The effects of the Corona pandemic on society and the economy are omnipresent. The (global) mobility industry is not spared either. Our experts from the mobility hubs in San Francisco, Berlin, Cologne, Munich and Stuttgart share their insights on shared mobility during and after Corona - as well as views on the Way Forward.

To be successful in the mobility market, the focus must always be on the needs of the customer. These needs include, among other things, flexibility, the lowest possible costs, a short travel time - and in times of Corona now also increasingly: safety from contracting the virus. Shared Mobility offerings largely address these needs and target customer groups such as young adults, tourists and business travelers. Shared Mobility was already a difficult market environment before the current crisis due to low market maturity, high competitive pressure and sometimes blurred positioning of the players. Corona and the new need for security have further intensified the conditions.

Shared Mobility faces major challenges

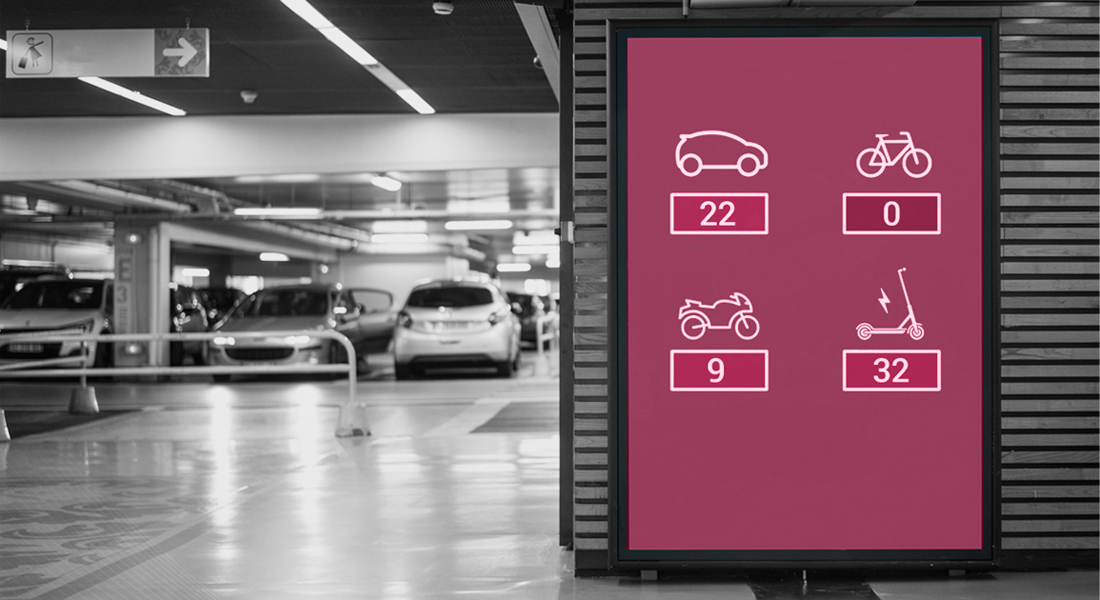

In the course of the first wave of the Corona pandemic, infection control measures drastically reduced travel volumes. Existing resources of shared mobility providers were only marginally utilized as a result, leading to revenue declines of up to 80% in some sectors. Also affected: public transportation. Some mobility players reacted specifically to the new situation with short-term as well as long-term measures. A key obstacle to using shared mobility services during Corona is customers' fear of contracting Corona due to the providers' lack of hygiene measures. Means of transport with enclosed spaces, such as cars or trains, are more affected than "open" means of transport, such as bicycles or e-scooters.

Responses to disruptive change through Corona

In the short term, it is therefore essential for shared mobility providers to respond to customers' need for security. The entire customer journey, including the customer touchpoints, must be adapted to this need. In addition to the mandatory wearing of masks imposed by the government, greater attention can be paid to the cleaning/disinfection of means of transport and the implementation of new digital approaches. An example of this is the use of AI-supported image recognition to monitor compliance with the mask requirement in the case of the ride-hailing provider Uber. Through good communication or marketing, such safety measures should be communicated to customers to stimulate demand. In the short to medium term, some providers are also increasingly focusing on building loyalty programs, e.g., by means of price reductions (see WeShare: free stopovers) or special (subscription) offers to increase the attractiveness of their services.

Some providers have also tweaked their business model directly in response to the pandemic. In isolated cases, for example, other target groups were specifically addressed. Lyft, for example, maintains numerous partnerships with healthcare organizations and uses its mobility service to transport patients to appointments or staff to their workplace. In general, the availability of transportation is an important prerequisite for shared mobility providers to serve customers in the medium term and build loyalty. Deutsche Bahn, for example, offers a consistent service based on demand despite a drop in revenue and thus benefits by reinforcing its image as a safe transportation service despite the Corona crisis. Other players are focusing their business more on freight transport instead of passenger transport. Customers' need for safety plays a less important role in freight transport and is an interesting business area with existing vehicles and infrastructure. In particular, food delivery services (e.g., Uber Eats) represent an additional lucrative source of revenue to passenger transport in times of Corona. New sharing models (see e.g. the electric car startup Canoo) with longer-term but still flexible rental of vehicles, so that the user is provided with a dedicated e-vehicle for the duration of the subscription, can also prevent safety concerns on the part of customers.

Long-term development after Corona

In the future, those who retain as many customers as possible in the short term despite a temporary slump in business and long-term market changes, and who do not shy away from well thought-out investments to do so, will have an advantage, particularly in meeting the customer's need for security. The crisis has the potential to influence mobility behavior and thus the entire industry in the long term as well. Fewer business trips, more home offices and other tourism preferences are just a few examples of the change. Shared mobility providers will have to keep a close eye on the market in order to create a future-proof offering that is tailored to customer needs. Even before Corona, horizontal consolidations between former competitors to improve service availability (e.g., by increasing the number of car sharing vehicles) have emerged, such as the merger of Car2Go and DriveNow to form ShareNow. The continuation of this trend is also expected in the future, now strengthened by the consolidation of several means of transport into mobility platforms, as well as through partnerships with other industries (e.g. media, gastronomy, etc.). In this way, customers can be offered a fully comprehensive and attractive interface for mobility. Gathering experience in freight transport, especially also through modern autonomous delivery systems (e.g., Nuro.AI or Kiwibot), can serve as another mainstay for some providers in the long term.

The future of shared mobility

Due to the Corona pandemic, shared mobility will continue to be subject to fundamental changes, for example in the form of changes in daily travel, especially on the way to work or during business trips. The increasing importance of home offices will also play an important role here. Despite the lower volume of traffic caused by commuters, the market for transportation will grow significantly in contrast. In addition, the discussion about social distancing is promoting the development of autonomous transport concepts that minimize direct contact between people. Consequently, business models for sharing services will no longer be able to focus solely on a user market, but will have to address vertical strategies in addition to new flexible pricing and technological achievements.