How Uber plans to stir up a $700 billion industry

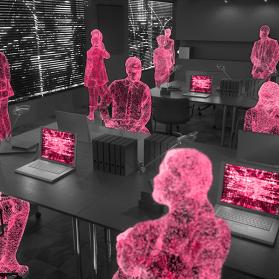

Smart mobility could soon reach the logistics industry: By means of a dual strategy, Uber wants to tap into new business in the long-haul trucking industry. Uber is neither the first nor the only player in this field. It remains to be seen whether the experience gained in the cab industry will be an advantage.

Against a backdrop of news stories about disputed company valuations and global battles with regulators, headlines about Uber's self-driving trucks and an online exchange for trucking and transportation companies seem unimpressive. Yet the underlying technologies could have significant financial implications for an industry that generates more than $700 billion in annual revenue.

A Startup as a Catalyst for Autonomous Trucks

According to a Bloomberg report, last October an autonomous truck loaded with 50,000 cans of Budweiser drove itself nearly 200 kilometers on a highway in Colorado, USA. The test drive was a joint project between Uber Technologies Inc. and AB InBev, the brewing giant. Otto, a startup company that bought Uber for $680 million, is behind the self-driving truck.

Trucking companies have been working to develop autonomous trucks for some time, but Otto is the only one to offer a solution that can convert older vehicles into autonomous trucks.

Otto's technology is still in the testing phase, but smaller services are expected to become possible soon. Experts expect autonomous trucks to catch on before autonomous cars. The framework conditions for trucks are far more favorable than for passenger cars; trucks offer more space to place the sensors, they have less price sensitivity and are less influenced by external factors.

Massive Economic Advantages

In addition to an increase in safety, the main attraction of this smart mobility is the potential reduction in costs. An optimistic estimate by Morgan Stanley shows that autonomous trucks could save up to $168 billion in the long term.

However, even though it is emphasized that the new technology is not intended to fully replace the work of truck drivers, it is conceivable that the technology will develop in such a way that fewer and fewer drivers will be needed.

Dynamic Pricing for Carriers and Drivers

For Uber, the development of self-driving technology represents only one part of its trucking strategy. The other part consists of expanding an "on-demand" model: Just recently, the company launched "Uber Freight", which connects haulers and drivers via an online exchange in a similar way to the Uber app connects passengers and cab drivers.

Startups such as Convoy, Cargomatic and TugForce have tried with moderate success to grab a piece of the brokerage market. But secure transportation delivery on a large scale is far more complex than developing an app and running a few servers. But Uber is apparently banking on its vast experience in the field of dynamic pricing.

Now it's getting serious

It will be a rocky road for Uber to shake up the trucking industry. Just as in the case of autonomous cars, the legal framework must be clarified. The still-high cost of the technology - up to $30,000 per truck - decimates the amount of potential customers. As for the online platform, factors such as increased complexity due to matching heavy loads and matching trucks, heightened safety standards, and time urgency requirements call primarily for new organizational capabilities.

Regardless of the challenges, Uber seems determined to continue growing its trucking business. "Uber Freight" will drive the platform to a greater extent. Regarding Otto trucks, the question is no longer if, but when we will see them on the highways.

(The full version of Oscar Escalante's contribution can be found here)