The climate crisis is also putting the issue of sustainability at the top of the strategic agenda in the telecommunications industry. In large parts, the industry is striving to achieve net zero by 2050 at the latest. Part 1 of this article provides a detailed evaluation of the current challenges. (Read Part 2 here).

For now, digitization is a double-edged sword when it comes to energy consumption and CO2 emissions. The ICT industry is certainly making its contribution to the generation of GHG emissions. Experts estimate that it accounts for around three to four percent of the global carbon dioxide burden, and with global network traffic expected to grow exponentially, the pressure for the ICT industry is evidently (Friedrich, Roman, et al 2021). However, this is opposed by a CO2 savings potential of 15 to 20 percent for other industries through the enablement of digital technologies (Bieser, Jan, et al 2020; Ekholm, Börje and Rockström, Johan 2019).

But how can such impacts, efforts, and achievements be represented and evaluated? And what are main obstacles for the telco journey towards sustainability? In the following article, the current sustainability status and challenges within the telco industry are described. Furthermore, potential next actions and future outlooks are illustrated. Hence, we provide a general overview of the sustainability journey within the telco industry until now, as well as the current burning topics and ideas for the future.

Environmental sustainability focus of telco operators/ vendors

Due to external pressure by regulations, shareholders, and customers, the ICT industry is working on integrating sustainable business practices, while keeping costs and prices low and staying competitive. Sustainability reports show an industry trend towards carbon neutrality, circular economy is a big topic, and commitment to the SDGs is omnipresent. When refusing to integrate sustainability practices, telco companies risk not only an image and credibility loss but also the loss of a competitive advantage for specific products and their brand. Hence, environmental sustainability should be strategically prioritized. Based on recommendations by the science-based targets initiative (SBTi), the main goal for the telco industry in this area is to achieve net zero by 2050 latest.

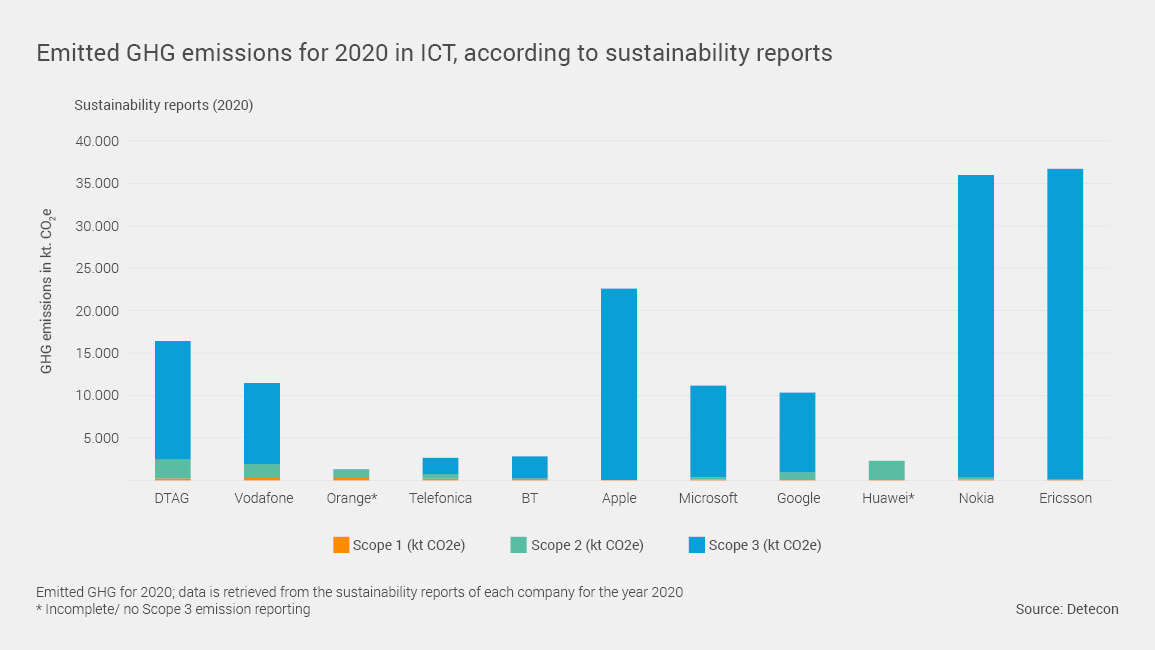

To achieve this objective, several near-, middle-, and long-term steps need to be considered by telco companies. As a first step, it is essential to develop transparent and detailed GHG emission reporting at company level. A complete emission reporting includes direct, indirect, upstream- and downstream GHG emissions (Scope 1-3). A comprehensive reporting enables the telco industry to identify gaps within their emission reduction strategies, and enables them to set data-based, and ambitious targets.

As a second step, it is important to implement and consistently use KPIs within the industry. KPIs enable stakeholders to evaluate the business activities of the reporting companies and position the environmental performance in the competitive market. In the telco industry, consistent KPIs regarding energy consumption and energy efficiency are essential. As a third step, the carbon footprint of network equipment at product level should be evaluated. Here, it is necessary to assess the entire lifecycle of a product, meaning that data collection from suppliers and other entities within the value chain becomes relevant.

For middle- and long-term targets, SBTi recommends aiming at halving the GHG emissions by 2030 and achieve net zero by 2050. Here, it is essential to highlight net zero as actual decarbonization of 90-95% of the GHG emissions within Scope 1-3 and neutralization of the remaining 5-10%.

Challenges of telco operators

When evaluating the environmental sustainability strategies within the ICT industry, several challenges catch one’s eye.

First, the Corporate Carbon Footprint (CCF) often lacks detailed data and information, complying with existing standards. There are significant discrepancies in carbon accounting and differences in the quality of sustainability reports visible.

While Scope 1 and 2 emissions are reported by most companies within the industry, complete and transparent Scope 3 emission reports are largely missing. It is important to mention that Scope 3 emissions have the biggest share of a telco’s total carbon footprint, sometimes more than 90%22. Transparent and detailed Scope 3 emission reporting is essential for finding practices to reduce emissions in the value chain. However, gathering all the data from suppliers and customers may be time- and cost-intensive because Scope 3 emission reporting affects the whole value chain.

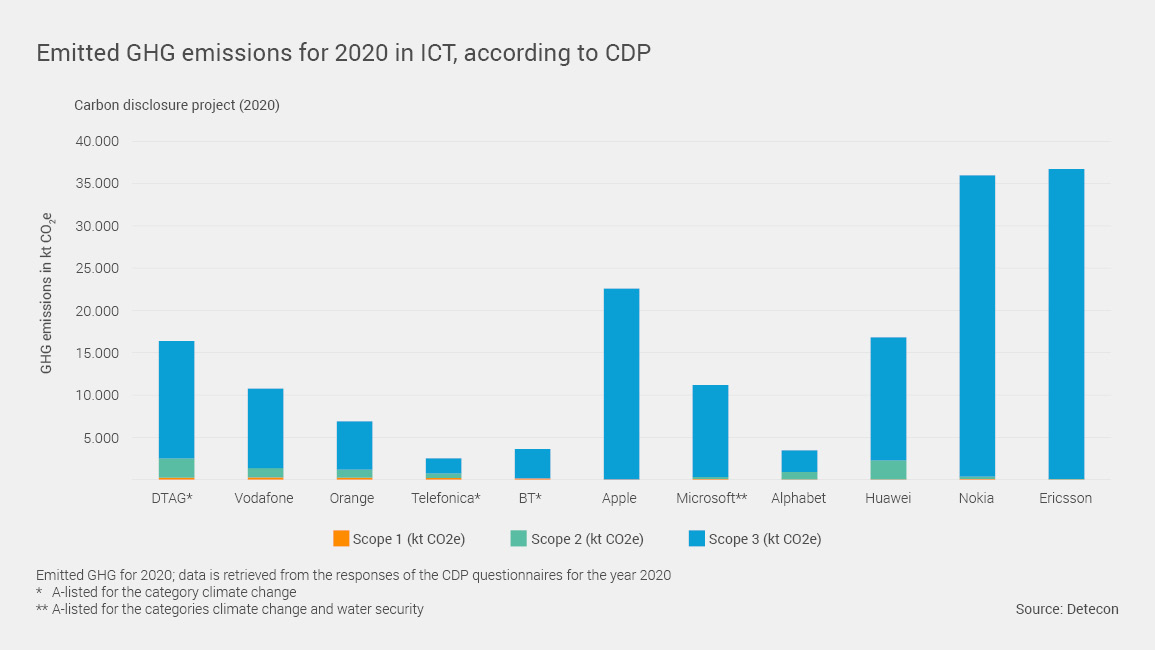

The carbon disclosure project (CDP) asks for statements and explanations about every category of Scope 3 with questionnaires. These efforts establish consistent, complete, and comparable reporting. Reporting with CDP supports the progress towards a sustainable economy and companies can gain a competitive advantage, get ahead of regulatory and policy changes, identify risks, and find opportunities for action (Carbon Disclosure Project).

However, just 1% of the companies who submit their data to CDP disclose all the relevant data for external stakeholders to judge the environmental performance (Jessop, Wilkes, Howcroft. 2022). Furthermore, in the ICT industry, it is observable that some companies report their emission data more complete to CDP than within their own sustainability reports. These gaps need to be closed, to track the progress towards a thriving, sustainable future.

Some best practice examples within the ICT industry are the Deutsche Telekom AG, Telefonica, BT Group, and Microsoft. These companies are A-listed by CDP for the category climate change, while Microsoft is additionally A-listed for the category water security. To conclude, it is inevitable to report complete Scope 3 emissions, to define efficient and data-based reduction strategies.

Second, several KPIs are not used consistently within the telco industry. For instance, while energy efficiency is an essential priority within the telco industry, consistent KPIs are not defined and communicated. It is observable that there are several KPIs, describing energy intensity like energy per unit of traffic/ per connection/ per cell site/ per revenue, which are also predefined by initiatives like GSMA (Kolta, Hatt 2021). However, a consistent use within the industry is not yet established.

Similarly, carbon intensity would be a powerful KPI, describing the GHG emission impact per output unit. Here, a consistent realization of the output unit for the telco industry (e.g., data volume), as well as the included Scopes for GHG emissions are lacking. Carbon intensity should, by definition, contain all Scopes but differing reporting quality and the neglection of Scope 3 reporting limits the meaningfulness of the KPI for telcos. To give an example, while Deutsche Telekom provides relatively complete Scope 3 data, Orange only includes Business Travel in its Scope 3 reporting. Hence, the carbon intensity KPI would paint a more positive picture of Orange due to the limited data. Furthermore, the neutralization of Scope 2 emissions with renewable energy sources has a similar effect on the meaningfulness of carbon intensity. It is critically to evaluate the need for standardization within the industry and push their application.

Several cross-industry standards, KPIs, and initiatives are already existent and provide guidelines for reporting and measuring the environmental performance. The telco industry needs to avoid reinventing the wheel and creating separate telco-specific standards and KPIs, when economy-wide standards are already existent. Such extra layers create a new ecosystem to regulate and manage, which not only relates to a lot of extra work but also to less focused decisions by policy makers. However, a consistent use of existing KPIs needs to be pushed within the industry to enable comparison and competition.

Third, telco operators increasingly demand Product Carbon Footprint (PCF) calculations for base stations and other products from their vendors. However, existing PCF calculation results are not comparable and lack the possibility to offer advantageous positioning in the market. The challenge of representing an exact PCF for the network equipment can be broken down into several parts. The sustainable impact of specific products may often not be adequately represented, because the reports lack comparability.

While some standards provide general and industry-specific guidelines (International Organization for Standardization 2006; International Telecommunication Union 2014; European Telecommunications Standards Institute 2014), there are no clear calculation and data collection methodologies in place. Furthermore, the definition of system boundaries is in the responsibility of the reporting company, allowing companies to exclude specific lifecycle stages. Moreover, there is a challenge in defining an average usage scenario to determine the energy consumption in the PCF adequately. Sourcing renewable energy for the use of the equipment is a key factor for improving the environmental impact of the energy consumption.

Because the emission factor of renewable energy sources tends towards 0, the emissions from the product use stage of the lifecycle decrease significantly. However, electricity is often still drawn from the regional energy grid, which needs to be considered. While some countries have a higher share of renewables within their energy grid, others are still mainly powered by non-renewables. For instance, while Germany has a share of 45% renewable energy in its electricity grid, China has a share of only 29% (Ritchie, Roser 2020). To solve this issue, companies can produce renewable energy at their facilities themselves with solar panels or wind projects.

Furthermore, they may influence their regional energy grid. For instance, Google implemented renewable energy projects across several continents to influence regional electricity grids in their operating countries (Google Cloud 2021). However, there is an immense financial investment needed to influence regional electricity grids, and many telco companies may not be big enough. In addition, there is the challenge of representing energy efficiency and renewable energy sources within the PCF. Because of the emission factor tendency of renewable energy towards 0, innovations in energy efficiency are not represented, when a product is powered with 100% renewable energy.

Fourth, the value of innovation in the field of energy efficiency may not be well reflected in the CCF. For telco operators, a growing energy challenge in the form of exponential growth in network traffic is observable (Lee, et al 2020), entailing the risk to rise the CCF to a new level. Since operators cannot force their end customers to source 100% renewable energy, the neutralization of GHG emissions during the use phase of a product is challenging.

On the positive side, innovations in energy efficiency make it possible to limit the increase in energy consumption. This means that energy efficiency has a huge impact because operators may reduce or, at least, predictably manage the environmental impact related with the increased network traffic. Thus, energy efficiency entails the possibility to balance economic and ecological demands. Nevertheless, the positive effect of energy efficiency may still be diminished because of the exponential increase in traffic and total energy consumption due to new services like 5G34. Hence, the reported CCF would continue to increase, diminishing the efforts and innovative capacity in the field of energy efficiency.

Fifth, the telco industry enables other industries to reduce carbon emissions and achieve their climate targets. Due to, for instance, the use of new technologies, the increase of connectivity, and energy efficient products, other industries may reduce their carbon footprint. To give a more tangible example, the telco industry reduced employee commuting of several industries due to the enablement of video conferencing. GSMA estimated a global enablement impact by mobile communication technologies in 2018 of around 2,135 million tons CO2e, which is ten times greater than the emissions of the sector (GSMA, Carbon Trust 2019).

Some telco operators like the Deutsche Telekom (DT) report an enablement factor, describing the distribution of DT’s emissions and emission reductions enabled for DT customers (Deutsche Telekom 2020). However, some challenges remain open when investigating the enablement factor within the telco industry. To begin with, there is no common definition and methodology for the enablement factor within the industry. How much CO2e reduction efforts of other industries may be contributed to new technologies and digitalization? How big is the share of the telco industry compared to innovative industry processes?

Furthermore, a distribution within the value chain of the telco industry, meaning the share for operators, vendors, and other suppliers remains uncertain. How much does every part within the value chain contribute to the enablement of other industries? How can innovations within the industry be recognized by the enablement factor? Finally, there is a reporting challenge within the industry because the enablement factor may be perceived as greenwashing. Can the enablement factor be used to reduce reported GHG emissions? Should the enablement factor be integrated within the Corporate Carbon Footprint or the Product Carbon Footprint? Many questions remain open, and further discussion within the industry is necessary to come to conclusions and principles.

Many thanks to Tim Krüger for his collaboration on this article.

Bibliography:

Friedrich, Roman, et al (2021). Putting Sustainability at the Top of the Telco Agenda. Bosten Consulting Group.

Bieser, Jan, et al (2020). Klimaschutz durch digitale Technologien - Chancen und Risiken. Bitkom, Kurzstudie.

Ekholm, Börje and Rockström, Johan (2019). Digital technology can cut global emissions by 15%. Here's how. World Economic Forum.

Carbon Disclosure Project. Environmental transparency and accountability are vital to tracking progress towards a thriving, sustainable future; Why disclose as a company .

Jessop, Wilkes, Howcroft. (2022). Almost all climate-related corporate disclosures are inadequate, CDP says. Reuters.

Kolta, Hatt (2021). Going green: Benchmarking the energy efficiency of mobile. GSMA Intelligence, Report.

International Organization for Standardization (2006). Environmental management - Life cycle assessment - Principles and framework. Standard 14040.

International Organization for Standardization (2006). Environmental management - Life cycle assessment - Requirements and guidelines. Standard 14044.

International Telecommunication Union (2014). Methodology for environmental life cycle assessments of information and communication technology goods, networks and services. Standard L-1410.

European Telecommunications Standards Institute (2014). Environmental Engineering (EE); Methodology for environmental Life Cycle Assessment (LCA) of information and communication technology (ICT) goods, networks and services. Standard ES 203 199.

Ritchie, Roser (2020). Electricity Mix. Our World in Data.

Google Cloud (2021). Sustainability. Four consecutive years of 100% renewable energy - and what's next.

Lee, et al (2020). The case for committing to greener telecom networks. McKinsey & Company.

GSMA, Carbon Trust (2019). The Enablement Effect, The impact of mobile communications technologies on carbon emission reductions. GSMA.

Deutsche Telekom (2020). Corporate Responsibility Report. Environment, Enablement factor.

Click here for the Glossary: Sustainability jargon