Broadband networks of the future will be heterogeneous. This heterogeneousness is rooted in using multiple generations of technology and involves collaboration with different operators. The challenge is that these networks need to work harmoniously and have to be seamless for the end user. This leads to the question: How to accomplish that? With whom do I do it with and where do I do it?

Existing operators have gone through various stages of new technology introduction into their networks. This includes operating different generations of networks, which include 2G, 3G and 4G networks on mobile, but also different architectures like small cells and macro cells. Other example is fixed mobile conversion between mobile and fixed network assets. However, most of these assets remain within the control of the same Entity.

Integration of alternative network providers

There is now an emergence of new, alternative access networks that provide connectivity to address specific needs. An example is Loon, a graduate from Google X, using high altitude balloons with wireless access network technology to address rural markets. In the not too distant future it will be the LEO Satellite providers offering access services on a global scale.

These new alternative network providers address a specific market, utilizing a unique and specific technology. We believe that these new network providers will also be highly dependent on partnering with terrestrial networks. This however will necessitate complex integrations to be able to offer a seamless service to the end user.

Making heterogeneous networks work

New, alternative access networks that provide connectivity to address specific needs, like the Loon, OneWeb (No in Chapter 11), SpaceX and LEOSat will potentially be operating together with the mobile networks but each on its own infrastructure.

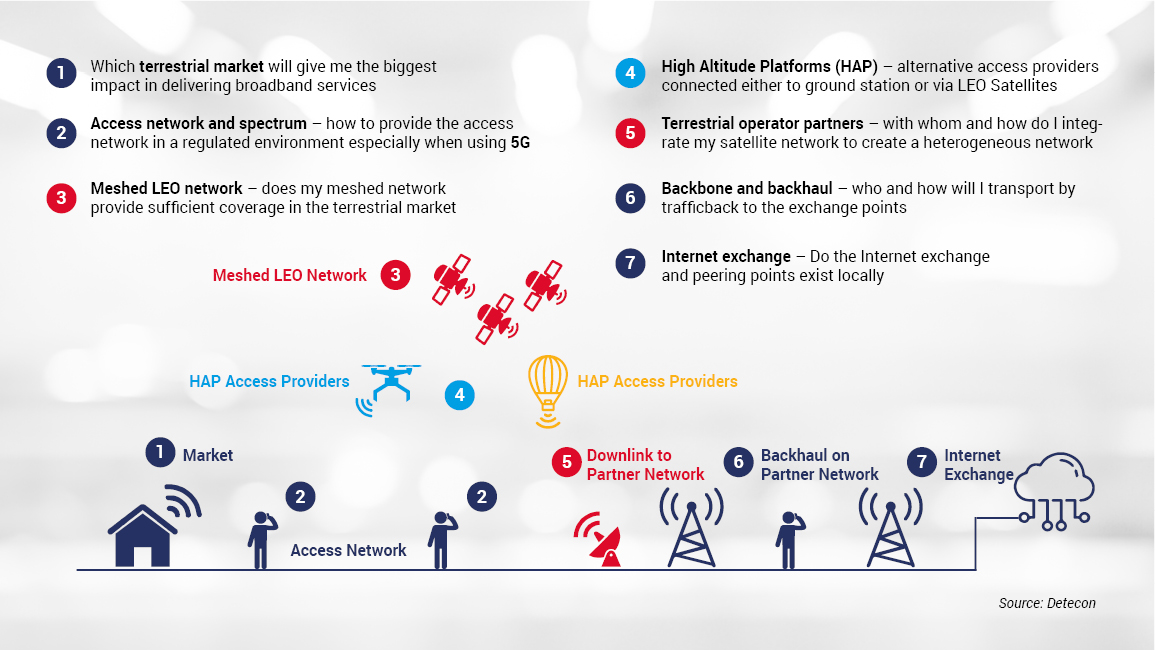

While this would seem simple at a 50,000-foot point view, if you think about it for a second it would imply that these different “access mechanisms” be it HAP (High Altitude Platforms) such as balloons, or LEO satellites or terrestrial networks need to all work with each other to be able to offer this compelling end-user experience. That is perhaps, easier said than done. It is perhaps, interesting to explore a few areas which need to be examined to determine how best this would work:

- Which niche market do I serve and how do I approach them?

- What is the new business and operating model?

- Do I go directly to the consumer or offer a wholesale services or a combination of both?

- Which terrestrial networks do I depend on?

- Do I partner and with whom?

- Are there any market inhibitors/ accelerators that I can eliminate or be aware of?

- What are the regulatory constraints?

- Should it be 5G only or combined with other existing broadband technologies (e.g. 4G, Wi-Fi etc.)?

The niche market

Determining the market niche is key to establish a successful partner relationship with other networks. All players need to define their niche market where they will compliment and compete against each other. It is about defining a market where each player will contribute the most value. This could be by offering coverage on a cross-country/territory basis by LEO satellites or ultra-rural coverage for the HAPs. This is also about defining the business models to each other, to extend each other’s networks, like backhaul and backbone services.

This is an established practice among telecom operators - and there is no reason to believe that it cannot be extended to other platforms (be it balloons or satellites) - in the end, they are simply base stations, albeit ones that are floating in the sky or orbiting the earth. The market should be one that satisfies all players - an area/ region that a terrestrial operator cannot economically cover, but would lend itself well to a HAP, or one, where a single network could not adequate address the redundancy needs of a particular application.

Business model

Once the market has been identified there are two distinct elements that need to be considered.

- Ownership of the end customer relationship

- Business model between the different network providers

In a heterogeneous network the customer would like to be abstracted from the infrastructure and would like to only deal with one service provider. In understanding the customer relationship, one need not look much further away than the current setup. Operators already offer services as a wholesale offering to MVNOs on their network. The MVNO has the commercial relationship with the customer and is responsible for all customer interfacing interaction, including product offering, billing and support.

By nature, the terrestrial network would have a direct relationship with the customers in a heterogeneous network with the LEO Sat providers. Either they already provide the services to the customers and/or they are much closer in proximity to the customers. The alternative access network provider then becomes a wholesale operator, offering roaming services or offering Network as a Service (NaaS).

Network as a Service (NaaS): Software Defined Network (SDN) is enabling operators to have networks that are programmable which can be virtualized using Network Function Virtualization (NFV). These new alternative networks don’t have the legacy baggage that traditional mobile operators have, that build their infrastructures many years ago. By using SDN they can enable an overlay model on the infrastructure and offer Network services virtualized to operators.

But does it stop there or will it be a mixed business model? We believe it will be a mix. Alternative access network providers like the LEO Sat will have a much greater coverage compared to terrestrial networks within a region and even a global reach. The most likely scenario would be offering a global service for global mobility services as direct service that crosses borders and a niche market gap filler as a wholesale service for terrestrial networks.

Example: A terrestrial mobile network in a country can buy a wholesale service from the LEO Sat providers to provide service in rural under services areas. The business model could be a roaming services or buying a managed service from the LEO Sat provider to service its customers. The customer will have a SIM Card (hopefully an eSIM) from the mobile operators and will seamlessly move between terrestrial service and LEO Sat service depending on the coverage.

Or it could be a Global IoT logistic customer that is tracking their assets as an example on a global scale across land and sea. The global customer is buying a service directly from a LEO Sat Provider and there could be a hand off to a mobile network for redundancy purposes (swapping the relationship). The customer is subscribed to the LEO Sat Provider.

Network partnerships

The networks will be built around partnerships with other operators. They will compliment and compete against each other, coopetition. They will complement each other by offering a service in areas where the other network has no coverage or is an extension towards other networking resources. Example a High Altitude Platform (HAP) like Loon or a Drone can offer access services in rural environment but requires terrestrial downlink towards partners. The HAP and the terrestrial networks complement each other. But in urban areas they will compete for the same access connectivity.

A level of integration is needed for these partnerships as with the example above. This could be as complex as LEO Sat offering backbone services to HAP access networks that are integrated into a terrestrial mobile network for access to a local break out or internet exchange point. The service needs to look homogeneous to the end user with seamless handover between the different networks.

Example: The access in urban areas is provided by someone like Telkom Kenya. They are the partner to Loon who will provide the rural access is underserved areas. The Loon network is integrated with the Telkom Kenya network and service is experienced seamlessly by the Telkom Kenya customer.

Complex ecosystem

These types of collective heterogeneous network infrastructures result in a complex ecosystem with a lot of moving parts needing to work harmoniously to offer a seamless service to the customer. One major barrier that remains is the availability and affordability of end user devices on these networks. This barrier will be based on the market being addressed. Rural markets that are underserved are also underserved by power and are relative poor. Smartphones that connect to these networks are the biggest communication expense to these customer wallets and charging these devices is more frequent and costs more. Solving the affordability for the end to end ecosystem is key to ensure that these business models will be sustainable.

Example: In India and Tanzania the average cost of a smartphone can be up to 16% of the income. Detecon did an analysis on off-grid charging of smartphones and it could be in the range of 28%-35% of a user’s TCO of owning a smartphone.

Market inhibitors or accelerators

Inflexible and defending dominant operators will be the biggest inhibitor to the market. The dominant players that have complex group and shareholding structures unfortunately do not move as fast as an agile new operator. Changing business models for them will be challenging especially if new heterogeneous networks are also enabling their competition to better compete in the market.

However, they can be the best accelerators especially if they have networks that span different markets and countries. Enabling this across markets allows for scale across the network. Solving this and interconnecting at strategic locations will be a move in the right direction. Once this is solved, there is one last hurdle to be overcome - the regulator.

Regulatory Constraints

The key regulatory constraint that remains is access to spectrum. This will depend on the ownership of the spectrum and usage regulations. Access to favorable spectrum is already a heated debate in certain countries especially for “High-Demand Spectrum”, which is also due to countries failing to implement their digital dividend strategy and missing the 17 June 2015 cut off set by the ITU.

The regulator can have an enabling effect in some of the underserved markets by providing access to the necessary low spectrum frequencies for rural development. The regulator should provide access to the necessary spectrum and should build a regulatory framework to encourage operators and infrastructure providers to cooperate with each other, while fostering a competitive environment between operators.

Achieving impact and moving fast

Alternative access routes are upon us - it is not a question of if, more a question of when and at what cost. Advances in technology and the abundance of talent and capital thrown at the problem point to the fact that we will soon observe these over our skies in the near future. They also complement and overcome what have been traditionally difficult problems for a terrestrial network - from improving unit economics of connectivity in underserved regions to enabling a class of new applications that need enhanced SLAs of reliability and connectivity.