Climate change mitigation and sustainable development are fortunately on the agenda of more and more companies, regardless of business model, location or supply chains. Through the goal of profitability as well as international governance policies and customer’s expectations regarding the Sustainable Development Goals (SDGs), companies are permanently confronted with the implementation of measures that make a positive contribution to sustainability. In the current scenario, sustainable finance appears to us to be an essential tool for overcoming these challenges both inside and outside a company - especially when accompanied by technology and high-end data management.

Financial officers are challenged to increase revenue and reduce costs, yet at the same time to improve operational and organizational efficiency, laying a strong fiscal foundation that will keep the companies operating. The relationship between sustainability and cost reductions has not always been obvious.

Sustainability: a tool for cutting costs immediately

For decades, investments in green solutions in their own operations as well as for general social and environmental well-being were found solely in companies that had a fundamental interest in sustainability - or companies that could afford high costs in the long run such as the apparel company Patagonia.

As new technologies developed and awareness of the human impact on the global climate balance rose, the potential of sustainable solutions to reduce overall costs in business was recognized as a positive financial metric. Adopting green energy sources (e.g., photovoltaic panels or direct energy sources) can immediately optimize operating costs such as energy consumption and simultaneously support the national energy transitions goals.

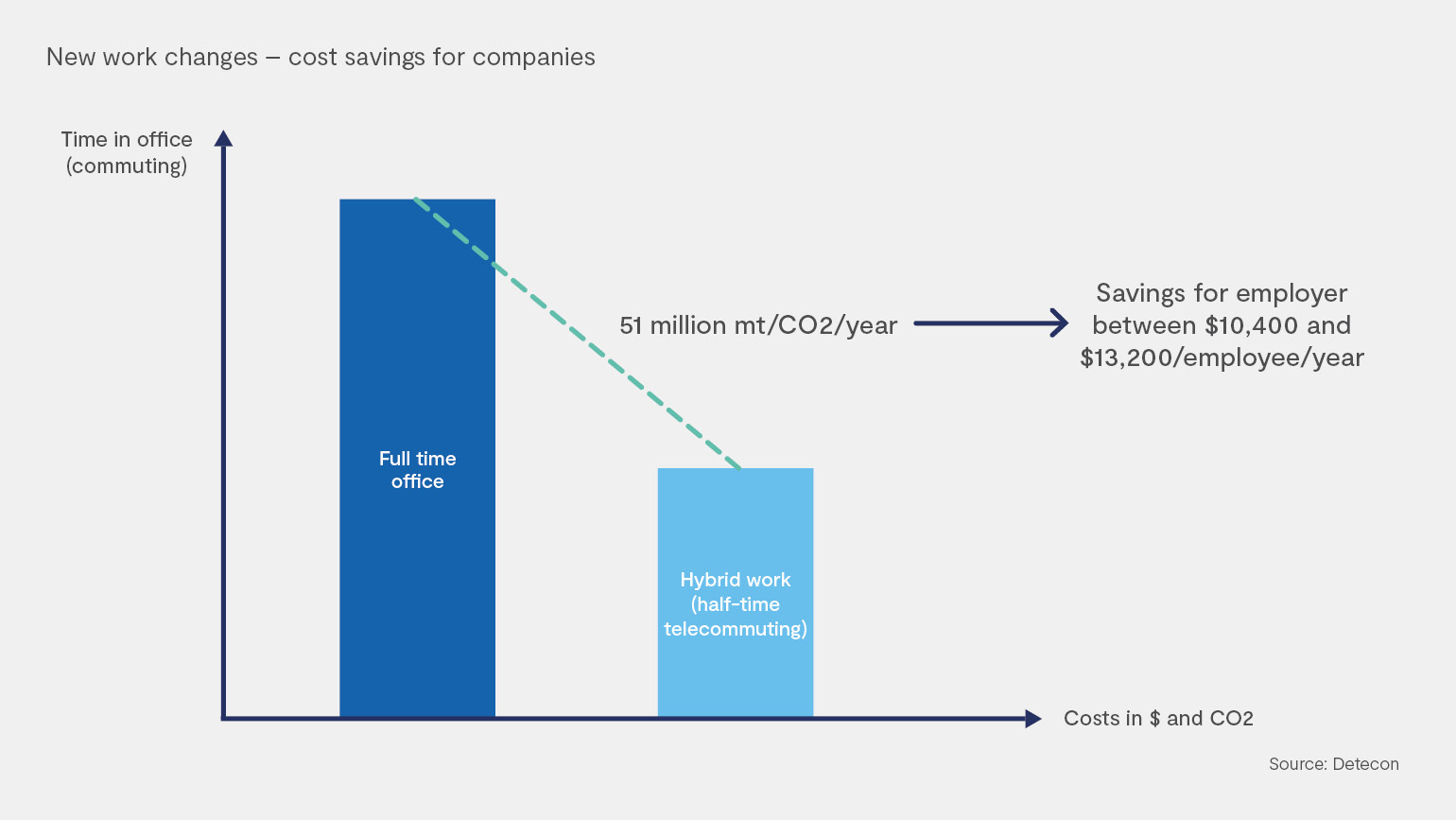

Moreover, financial lessons concerning employee welfare can be taken from the COVID-19 pandemic: improved work-life balance through flexible working schedules and remote working increases workers’ productivity and in many cases reduces rent expenses for offices and parking spaces. An additional benefit is that less commuting to offices reduces the overall carbon footprint of the company — another financial win-win.

Technological enablement with new IT solutions is also having a major impact on spreadsheets. The increase in cloud-based solutions for data storage and management is substantially changing the carbon footprint and operating costs of companies that have decided to close down inefficient on-premises data centers. The replacement of legacy operating systems requiring extensive equipment with solutions that are less dependent on hardware allows companies to heighten the level of efficiency in operations.

A green path in the added-value chain: the impact of incorporating sustainable solutions into the business model

The time has come to take a magnifying glass and to analyze all details of the supply chain. From the initial extraction of a natural resource to the disposal of the product by the consumer, all companies can discover opportunities for improvement that will reduce costs, increase revenue, and at the same time appeal to its consumer group. By reevaluating product portfolios or production methods, companies may determine that new opportunities are revealed when sustainability is incorporated into their business model.

Adding value to products and services does not have to mean making huge investments in innovation or new materials. The consumer goods industry can relate several success stories; using circular economy strategies can reduce material waste and increase production volumes while at the same time addressing the environmental concerns of consumers. Another sterling, yet simple example is the reduction of plastic packaging in the retail sector. These companies benefit in two ways: besides satisfying their customers, they reduce their costs and become less reliant on the consumption of a non-renewable resource.

Incorporating sustainability into the core business strategy and making it visible to both the internal and external public require effective data collection and analysis. Support for the achievement of success in the transformation can be found in the form of available technical solutions capable of identifying opportunities for improvement and increasing efficiency during the planning and implementation of changes in the operations.

There can be a number of reasons for reassessing supply chains and production strategies from the sustainability perspective. But one word has leaped to a prominent position after several years of climate forecasts and a global pandemic: resilience. Businesses needs to look closely at the impact of their products on the global climate system and the impact of the global climate systems on their products so that they can avoid supply shortages and assure long-term financial stability for their operations.

Financing the change: sustainable investment

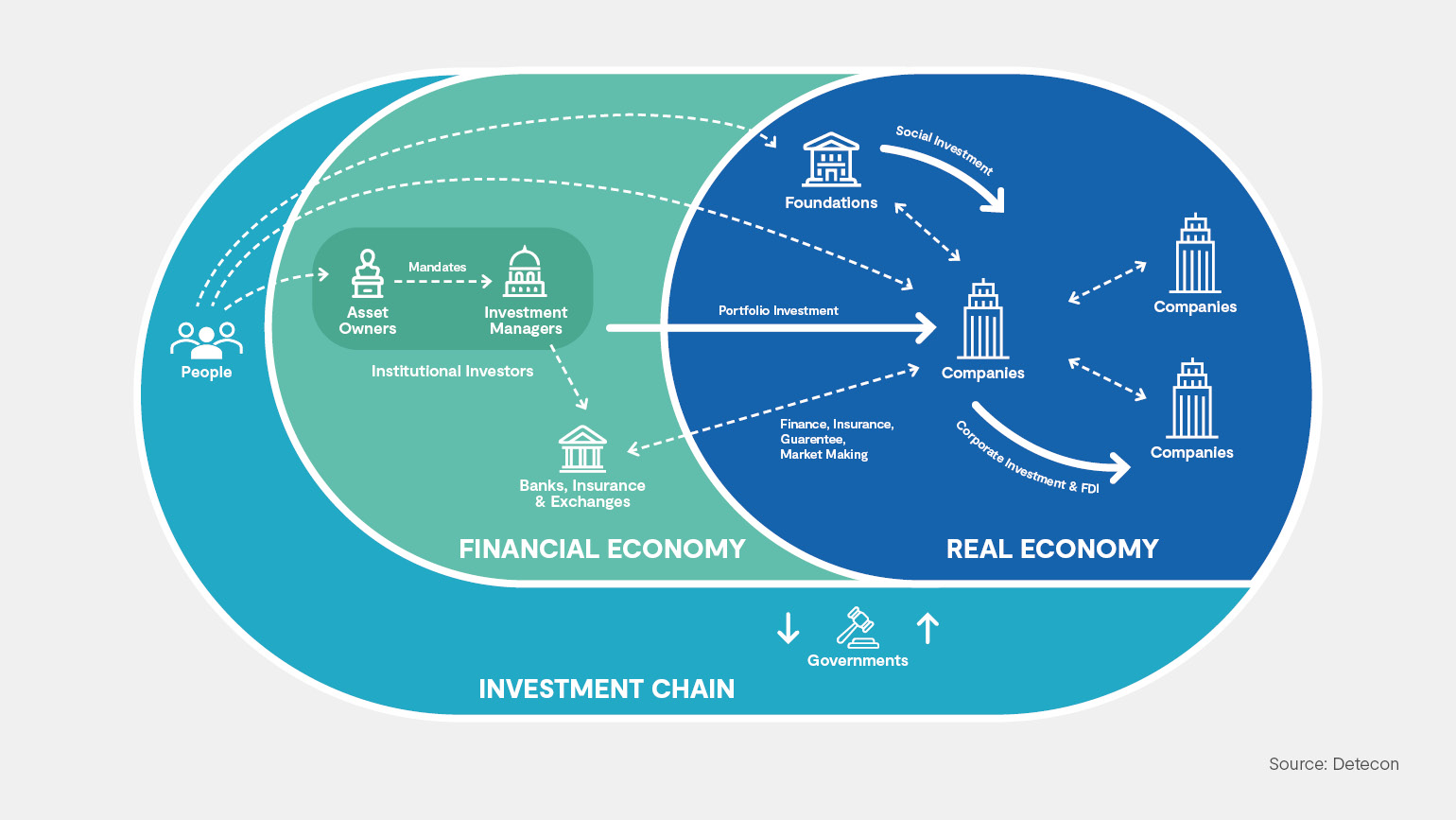

Sustainable finance involves much more than the reduction of costs, however. Sustainable finance means exploiting potential for growth within the scope of international policies and the frameworks derived from the Paris Agreement that must be taken into account when developing business strategies. Decisions on how and where to allocate public and private funds are no longer based exclusively on financial metrics; today, they must consider interdisciplinary social, environmental, and governance (ESG) factors to assure their conformity with this new configuration.

The 2015 Paris Agreement views the finance sector as a fundamental instrument that can be used to lay the path towards low greenhouse gas emissions and climate-resilient development. During the recent COP 26 in Glasgow, financial pledges were made to the so-called Adaptation Fund (totaling over $350 million) that will be translated into supporting concrete adaptation projects in developing countries. It was a clear signal from member states pushing financial institutions to gear up and expand investment for net-zero and climate resilience (see London School of Economics and Political Science (2021). Policy brief: Lessons from COP 26 for financing the just transition (see London School of Economics and Political Science (2021). Policy brief: Lessons from COP 26 for financing the just transition).

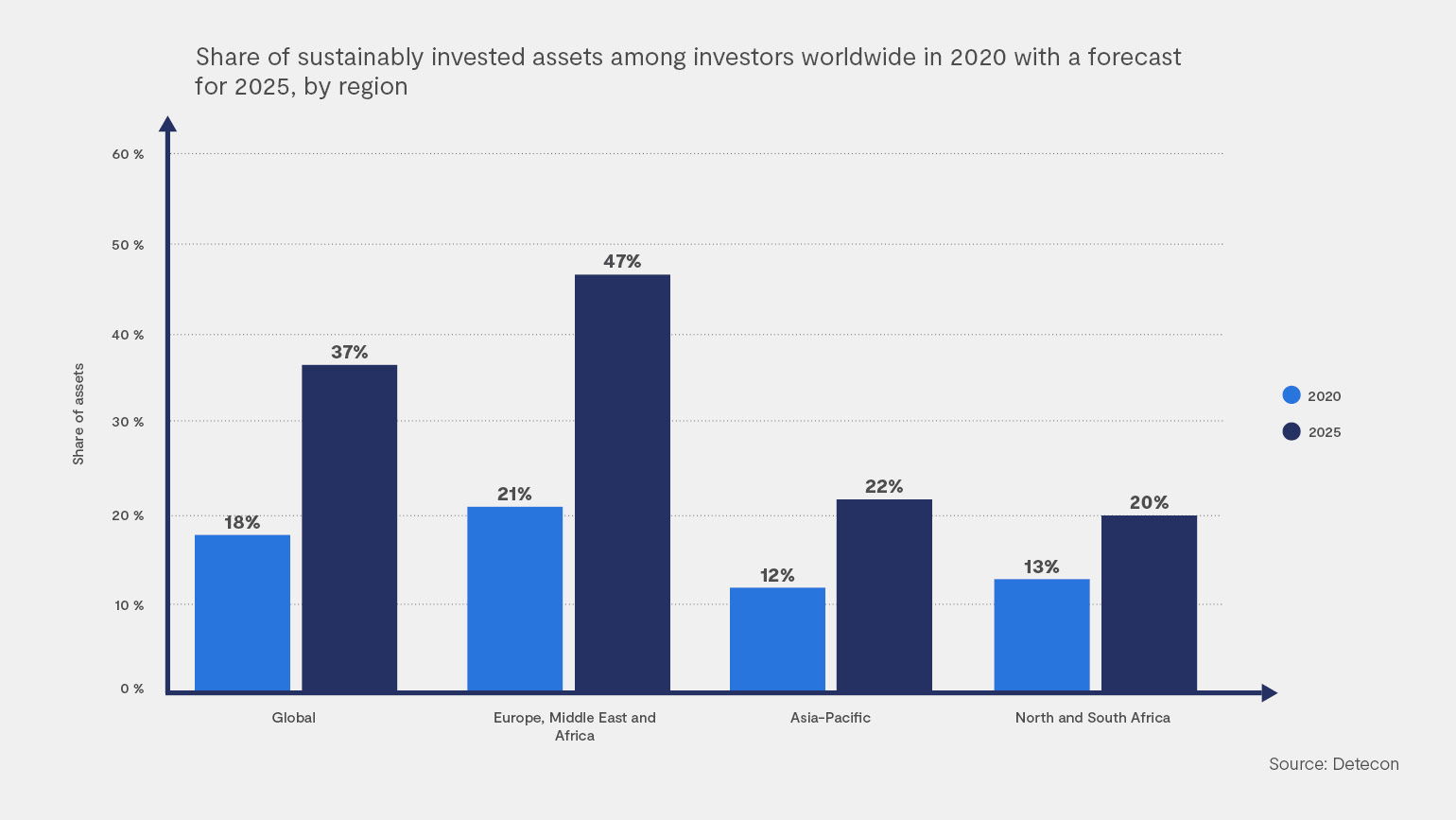

Investors will dedicate at least 37 percent of their assets to sustainable activities between now and 2025, a significant rise over the 18 percent in 2020. In other words, sustainability will not be missing from investors’ agendas any time soon. Business practices that integrate (or are willing to integrate) sustainability into their product portfolio and have environmental and social governance measures are the front runners in the race to obtain lines of credit dedicated to the climate transition. And the logic is self-evident. The more the world moves toward a scarcity of natural resources and biodiversity, the more severe and irreparable the economic crisis may prove to be — since there is no Planet B.

Furthermore, ESG reporting has been in the sights of the European Union for quite a while. The recent EU Taxonomy regulation issued in 2020 sets out general conditions for the classification of economic activities as sustainable. Such rules will directly influence the flow of funds and investments to initiatives capable of delivering sustainability as a main value. This new approach of the European Union reshapes the rules of corporate reporting, creating a level playing field for companies committed to adapting their business models to the EU climate targets (see Zhou, X., Caldecott, B., Harnett, E. and Schumacher, K. (2020) The Effect of Firm-level ESG Practices on Macroeconomic Performance. Oxford Sustainable Finance Group, Smith School of Enterprise and the Environment).

Companies have the chance to address their own environmental and social impact while obtaining support from the global financial system and participating in the current flow of green capital toward climate-friendly initiatives. Eligibility to receive these benefits, however, requires businesses to follow strict governance and reporting rules. This type of screening at a corporate level demands truly effective knowledge and data base management if the commitment to a positive climate future is to be honored (see Baer, M., Kastl, J., Kleinnijenhuis, A., Thomae J. and Caldecott, B. (2021). The Cost for the Financial Sector if Firms Delay Climate Action. Oxford Sustainable Finance Group, Climate Stress Testing and Scenarios Project (CSTS)).