In the corporate finance world, digital disruption often takes a back seat in the face of relationship management, financing structures, risk models and legal counselling. Corporate clients mull over banks’ financial instruments to fill liquidity gaps and optimize risk exposures, while haggling the same banks on proposed interest rates and fee structures.

Once the deal is signed, technology creeps back into the scene in the form of agency services to automate the routine tasks of credit administration, payments, settlements, trading, regulatory reporting, due diligence, etc. If you are a wholesale banker, you seldom lose a relationship based on technological deficiencies!

How quick and strong can digital disruption rattle the capital- and risk- centric corporate finance world? The industry today is surely far from a definitive answer. The only scoop we can provide - at this stage - is a glimpse at five (5) key trends that contribute to the groundswell. These are: Real Time Asset Monitoring, Digital Currencies, Smart Contracts, Crowd Funding and Artificial Intelligence-based Decision Making.

In this report, we describe each trend and examine its potential impact on the corporate finance lifecycle depicted in Figure 1 overleaf.

Finally, please note that we have deliberately excluded the Trade Finance sector in our coverage due to the present wide industry coverage of digital disruption in that domain.

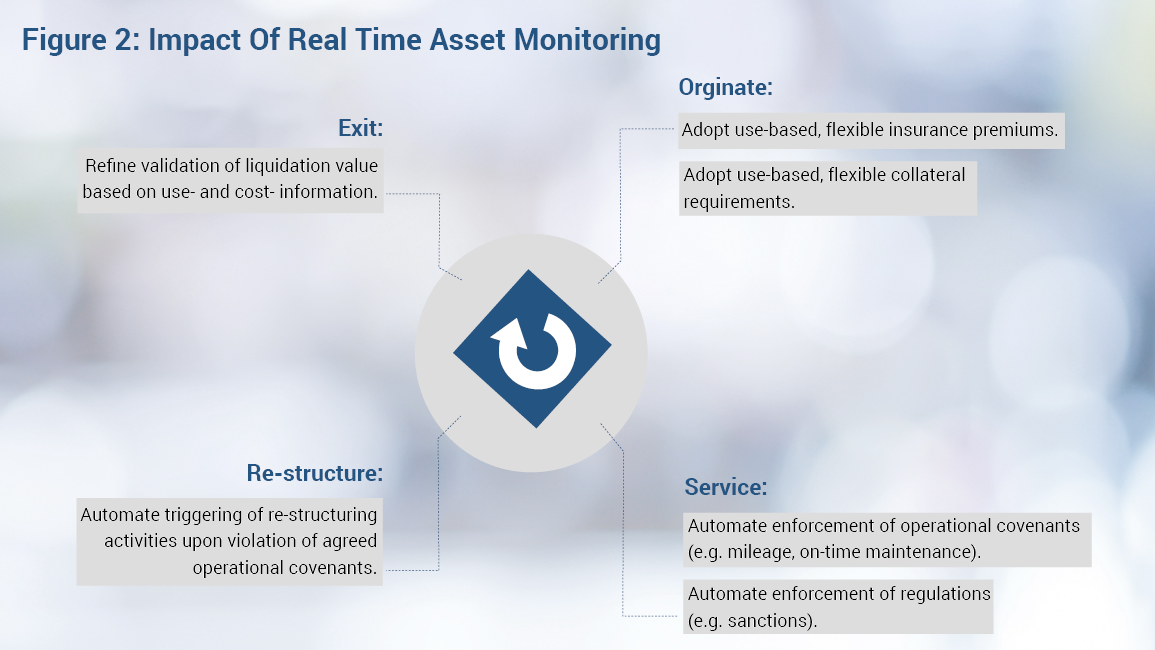

Trend #1 Real Time Asset Monitoring

Internet Of Things (I.o.T) technologies allow real time monitoring of the usage patterns and status of various assets through the deployment of sensors, monitoring software, big databases and advanced analytics.

Today, IoT is deployed in Oil rigs, vehicles, airplanes, manufacturing equipments, rail roads and buildings. Coincidentally, these are the same assets typically financed by the wholesale banking sector through operational lease, financial lease and syndication structures.

Once properly analyzed, the flux of information generated by these sensors can reveal valuable insights on:

- Asset Integrity: the asset’s operational fit (e.g. uptime, safety, throughput) to be used effectively and generate the yields projected in the underlying financing deal.

- Asset Overhead; the asset’s true maintenance and operation cost, compared to those projected in the underlying financing deal.

- Asset Fair Market Value: the asset’s liquidation value, considering its current status, the market’s supply/demand forces and buyers’ behaviours.

Figure 2 overleaf describes the corporate finance activities that are likely impacted by the above capabilities.

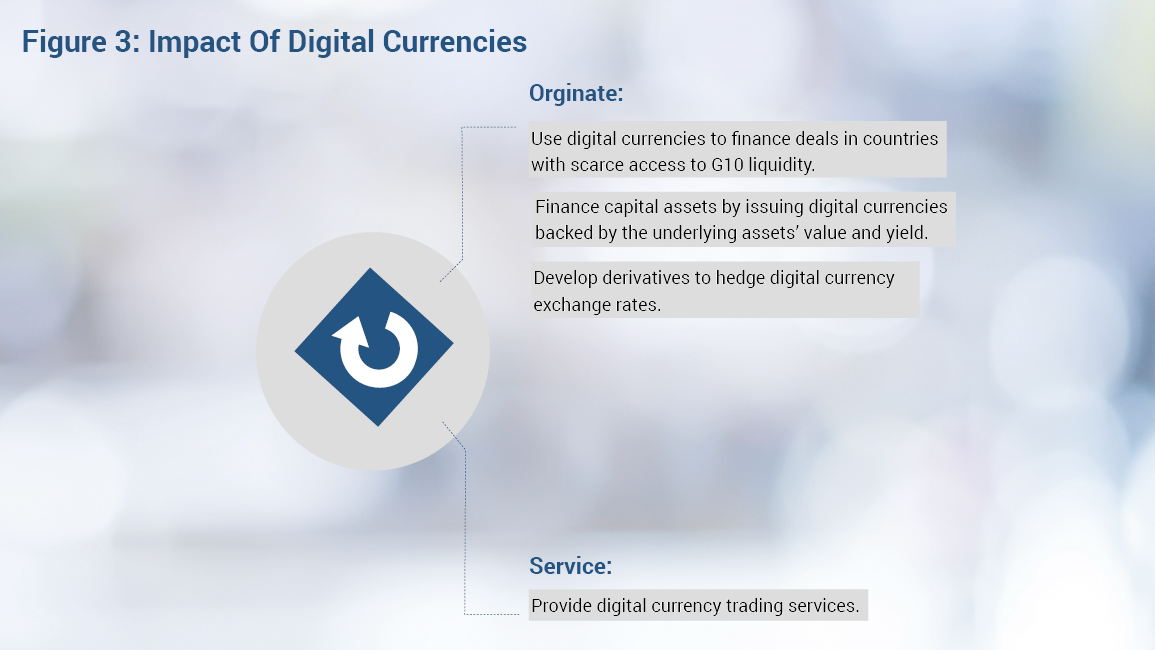

Trend #2 Digital Currency Financing

Digital Currencies are issued by anonymous sources (e.g. Bitcoin), virtual organizations (e.g. Ether) and software companies (e.g. XBR) to facilitate the anonymous storage and exchange of value on the Internet. The resulting transactions are processed exclusively electronically, without the need of a designated, centralized coordinator (e.g. Government, Clearing House) or paper documentation. This model is made possible through the use of distributed ledger technology, where multiple parties collaborate to authenticate and process a transaction once a consensus quorum is achieved or a unique key is arrived at.

The digital currency eco system is growing rapidly, adding on merchants (e.g. Microsoft), exchanges (e.g. Kraken, CoinBase), analysts (e.g. Bloomberg) and users every day.

In today’s global economy where the G10 currencies are “fiat” tender instruments whose value is primarily derived by people’s wide acceptance and trust in the issuing country’s political, economic and military powers, the digital currencies is not a complete alien!

In congruence, the digital currencies can draw their value from people’s trust in the issuer - if known -, or in the parties who adopt the currencies.

Figure 3 overleaf describes the corporate finance activities that are likely impacted by digital currencies.

Trend #3 Smart Contracts

Another off-shoot of distributed ledger technology is the concept of a “Smart Contract”. It’s a digital record capable of executing certain activities, upon the occurrence of specific events. Any changes to this digital record requires the consensus of involved parties which can only be achieved through digital negotiation and voting. Similar to digital currencies, no single authority is required to ensure the integrity and execution of a “Smart Contract”. Rather, the distributed ledger technology ensures that; (i) various copies of the “Smart Contract” are held up-to-date by various counterparts, (ii) events are effectively monitored and (iii) activities are promptly executed.

The application of “Smart Contract” in today’s corporate finance world is versatile, and often, tout as incredible. The digital record could hold the details of a bond, a note, an asset, a derivative or a structured finance agreement combining them all. The events may include, credit rating change, due coupon payment, price movements beyond a pre-agreed threshold or expired KYC data. The self-executing activities may include credit rating revision, proceeds collection, dividend disbursement, price fixing or collateral replenishment.

While some enthusiasts predict that “Smart Contracts” would eventually supplant “agency services” of large investment and corporate banks, others foresee a parallel industry emerging to serve small-to-medium size debt issues and structured investments. Figure 4 overleaf describes the corporate finance activities that are likely impacted by “Smart Contracts”.

Trend #4 Crowd Funding

In general, “Crowd Funding” is the process of helping businesses raise funds directly from the public in the form of debt, equity or charitable contributions, using the vast reach of the web, emails, social media and other digital channels. Investment Banking is no longer the only captive channel to achieve that.

In reality, regulations limit the overall capital raised, the contributions made by each individual investor, the investment content shared and the direct collection of funds. Despite that, the Crowd Funding industry has been growing at an impressive annual rate of 80 - 110%, depending on the underlying instruments (e.g. equity vs debt).

The impact of Crowd Funding extends to both the BUY and SELL sides of the market. From the Buy Side perspective, retail investors now have direct access to invest in start-ups, SMEs and tomorrow’s Unicorns. While on the Sell Side perspective, many FINTECH companies can partially play the role of Investment Banks in raising capital.

In the future, Governments may seek to finance their future projects and monetize current assets through Crowd Funding to bolster the community values of transparency, fairness and distribution of wealth. As a sovereign counterpart, Governments would enjoy a favourable investment risk profile.

Figure 5 overleaf describes the corporate finance activities that are likely impacted by “Crowd Funding”.

Trend #5 Artificial Intelligence-based Decision Making

Artificial Intelligence is a board term referring to a growing set of data analysis and modelling techniques that allow computer to mimic human decision making capabilities in specific unique situations (e.g. gauging investment sentiment, cross-matching documents, tracing sanctions violations, estimating collection probability). The techniques process large volumes of data to learn how to make an optimal - not necessarily a perfect - decision.

Corporate Finance has been actively using AI-related techniques for the past 15 years to measure the Credit Rating of its corporate clients and Value-At-Risk (VaR) of its market investments and held collaterals. While Corporate Finance officers relied heavily on such indicators in their day-to-day decision making, the officers were mostly oblivion to the indicators’ intricate calculation details.

The next wave of AI techniques brings on new capabilities in the form of natural language processing, image recognition and pattern searching. Not only that such techniques can now handle non-numeric data, but they can also learn by example, as opposed to, learn through structured financial computations as was the case in early techniques.

Figure 6 overleaf describes the corporate finance activities that are likely impacted by “AI-based Decision Making”.