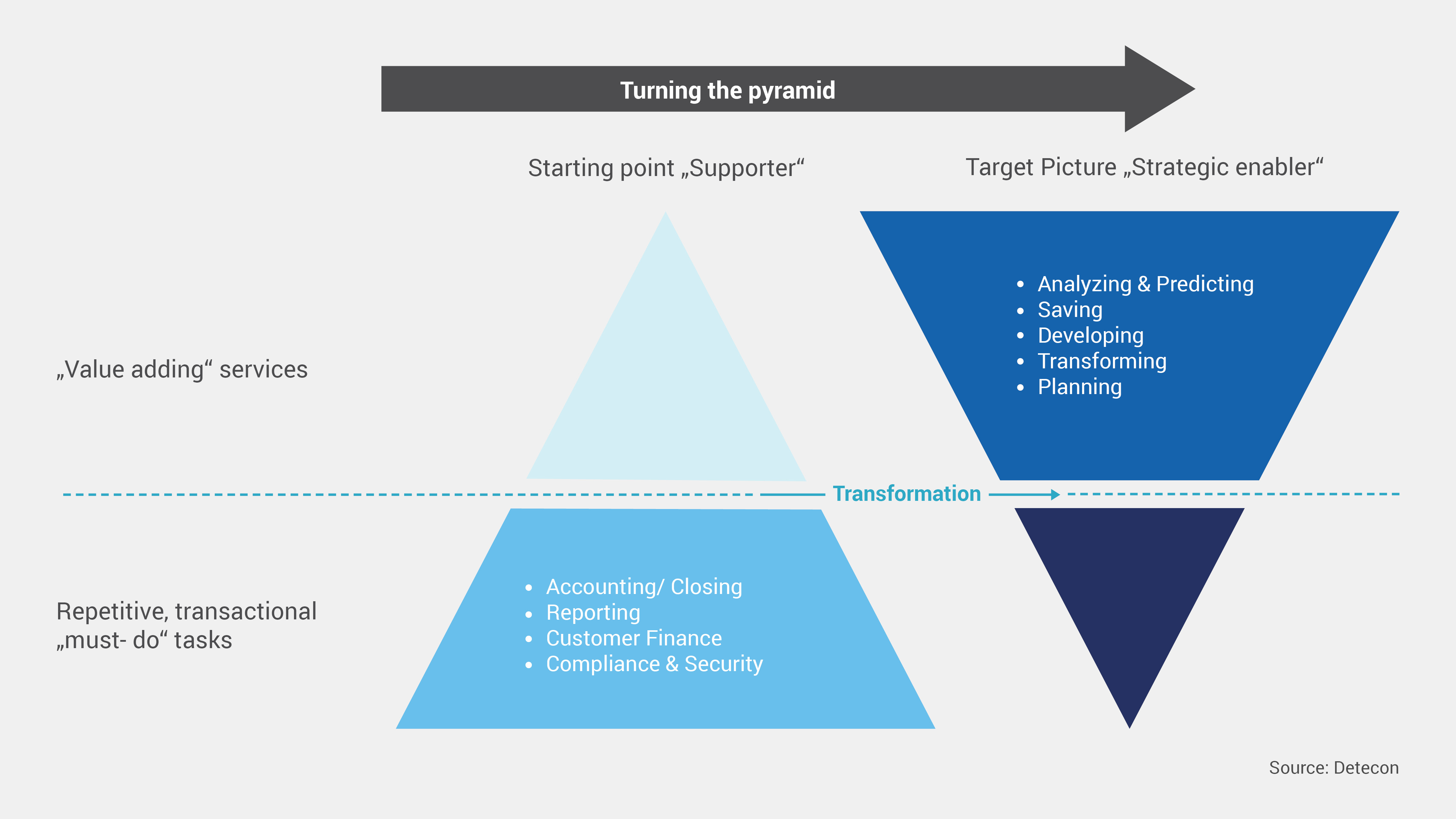

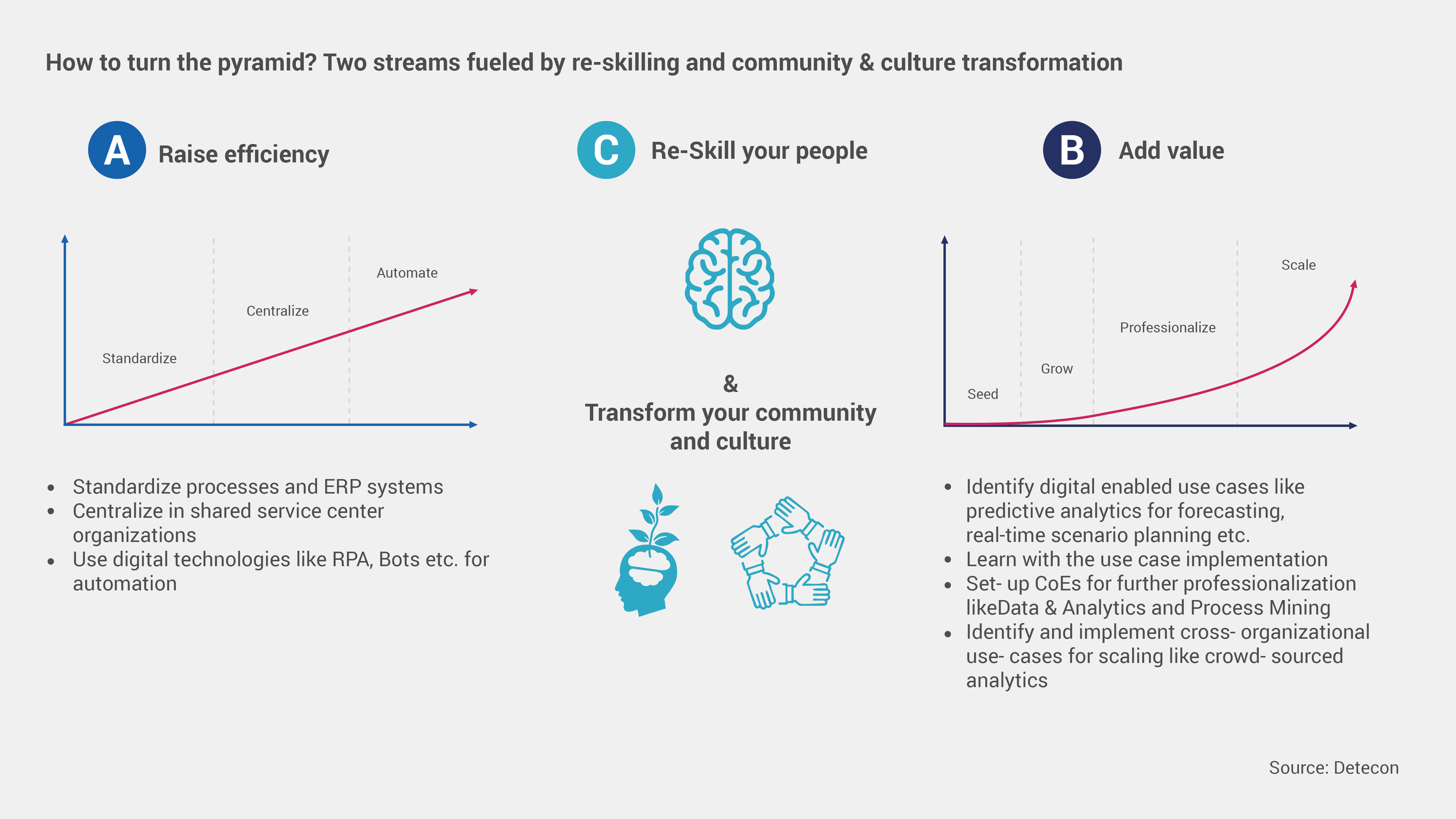

Technological changes underlying digitalization offer additional potential for the finance division in terms of efficiency and a sharper focus of its own organization. Non-value-added activities such as the posting of incoming invoices can be automated with the help of bots, and the free capacities that result can be transferred to value-adding activities such as the simulation of planning scenarios and risk analyses. In view of demographic change and the expected decline in the available workforce, it is possible to ensure that the employees who will still be available in the future are assigned to areas where they will generate the greatest added value for the company.

The increasing pressure on the value contribution from finance divisions from the centralization, standardization, and automation of transactional activities in recent years represents simultaneously an opportunity for the units to reinvent themselves, to reallocate resources as skills change, and to contribute to the company’s success with more value-adding activities and to find a new changed role.

Potential for the finance division can be found in the field of data and analytics, for instance, because already available analysis and reporting competencies can be applied to other data sources besides the classic ERP and commercial systems. The controlling position as a distributed organization with insight into all units of the company from corporate strategy and technology to sales, service, and customer experience management is in an excellent position to steer the linking and analysis of additional and decentrally distributed corporate data by virtue of this organizational embedding and related governance. New areas of responsibility and a new role for finance that generates steadily increasing value are emerging.

Agilization, which is also finding its way into companies and their workflows and processes in the course of digitalization (and, at first glance, causing the financial controller in charge of a 5-year plan to break out in a sweat), is a chance to make a contribution to value-oriented budget allocation through the implementation of agile planning and budgeting concepts. Budgets are no longer allocated historically according to cost center structures, but on the basis of the expected contribution to corporate goals and ROI for business projects and investments.

Unpredictable events such as the global COVID-19 pandemic or the escalation of the situation in Ukraine, impacting as they do markets, prices, and supply chains, challenge the resilience of organizations and companies, not just of people. Efficient financial risk management is becoming more and more important in these times and must be integrated even more tightly into financial management. Measures that are taken in the sense of this risk management and that present a solution in the crisis situation can become established instruments of cost management. This is obviously reflected in Future Work concepts at the level of the employees in that they heighten the flexibility of the companies’ work capacity and at the same time provide ways to cut costs in the future by reducing needed space.

In general, digital technologies, in addition to their potential for new business models, services, and products, offer companies a chance to realize a more efficient organization and to cut costs. Positive business cases for the use of virtualization, IoT, and other technologies prove this and represent modern actions and levers of cost management. The potential of other technologies such as blockchain cannot be overstated. The introduction of digital efficiency programs opens the door to companies taking advantage of digitalization as an opportunity for themselves. The finance division, as it is the guardian of the company’s efficiency, is predestined to initialize such programs and lead them to success.

The topic of sustainability must be anchored in the company through financial management. The contradiction initially seen between the idea of sustainability in its original interpretation from a CSR standpoint and the efficient management of the company is dissipating at an accelerating pace. Dramatic transitions are taking place at various points and allow environment, social responsibility, and sustainable use of resources to be combined with revenue growth.

Role reversal in finance: from brakeman to driver

A “Digital CFO Agenda” that takes into account the challenges and approaches to solutions is taking shape. It must take various forms that are dependent on a company’s industry, its size, and the existing maturity level of efficiency in organization and processes and be scheduled along a specific timeline.

The skills previously developed when dealing with and implementing regulatory requirements form the cornerstone for a positioning that makes effective use of them in the sense of business resilience in times of change for continued and sustainable corporate success.

There is a shift from the narrow focus on cost efficiency alone to the broader overview of the efficiency of the company as a whole, and the finance division is moving beyond being an enabler to become a driver of corporate success.

The previous perception of the finance division as a brake on innovation, or at best an innovation follower, is changing to the role of innovation driver because of the translation of innovation into corporate benefits.

Whatever else may happen, realizing the possible solutions and analyzing in depth the areas of responsibility and its position in the transformation of companies will lead to the finance division making an even more valuable contribution to corporate success in the future.