The telecommunications industry is in the midst of massive upheaval. On the way to a promising positioning for the future, the analysis of market changes is therefore indispensable. It turns out that seemingly dominant developments such as the enormous market power of many hyperscalers are not unchangeable for telecommunications companies. A call to take advantage of the momentum of digitization now.

In day-to-day business of our clients, focus is mostly on short-to medium-term actions and developments. In all the hustle and bustle, it is easy to lose sight of the extensive market changes in the telecommunications industry. Take "the cloud" and "mobile commerce": just ten years ago, these two buzzwords were still viewed skeptically. Today, consumers and companies use these services billions of times a day as a matter of course.

Change in the competitive framework

If we step back and view events over the course of time, we see that even seemingly dominating developments such as the enormous market power of many hyperscalers are not immutable.

The tremendous depth of the penetration of digital services into almost all facets of our lives and business activities over the last decade has had further decisive effects; all of us – whether we use digital services when acting as entrepreneurs, employees, politicians, or business or private users – are becoming increasingly aware of their power and profound structural impact.

Clemens AumannLife today is unimaginable without what was unthinkable the day before yesterday - and so we must think ahead to the day after tomorrow.

The crucial shift in comparison with the past: this realization is gaining broad acceptance across the many classes of social and political stakeholders and influencing concrete political and corporate actions more than ever before. The plethora of various initiatives of the moment at political as well business levels clearly demonstrate this. The consequence for telcos is that they will once again see profound changes in the competitive framework for all market players.

Second wave of digitalization: regulated race for Gigabit Societies

Whereas during the first wave of digitalization competition the internet giants achieved their success in the almost total absence of regulatory conditions and industrial policy ambitions, the second wave will be restricted by a much more heavily regulated environment.

Regulation will become more horizontal instead of vertical while taking into account the vanishing boundaries between industries. All important legal areas will be adapted to incorporate the conclusions drawn from the experience of the first wave, including its negative aspects. These legal areas include competition law, tax law, media law, consumer protection, criminal law, or previous regulations with more of a vertical orientation and focus on specific sectors. The significance of this second wave for the future prosperity of nations and generations will lead to further industrial policy initiatives that are likely to fuel the technological developments outlined above.

If, in the future, we decide to look for the iconic moment that triggered this second wave, we might consider the Cambridge Analytica scandal as a likely candidate because this data scandal dramatically revealed the risks of the data-centric business models of the major internet players to a broad public and sparked worldwide reactions and debates about fundamental principles.

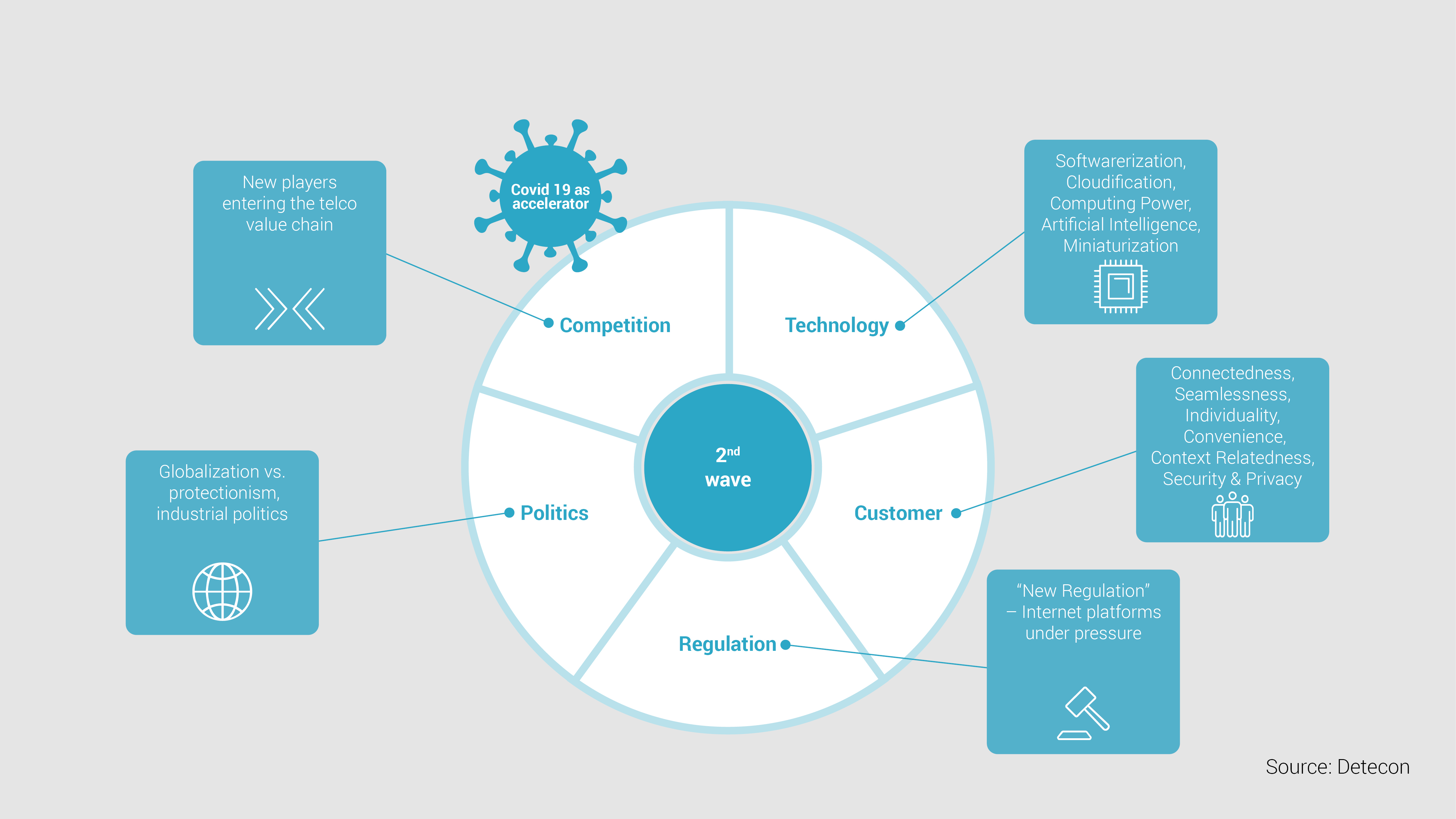

We have identified six drivers that are having a significant impact on the upheaval and momentum for telcos:

Figure: Six drivers with significant impact on momentum

These six drivers have reached a culmination point that confronts telcos with fundamental positioning decisions. The following five theses summarize our view of the future:

Five theses about the future

1. Telcos will undergo a consildation process over the next several years.

In Europe, where more than 100 network operators are active in an economic area of approximately 500 million inhabitants, there will be a rise in the number of international mergers alongside consolidation measures within the countries. This process will be driven above all by economic constraints. The huge investments in broadband infrastructures that are required while maintaining stability or even a reduction in end-customer prices will place a heavy burden on the earnings position and force network operators to ramp up cooperation or consolidation.

There will be between two and a maximum of three nationwide network operators in each country. Ultimately, a handful of telco groups will be left standing in Europe in the future. The process will start with cooperation agreements in the network sector (for instance, tower sharing, network sharing, joint ventures for network expansion) and end with the joint development and provision of services on the wholesale and/or retail market. Smaller carriers with a weaker market position or late entries will seek their salvation in close cooperation with the hyperscalers (see the example of AWS and Dish in the USA) or merge with other carriers. The possibility that hyperscalers will try to acquire participations in telcos to secure exclusive cooperation positions for themselves cannot be ruled out.

2. Telcos able to realize or maintain a vertically integrated business model for all customer segments will be few and far between. The process of the disintegration of the traditional telco added-value chain will continue. The field of competition will continue to split into various branches. There will be focused providers who cherry-pick specific components of the added-value chain for themselves.

3. Many telcos will lose their end-customer contact to the hyperscalers and concentrate on a wholesale business model. The process will extend to the traditional provision of lines service, beginning with the large international corporate customers, campus networks, or in the IoT sector and expanding step by step to engulf the smaller customers as well. Telcos’ dependence on hyperscalers will be manageable, however, as new regulatory frameworks (such as DMA and DSA in the EU) demand interoperability, open access, and data portability while blocking lock-in tendencies.

4. A small number of telcos will have a chance to compete on an equal footing with hyperscalers and retain their end-customer contact at the service level. The prerequisite for their success, however, is that they possess certain assets and capabilities and that they show determination in strengthening and leveraging these qualities in the time remaining to them. These telcos must be able to operate in ecosystems and partnerships at all stages of the added-value chain. Their presence on the end-customer side will be secured by services from a partner ecosystem that includes hyperscalers and by innovative, convergent services they have developed themselves and that (in contrast to the services provided by hyperscalers) have a primarily national or local scale.

In the setting of the drivers outlined above, new opportunities beyond connectivity alone will arise. Security solutions, cloud products, IoT, campus solutions, smart city, e-learning, and collaboration platforms are among the possible candidates. Opportunities for new services or the revitalization of existing services may arise from new regulatory developments or from industrial policy initiatives such as the European GAIA-X. Partnerships and participation in continental and regional ecosystems will create prospects for topline growth and customer retention in these and other sectors. Nevertheless, the necessity for massive efforts to optimize the customer experience across all touchpoints cannot be denied.

5. Telcos must put their trust in greenfield approaches and take radical steps in good time to achieve the required efficiency, automation, and flexibility in internal service delivery. Incremental further development of existing IT systems, processes, or network architectures takes too long, is too complex, and does not create the essential freedom of action.

Positionierung alternatives for telcos

Ultimately, network operators will have two fundamental choices:

- Infrastructure Broker: operations that tend to be oriented more closely to infrastructure ,

or

- Integrated Service Orchestrator: operating on the basis of a business model that continues to include the service level and end customer contact.

The various positioning options can be mapped along an added-value chain between end points defined as the extremes of these two positioning alternatives.

Which of the options — including the possibilities between these two extremes — come into question for individual carriers depends largely on the concrete manifestation and intensity of the above-mentioned drivers on their specific markets as well as the available assets and ambitions of the telcos.