The IT landscape of most large companies consists of several ERP systems - SAP and non-SAP - and is generally complex and distributed. Aspects for the heterogeneity of the system landscapes can be different business functions, regions or business units. This brings with it various challenges such as lengthy, error-prone update processes. Minimising business interruptions is therefore on the agenda of many companies. SAP's central finance approach can be a potential enabler in the transformation of the finance organisation in conjunction with the shared service model.

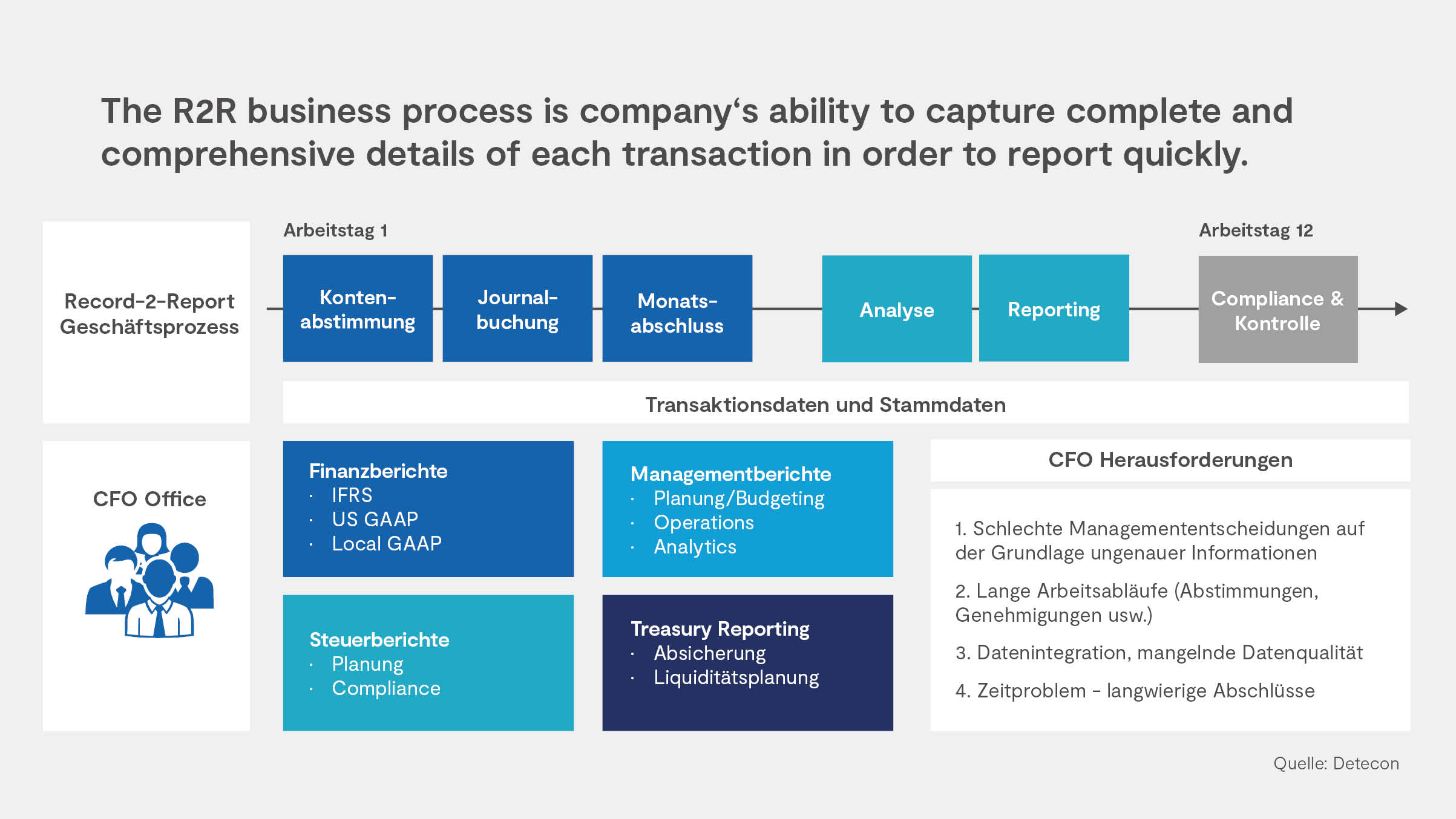

The recording and linking of all company processes through an ERP system affect many areas, especially accounting and controlling. In financial accounting, all financial transactions in the company are recorded and thus bring the necessary transparency for financial reporting and controlling of the company.

From the CFO's perspective, it is important to obtain accurate information from the systems in order to make fact-based management decisions. Long workflows due to coordination channels and costly data collection processes are still a challenge in finance today.

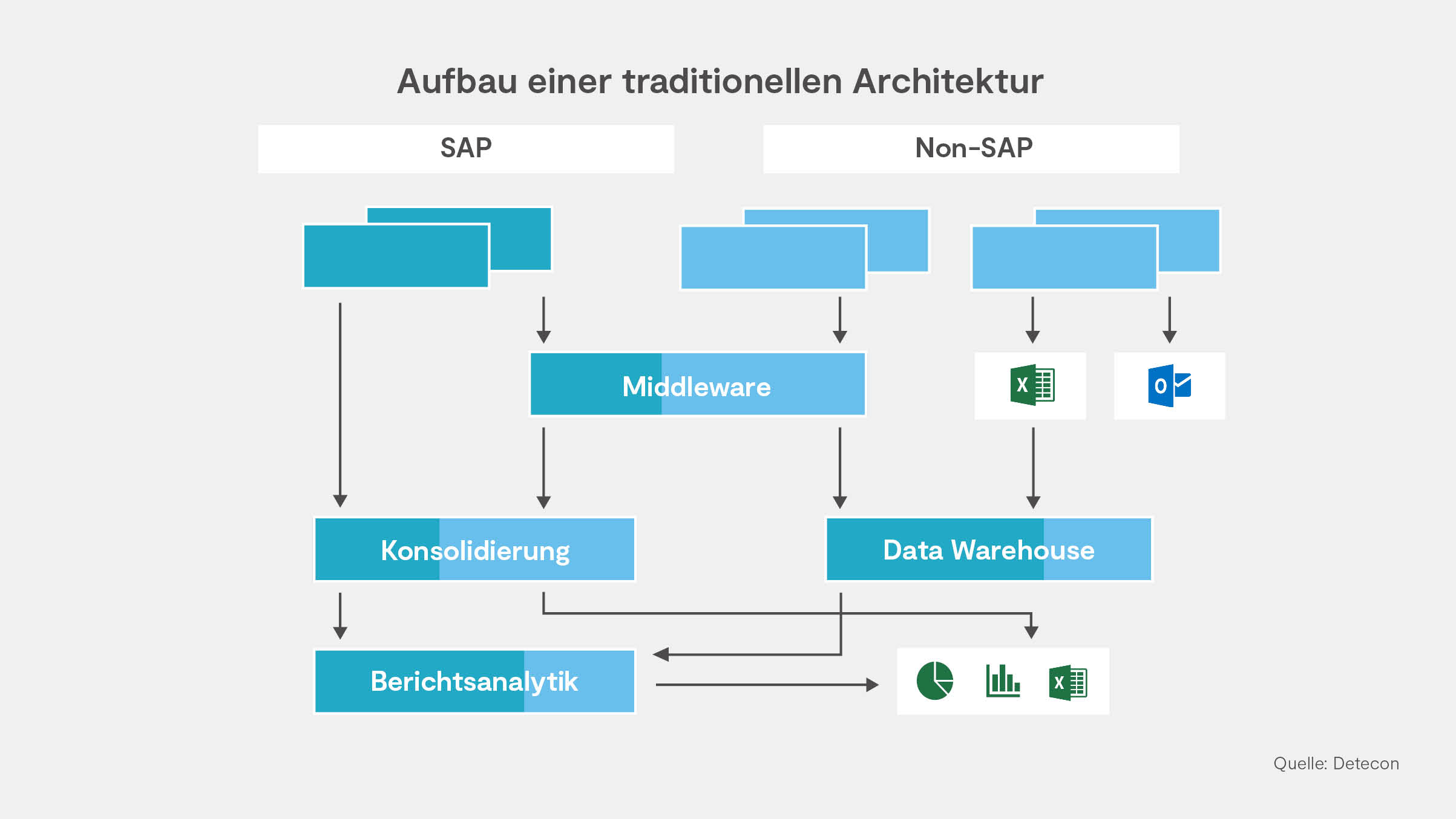

Conventionel ERP financial system landscape

Due to the increasing complexity and challenges in the markets, most companies operate more than one ERP system. In practice, a uniform and standardised reporting system often does not exist. The main reason for the heterogeneous system landscape is the situation in globally operating companies or in companies that have been taken over.

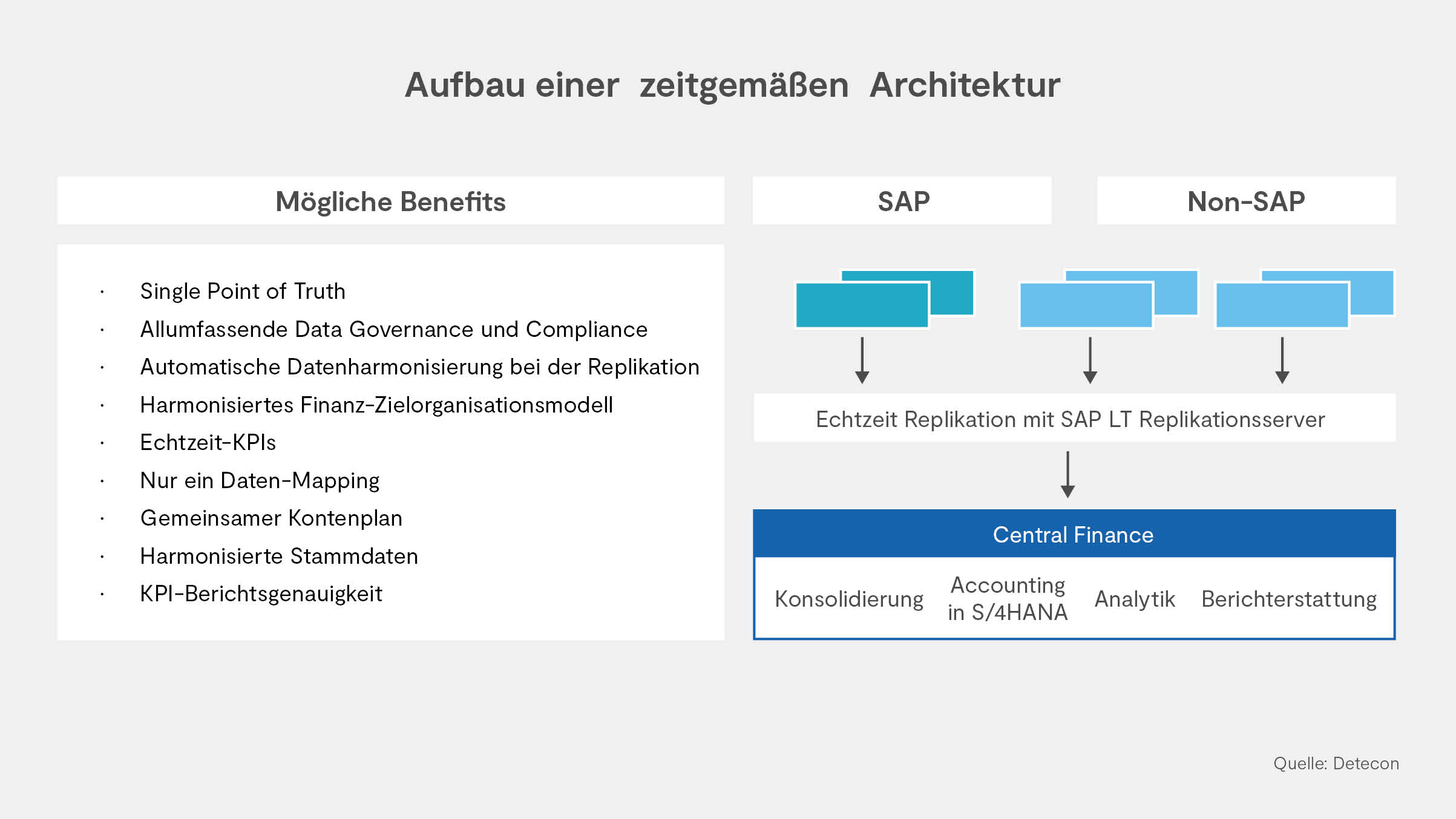

Creating a future-proof financial architecture

There are various options for dealing with heterogeneous system landscapes. One option is to centrally define a global template and roll it out to all group companies. This approach can be time-consuming and expensive. The alternative to this approach is the introduction of a central finance system. The central finance approach combines the functional and technical innovations of recent years: a central finance system with harmonised master data, which offers a uniform platform for planning, reporting, centralisation of processes and thus a "single source of truth" for consolidation.

The great advantage of such a financial architecture is that the implementation of a central finance system involves only minor changes to the source systems. The financial data of the affiliated companies are made available (replicated) in real time in the central finance system via a replication server.

The added value of a transformation with Central Finance can be summarised as follows:

- Single Point of Truth

- Only one data mapping

- Harmonised master data

- Harmonised financial target organisation model

- Possibility for real-time KPIs

- Simplified system governance

Technologische Voraussetzungen in der anstehende Transformation

With the S/4HANA Central Finance approach, SAP offers a future-proof solution for the finance sector to support a transformation. The basic technological requirements for this are as follows:

-

To harmonise financial master data, minor changes need to be made in the source systems compared to a system harmonisation.

-

The existing IT and SAP system landscape does not have to be completely redesigned.

-

Both SAP source systems and non-SAP source systems can be connected to Central Finance via middleware solutions.

-

A so-called SAP LT Replication Server must be installed as a technological component. The data is transferred to Central Finance in a uniform manner via the SAP LT Replication Server.

Business Case Consideration

Such an implementation brings with it a multitude of advantages. These include, for example, granular access to financial data from different IT systems right down to the original document.

Data efficiency: The potential can be optimally utilised if the data structures relevant to the entire company are harmonised. In addition, the centralisation of selected financial accounting tasks, a uniform data basis for controlling and accounting at the group level and the acceleration of a consolidated financial statement.

Shared Service Center approach: Central Finance enables the centralised provision of reports, the analysis of data, but also centralised booking activities within a single system. This creates a common unified information model, which is the prerequisite for the efficiencies needed to achieve this. This can increase the value of the system through a shared service centre approach (e.g. Central Payments).

Accelerator: Central Finance can act as an accelerator through the relative ease of connecting and replicating data. In the case of mergers, it offers the possibility of starting the integration of financial processes at an early stage by, on the one hand, continuing to work in the old system and, on the other hand, creating a "single point of truth" with the Central Finance system.

How is the introduction carried out?

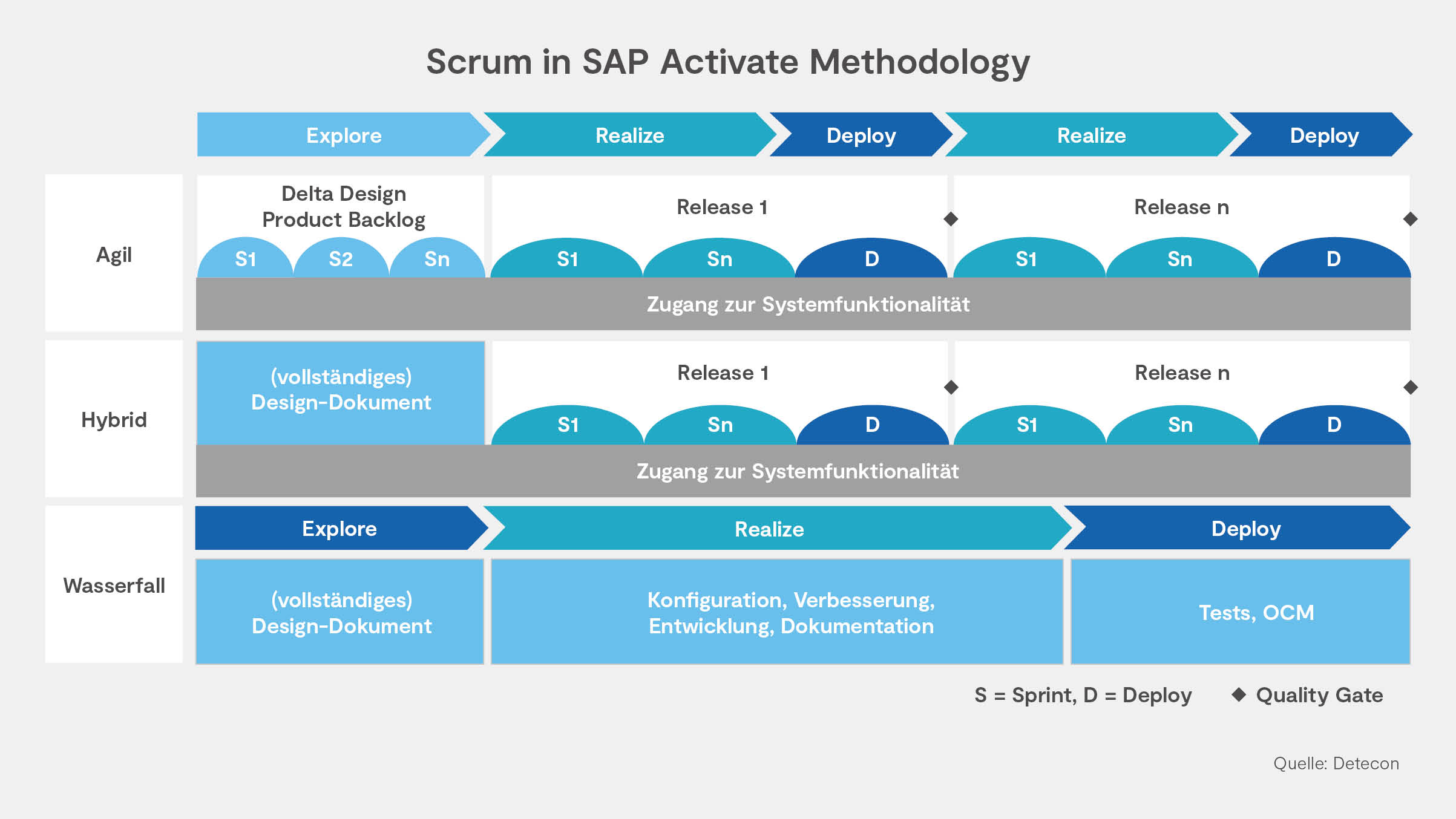

From a project management point of view, there are various approaches for the introduction of a Central Finance System. In the following, the three implementation options are presented and the essential features are briefly described.

Option 1: Waterfall

The waterfall-oriented method is the classic variant of project management in which the phases are consistently run through one after the other. Only when one phase has been completed does the next phase begin. This means that in a project, the requirements for the project procedure are first defined in the Explore phase and converted into a concept. Then the requirements are implemented in the realise phase, tested in the deploy phase, accepted and prepared for the go-live. The last step is the rollout.

Option 2: Agil

In the agile process, the phases are iteratively run through in smaller time-defined phases, the so-called sprints. So-called quality gates are carried out at the end of each phase. This is used to compare the requirements with the implementation. In this way, undesirable developments/misunderstandings can be recognised early on and readjustments can be initiated directly. The focus of this procedure is thus on the continuous improvement of the product. SAP projects show that due to the complexity, it is not possible to proceed in the usual sprint periods or to take over every release into production.

Option 3: Hybrid

The hybrid method combines the advantages of the waterfall and agile methods. Here, it is determined on a project-specific basis which procedure is particularly suitable in which phase. It has been shown, for example, that it can make sense to carry out the Explore phase completely, but to support the conceptual work with a prototype in this phase and to divide the Realise phase into several releases.

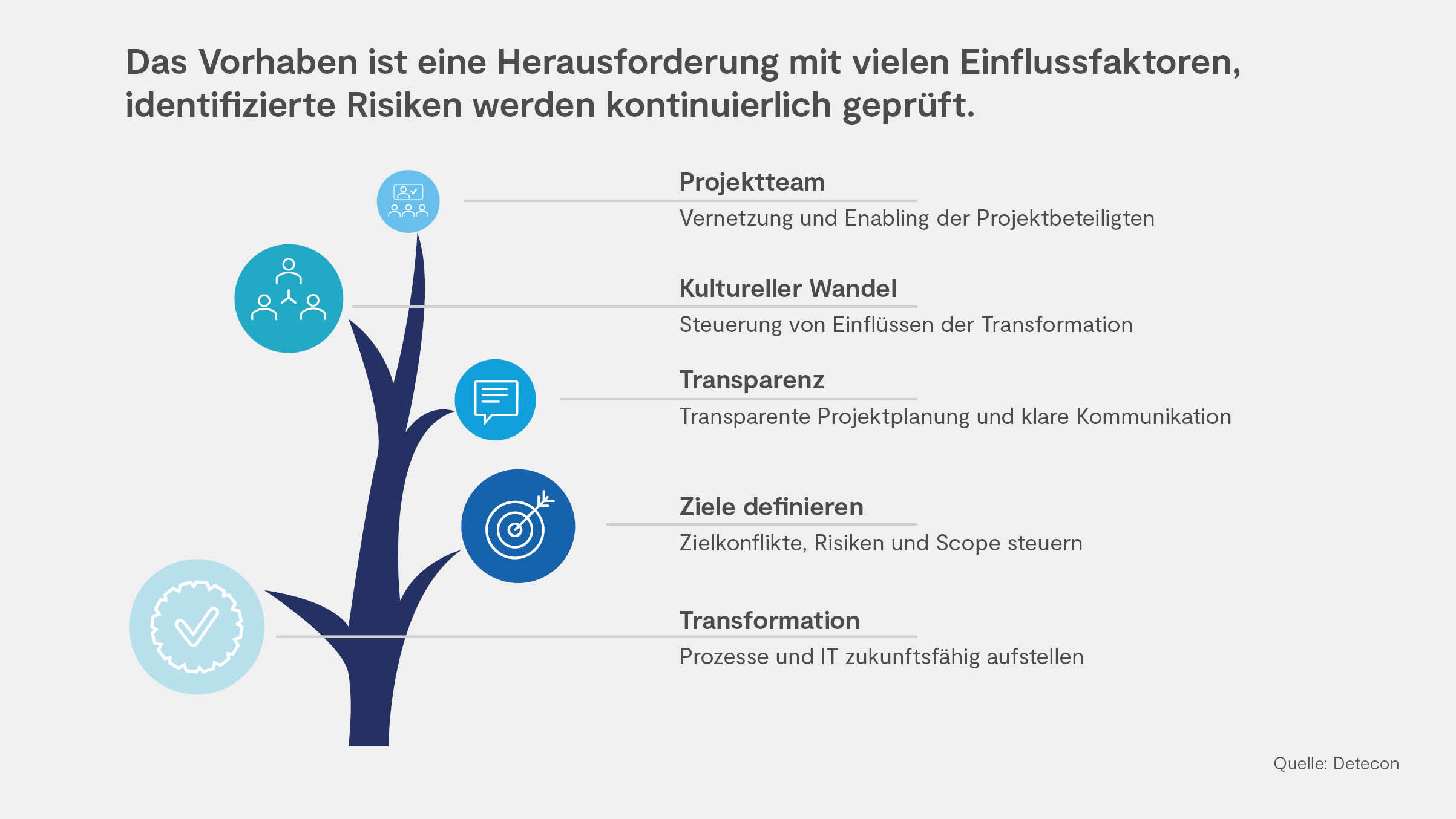

Essential factors influencing a transformation

In the context of a business transformation with Central Finance, various influencing factors must be taken into account. Those involved in the project must have internalised the new approach and therefore be fundamentally instructed in the procedure and concept. An important aspect is that everyone must agree on uniform principles and certain process areas must be "handed over". This is not generally new, but is particularly relevant in this type of project: Transparency and joint agreement are important, e.g. in the definition of goals. In this context, it is also of central importance that processes and IT must be more closely interlinked in order to optimally utilise the potential of the approach.

... and this is what a sensible start to the transformation looks like

We generally recommend carrying out a proof of concept after the conception phase in order to evaluate the use of Central Finance for a specific use case. This involves a detailed evaluation of the processes from your ERP system landscape by the stakeholders involved.

The results include a concrete roadmap for the implementation, which is agreed with all stakeholders involved. A time schedule for implementation and an initial cost estimate complete the picture. This is based on identifying your needs and challenges in order to recommend an ideal approach for your financial transformation.