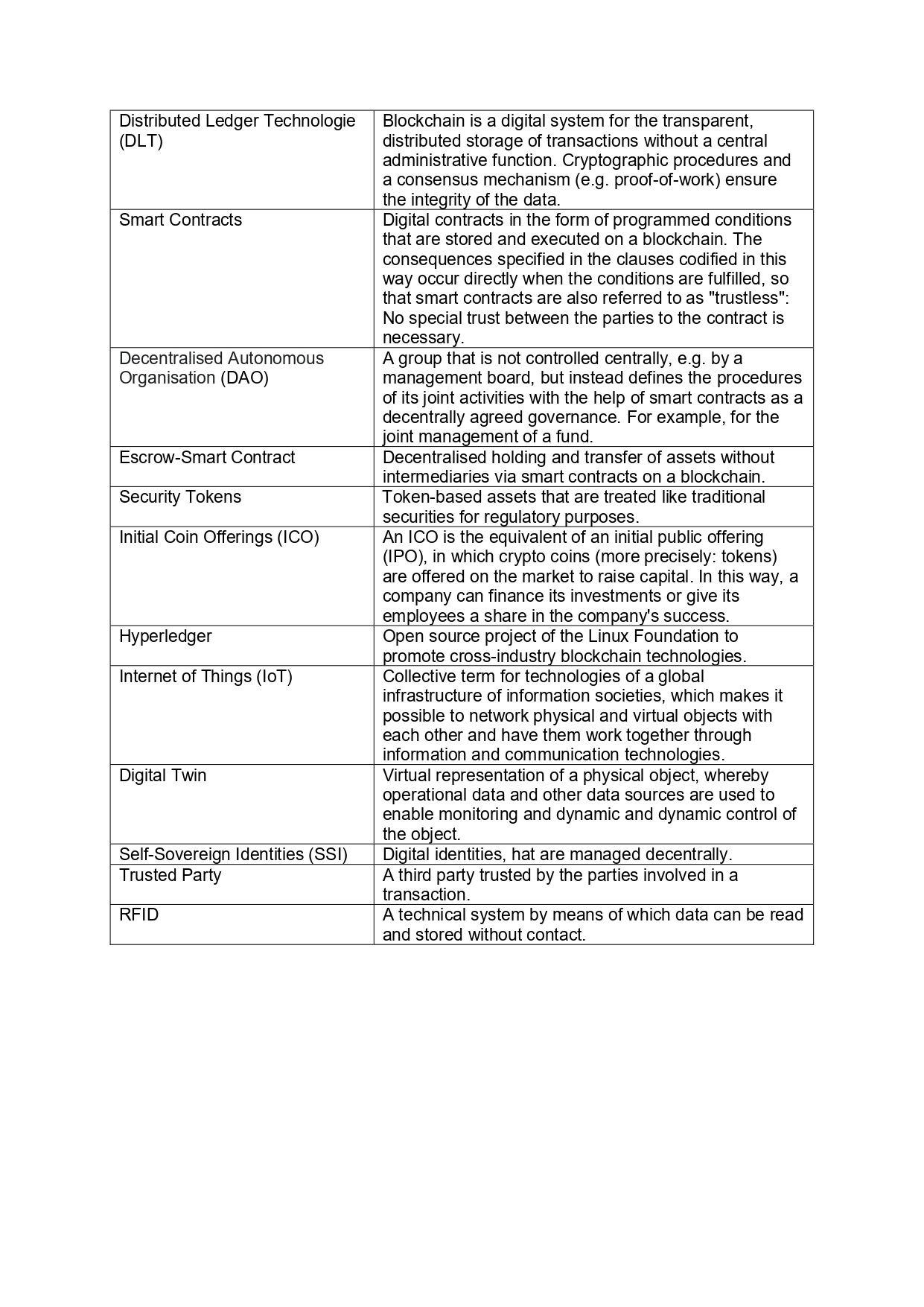

Blockchain is considered a key technology of Industry 4.0, as it realises end-to-end digital networking of value chains - even beyond a company's own boundaries. Björn Froese and Irina Rona provide an overview of the use cases.

Blockchain technology is considered a disruptive innovation in the digital transformation of the corporate world. The blockchain - often also referred to as distributed ledger technology (DLT) - is a technology for decentralised and distributed data storage that records transactions in a traceable manner in chronological order. The stringing together of data blocks represent links in a chain that interlock and cannot be replaced or changed: the blockchain. It originated in the best-known application, the cryptocurrency Bitcoin.

Development of blockchain technology

Even though the blockchain was initially created to programme cryptocurrency such as Bitcoin, it has long been a useful tool not only for the financial sector, but has also already experienced at least two major leaps in innovation: after cryptocurrency came the use of so-called smart contracts, which codify agreements on the "chain" in terms of simple if-then conditions. We are currently in the next cycle, the creation of entire decentralised organisations (DAOs) that contain complete governance coded into them on the basis of smart contracts.

The potential behind the technology is now also convincing in the business environment. Due to its special characteristics such as decentralisation, trust, anonymity, transparency and security against manipulation, it is conquering a broad spectrum of new application areas and cooperation possibilities.

Blockchain is considered a key technology of Industry 4.0, as its use is particularly interesting where products and services, processes or transactions of different players have to be tracked and traced in a forgery-proof manner. This makes it possible to realise end-to-end digital networking of value chains - even beyond a company's own borders.

Options for CFOs

For the CFO, this first of all directly opens up new options for action in the internal organisation of his processes, especially in accounting and controlling. DLT is always directly advantageous when different parties are to access the same data. These advantages increase with the size of the network, which does not only have to include the various departments of the FC organisation, but can also be opened up to partners in the same group, e.g. national companies, and business partners from other companies.

For this purpose, the blockchains do not have to be public, but can be organised as club DLTs for a limited number of actors. This way, only the partners get access to the ledgers. In this way, two companies can post the business transactions of their partnership in a joint blockchain in a fully transparent manner and would no longer need, for example, an open-books policy for the transparency of sales or even the establishment of a joint venture company to create trust.

The DLT system itself enables this trust between parties that would otherwise not necessarily cooperate in a trustworthy manner, even among competitors. For this reason, DLT solutions are often referred to as "trustless by design": All actors have a programmed possibility to participate in the joint action - up to the joint disposal of funds or even the establishment of governance in decentralised organisations in which the actors do not even know each other personally.

Use cases in finance

Beyond the FC process organisation, further use cases have already been implemented for the finance sector. In addition to managing different ledgers, global cash flows between the national subsidiaries can be moved at the push of a button without losing several days and having several banks interpose themselves as intermediaries. This creates efficiencies in cash pooling. Escrow services can be implemented via escrow smart contracts. And by issuing security tokens, alternative capital market financing can be created, also known as ICOs, Initial Coin Offerings, which are also suitable for employee participation.

There are already established platforms for financing the supply chain, such as Marco Polo, which has already been used by Daimler AG to secure payments for trade transactions. In this case, LBBW had taken over the financing and payment commitment, so that a traditionally bureaucratic foreign trade financing could be processed within minutes¹.

Use cases for supply chain management

From a business perspective, DLT can also be used to document the entire supply chain: From the procurement of resources and preliminary products to production, sales and aftersales. The cost of external regulation is increasing anyway; currently with the Supply Chain Act, which will come into force next year.

But also for their own sustainability considerations, companies are increasingly moving towards closed documentation and traceability of their own supply chains. Examples here are the implementation of Respeggt for tracking chicken eggs or also for "ethically clean diamonds" with a certificate of authenticity in the blockchain of Everledger.

Use cases in logistics

In logistics, Kuehne und Nagel has implemented a Decentral Ledger to accompany and track container transports. The waybills with important information about the shipment, such as the certified container weight, are stored once in a hyperledger and can then be viewed and, if necessary, supplemented by all the actors involved throughout the entire transport chain. According to the company, it now has almost one million transactions per month.

Another use case for blockchain is its application in production. Digitised production processes exchange several million pieces of data per day within the value chain and with participating companies. However, only a small part of the data generated in networked production has been digitally mapped so far.

The technology start-up Ubrich, for example, has developed an IT solution that makes production data more readily available and ensures greater security and transparency in the production process. The solution consists of attaching additional data libraries to sensors in machines and production facilities, which enable production data to be measured and encrypted on the basis of blockchain technology. The production data can thus be signed and stored in the cloud backend. The encrypted production data can be used for intralogistics to minimise manufacturing tolerances.

Components are often assembled in complex production networks from different factories or from several suppliers. In automotive production, for example, a component with a positive tolerance can be individually combined and balanced with a component with a negative tolerance.

Production capacities can also be made even more flexible and the capacity utilisation of the plants can be further increased to cover costs. As soon as you manage your facilities transparently in a decentralised manner, capacities can be offered and auctioned on marketplaces..

For many of these use cases, the automatic capture of sensor data using IoT tools is helpful to enable a seamless transition from the physical to the digital world. Once the transition from the real economic situation to the data image is completely reliable, legal dispositions can be managed with the help of smart contracts. An intermediate step, which in itself already triggers an industrial revolution, is the use of digital twins that represent precisely this virtual image of, for example, a production machine („Digital Twins - Leading the Way to Tomorrow’s Ecosystems“, https://www.detecon.com/drupal/sites/default/files/2021-03/ST_DigitalTwins_V1_EN_251119.pdf).

Use Cases for Self-Sovereign Identity Management

On the blockchain level, in a sense as the fourth revolutionary step that will once again change many things, work is currently being done on Self-Sovereign Identities (SSI). The federal government is having some use cases implemented for this by industry partners, including Verimi from the Telekom Group.

The SSIs are designed to help people manage their digital identity securely while regaining sovereignty over their data. A query as to whether a contracting party is contractually capable can thus be made to the SSI solution, which in turn only has to answer with a yes or no in a data-saving manner. Behind this is a blockchain that keeps the data of the identity card encrypted together with a confirmation from a trusted party. In the same way, however, it would also be possible to find out from the commercial register whether a business partner effectively represents the company, and to make all state registers public.

However, this attribution of unique and verifiable identities is already being thought through further: Why should it not be possible to use it in the context of Industry 4.0? For example, machines could be certified by the manufacturer and provided with a unique identity so that, for example, only approved spare parts can be used in a safety-critical area. Or the manufacturer immediately retains ownership of the means of production, ensures availability and offers production capacity on demand and for individual billing: cloud production.

For the individual consumer, the circle can also be closed. As soon as suppliers have placed their purchases in a cooler that is accessible from the outside, the items are read by a verified RFID reader. This then confirms the products received and initiates immediate payment via a smart contract. The food suppliers would thank you, as they can now deliver at any time and do not have to supply all households in the peak time between 6 and 8 pm.

CF as a stakeholder of transformation

It can be concluded that the blockchain as a concept has already outgrown its use for cryptocurrencies. There are now hundreds of successful use cases where distributed ledgers help to make processes more efficient, involve partners in the value chain, or even enable completely new business models. Together with ensuring the accountability of (virtual) transactions via the SSI, all business transactions of all companies can be put to the test and many of them can be completely rethought.

The CFO is often a decisive stakeholder in the transformation and can even drive many of these innovations from his area. On the one hand, because there is a great affinity and professionalism in dealing with ledgers anyway and they are also used to keeping company data ready for auditing. On the other hand, controlling can also gain a much deeper insight into the value flows with the digitalisation of all assets and business transactions.

¹ReThinking Finance, 6/2019